Vietnam Security Services Market Outlook to 2030

Region:Asia

Author(s):Sanjeev kumar

Product Code:KROD1272

November 2024

90

About the Report

Vietnam Security Services Market Overview

- The Vietnam Security Services market is valued at USD 101 million, based on a five-year historical analysis. The market's growth is driven by increased demand from commercial, industrial, and residential sectors for robust security services to ensure safety and protection. The expansion of urban areas, combined with heightened concerns over theft, vandalism, and unauthorized access, has led to a growing reliance on security solutions, including manned guarding and electronic surveillance systems. Furthermore, technological advancements such as AI and biometric security systems have also played a significant role in expanding the market.

- Key cities that dominate the Vietnam Security Services market include Hanoi and Ho Chi Minh City. These urban centers have seen rapid industrialization and urbanization, resulting in a higher demand for security services across various sectors. The dominance of these cities is largely attributed to the concentration of commercial and governmental establishments, as well as high-value infrastructure projects that require comprehensive security coverage. The growth of multinational corporations and foreign direct investment in these areas also boosts the demand for private security services.

- The Vietnamese government has been actively promoting public-private partnerships (PPPs) to enhance national security efforts. Through collaborations with private security companies, the government has developed initiatives to safeguard critical infrastructure, such as transportation hubs, public buildings, and industrial zones. In 2024, the Ministry of Public Security expanded its cooperation with private security firms to include more comprehensive surveillance in major urban areas. This collaboration allows for the integration of private security technologies, such as CCTV and biometric systems, with government databases, strengthening the overall security framework.

