Region:Asia

Author(s):Geetanshi

Product Code:KRAC3761

Pages:96

Published On:October 2025

By Type:The property management services market is segmented into Residential Property Management, Commercial Property Management, Industrial Property Management, Retail Property Management, Facility Management Services, Asset Management Services, and Others (Including Mixed-Use Developments). Each segment addresses distinct property types and management needs, reflecting the diverse requirements of property owners and tenants .

The Residential Property Management segment leads the market, driven by the growing demand for rental properties and the urbanization trend in major cities. Increasing numbers of individuals and families are opting for rental housing, resulting in heightened demand for professional residential management services. Property managers in this segment are increasingly leveraging digital platforms and smart building technologies to enhance tenant satisfaction and retention .

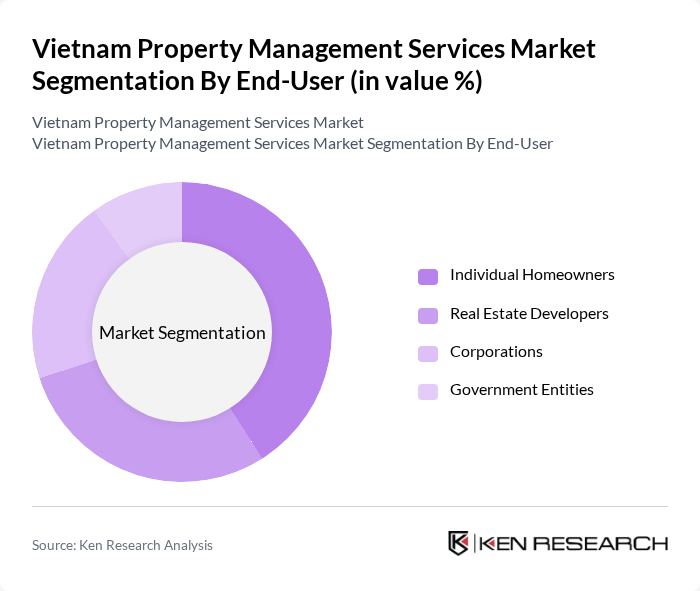

By End-User:The market is also segmented by end-users, including Individual Homeowners, Real Estate Developers, Corporations, and Government Entities. Each end-user group has specific requirements and expectations, shaping the overall market dynamics .

The Individual Homeowners segment is the largest, propelled by the rising number of rental properties and the need for professional management to handle tenant relations, maintenance, and asset upkeep. Urbanization and the shift toward renting continue to drive this segment, with homeowners increasingly seeking to maximize returns through effective property management solutions .

The Vietnam Property Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Savills Vietnam, CBRE Vietnam, JLL Vietnam, Colliers International Vietnam, Vinhomes, Novaland Group, Dat Xanh Group, Phu My Hung Development Corporation, Him Lam Land, Kinh Do Investment, An Phuoc Investment, FPT Property Management, Vietstar Property Management, Saigon Pearl, and Golden Land contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam property management services market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital solutions become more prevalent, property management firms will increasingly adopt software and IoT technologies to enhance operational efficiency and customer engagement. Additionally, the growing emphasis on sustainability will push service providers to implement eco-friendly practices, aligning with global trends and consumer expectations. This dynamic environment presents opportunities for innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Property Management Commercial Property Management Industrial Property Management Retail Property Management Facility Management Services Asset Management Services Others (Including Mixed-Use Developments) |

| By End-User | Individual Homeowners Real Estate Developers Corporations Government Entities |

| By Service Model | Full-Service Management A La Carte Services Consulting Services |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Contract Type | Short-Term Contracts Long-Term Contracts |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-Based Pricing |

| By Technology Utilization | Traditional Management Tools Cloud-Based Solutions Mobile Applications Others (Including IoT and AI Integration) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Management | 120 | Property Managers, Homeowners |

| Commercial Property Management | 100 | Facility Managers, Business Owners |

| Industrial Property Management | 60 | Warehouse Managers, Logistics Coordinators |

| Real Estate Investment Trusts (REITs) | 40 | Investment Analysts, Portfolio Managers |

| Property Maintenance Services | 80 | Maintenance Supervisors, Service Providers |

The Vietnam Property Management Services Market is valued at approximately USD 1.3 billion, driven by urbanization, foreign investment, and a growing middle class seeking professional management services for residential and commercial properties.