Region:Asia

Author(s):Dev

Product Code:KRAD6372

Pages:81

Published On:December 2025

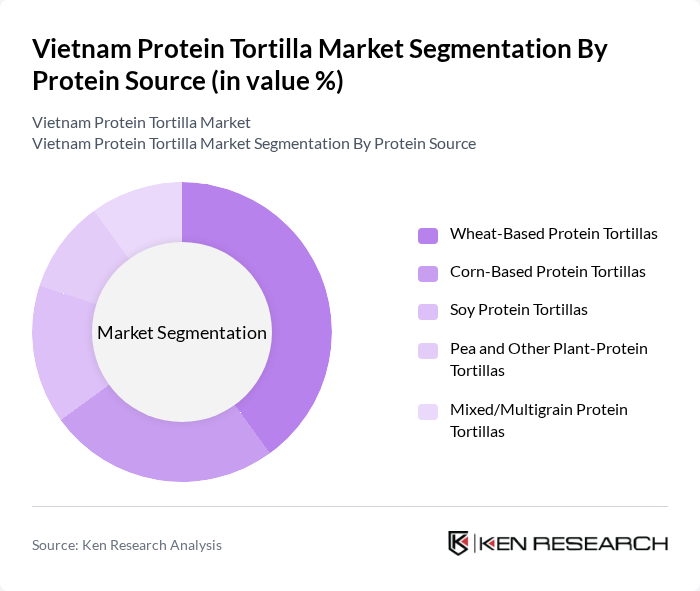

By Protein Source:The protein source segmentation includes various types of tortillas based on their primary protein content. The subsegments are Wheat-Based Protein Tortillas, Corn-Based Protein Tortillas, Soy Protein Tortillas, Pea and Other Plant-Protein Tortillas, and Mixed/Multigrain Protein Tortillas. Among these, Wheat-Based Protein Tortillas are currently leading the market due to their widespread acceptance and versatility in various culinary applications, in line with the global and Asia Pacific tortilla markets where flour (wheat) tortillas hold a dominant share. Consumers appreciate the familiar taste and texture and the ease of using wheat-based wraps in Western-style and fusion dishes, making them a popular choice for both traditional and modern recipes.

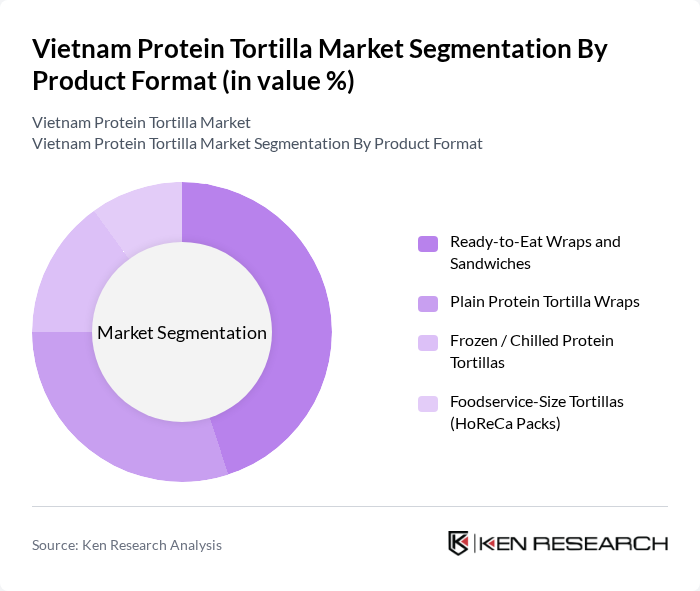

By Product Format:This segmentation focuses on the different formats in which protein tortillas are available. The subsegments include Ready-to-Eat Wraps and Sandwiches, Plain Protein Tortilla Wraps, Frozen / Chilled Protein Tortillas, and Foodservice-Size Tortillas (HoReCa Packs). The Ready-to-Eat Wraps and Sandwiches subsegment is currently dominating the market due to the increasing demand for convenient, on-the-go meal options among busy consumers and the rapid growth of foodservice and QSR channels using tortillas and wraps as carriers for protein-rich fillings. This format appeals to those seeking quick, nutritious meals without compromising on taste and aligns with broader Asia Pacific trends where tortillas and wraps are being adopted in ready-to-eat, chilled, and foodservice applications.