Vietnam Security Services Market Segmentation

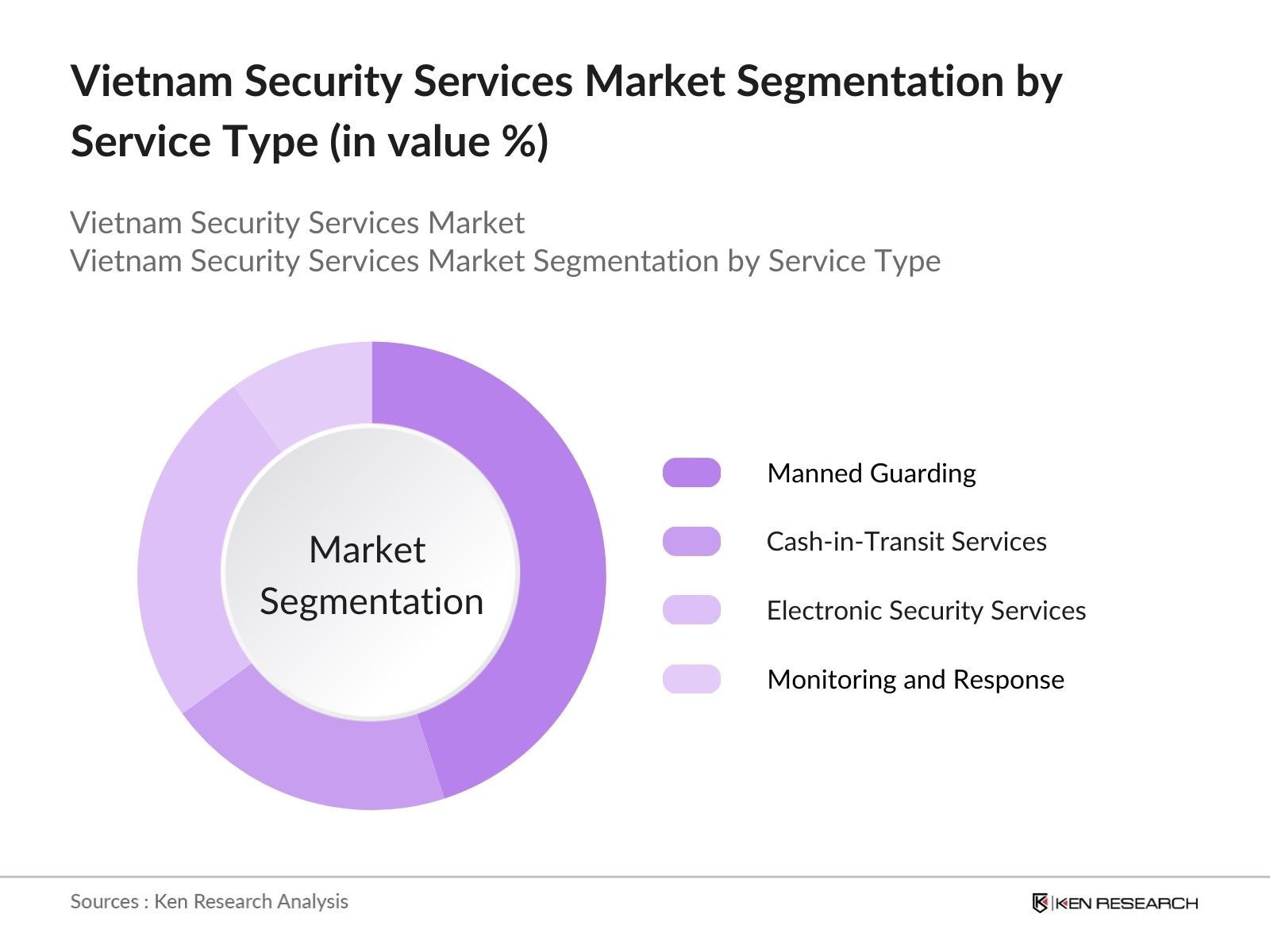

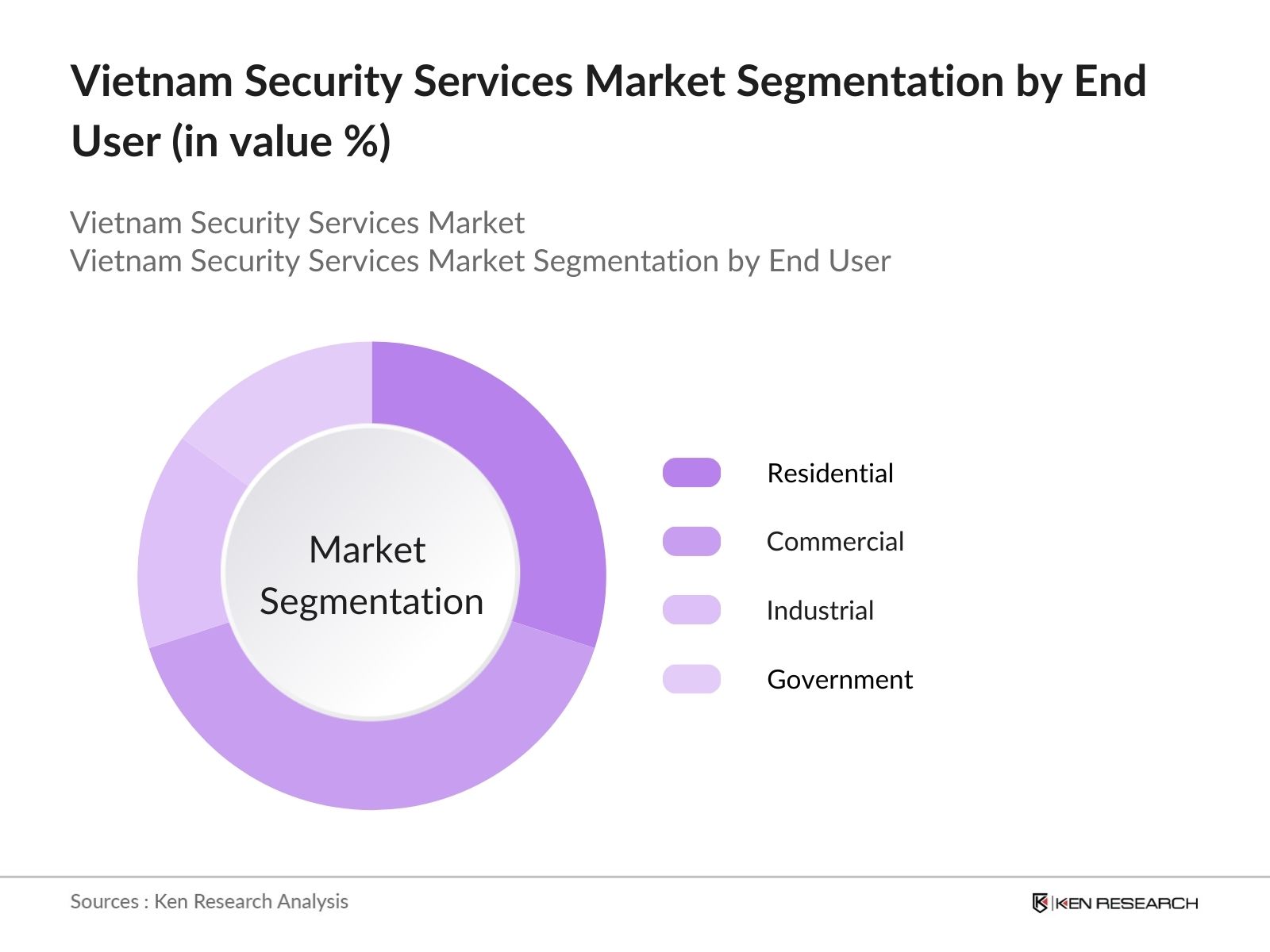

Vietnam's Security Services market can be segmented by service type and by end-users.