The Vietnam Protein Tortilla Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gruma, S.A.B. de C.V. (Mission Foods Vietnam), La Tortilla Factory, General Mills, Inc. (Old El Paso), PepsiCo, Inc. (Doritos & Tortilla Chips Portfolio), Grupo Bimbo, S.A.B. de C.V., CJ Foods Vietnam Co., Ltd., Acecook Vietnam Joint Stock Company, Masan Consumer Corporation, Mondelez Kinh ?ô Vietnam, Orion Food Vina Co., Ltd., URC Vietnam Co., Ltd. (Universal Robina), Unilever Vietnam International Co., Ltd., Nestlé Vietnam Ltd., Lotte Vietnam Co., Ltd., Central Retail Vietnam (Private Label Tortilla & Wrap Offerings) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam protein tortilla market is poised for significant growth, driven by increasing health consciousness and a shift towards high-protein diets. As urbanization continues, more consumers are expected to seek convenient, nutritious food options. Innovations in product offerings, such as gluten-free and plant-based protein tortillas, will likely attract a broader audience. Additionally, the rise of e-commerce platforms will facilitate easier access to these products, enhancing market penetration and consumer engagement in the health food sector.

| Segment | Sub-Segments |

|---|---|

| By Protein Source | Wheat-Based Protein Tortillas Corn-Based Protein Tortillas Soy Protein Tortillas Pea and Other Plant-Protein Tortillas Mixed/Multigrain Protein Tortillas |

| By Product Format | Ready-to-Eat Wraps and Sandwiches Plain Protein Tortilla Wraps Frozen / Chilled Protein Tortillas Foodservice-Size Tortillas (HoReCa Packs) |

| By Consumer Segment | Mainstream Retail Consumers Sports & Fitness Enthusiasts Diet & Weight-Management Consumers Vegan / Vegetarian / Flexitarian Consumers |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores & Mini Marts Specialty Health & Organic Stores Online Grocery & E-commerce Platforms HoReCa & Foodservice Distributors |

| By Nutritional Positioning | High-Protein High-Protein and Low-Carb High-Protein and Gluten-Free High-Protein and High-Fiber / Functional |

| By Price Positioning | Mass-Market Premium Private Label / Store Brands |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 150 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Food Service Sector Analysis | 100 | Restaurant Owners, Menu Planners |

| Nutritionist Feedback | 75 | Registered Dietitians, Nutrition Consultants |

| Market Trend Analysis | 120 | Food Industry Analysts, Market Researchers |

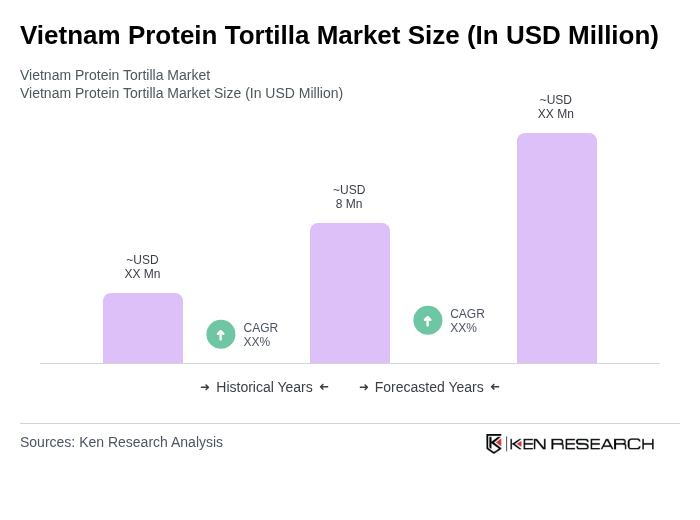

The Vietnam Protein Tortilla Market is valued at approximately USD 8 million, reflecting a growing trend towards healthier food options among consumers, particularly high-protein and nutritious bakery products like tortillas and wraps.