- By Service Type: The market is segmented by service type into manned guarding, cash-in-transit services, electronic security services, and monitoring and response services. Manned guarding holds the dominant market share under the service type segment due to its widespread use in industries, residential complexes, and government facilities. The presence of a large workforce in Vietnam, combined with the relatively lower costs of employing security personnel, has driven the demand for these services. The high reliance on physical security to manage entry points and provide on-site protection, especially in high-risk areas, further solidifies the position of manned guarding as a dominant sub-segment.

- By End User: The market is also segmented by end-user into residential, commercial, industrial, and government sectors. The commercial sector dominates the market share within the end-user segment, largely due to the proliferation of businesses, offices, and retail spaces in urban areas like Hanoi and Ho Chi Minh City. With the increasing number of corporate offices, retail chains, and hotels, the demand for sophisticated security solutions has surged. Furthermore, the need for secure premises in financial institutions, including banks and corporate headquarters, reinforces the dominance of the commercial sector in this market.

Vietnam Security Services Market Competitive Landscape

Vietnam Security Services Market Competitive Landscape

The Vietnam Security Services market is dominated by several major players, both local and international. These companies provide a range of services, including manned guarding, electronic security, and surveillance services. Their strategic presence across urban areas and strong client relationships makes them key contributors to the overall market. The competitive landscape in Vietnam is shaped by a mix of established multinational firms and local service providers that cater to the specific needs of Vietnamese businesses and industries.

|

Company Name |

Established |

Headquarters |

No. of Employees |

Revenue (USD Mn) |

Services Provided |

|

G4S Secure Solutions |

1901 |

London, UK |

|||

|

Prosegur |

1976 |

Madrid, Spain |

|||

|

Securitas |

1934 |

Stockholm, Sweden |

|||

|

Viettel Group |

1989 |

Hanoi, Vietnam |

|||

|

VinGroup Security |

1993 |

Hanoi, Vietnam |

Vietnam Security Services Industry Analysis

Market Growth Drivers

- Rising Demand for Corporate Security Services (Driven by Business Expansion): Vietnams rapidly growing economy, with a GDP of $408.81 billion in 2024, has seen a surge in foreign direct investment (FDI). With over $22 billion in FDI inflows in 2023, many multinational corporations are establishing a presence in Vietnam. This business expansion has driven the demand for corporate security services to safeguard physical assets and employees. Large industrial zones like Bc Ninh and Hi Phng have experienced increased security spending as businesses look to protect against theft, vandalism, and industrial espionage. This trend is set to grow as Vietnam becomes an even more attractive hub for manufacturing and logistics operations.

- Increasing Crime Rates (Urban and Industrial Regions): Vietnams crime rate has been steadily increasing, especially in urbanized areas like Ho Chi Minh City and Hanoi. In 2023, the Ministry of Public Security reported over 50,000 criminal cases, with a significant number occurring in high-density urban areas. Industrial regions have also witnessed a rise in crimes such as burglary and property damage, further necessitating enhanced security measures. The rise in theft in manufacturing and warehousing sectors in regions like ng Nai highlights the urgent need for robust security services.

- Technological Integration (Use of AI, Biometrics, and CCTV): The Vietnamese government has been promoting the adoption of advanced technology in security services. In 2024, the market for CCTV, biometric identification, and AI-driven surveillance systems has seen a significant boost, with over 80% of corporate security providers offering tech-based solutions. The governments 2025 Vision initiative focuses on smart city developments, where advanced surveillance systems play a critical role. Security companies are investing in AI-enabled cameras and biometric access controls, improving operational efficiency and enhancing safety measures in public and private spaces.

Market Challenges

- High Operational Costs (Security Infrastructure and Personnel): Security service companies in Vietnam face rising operational costs, driven by the need to invest in advanced technology and skilled labor. With the average monthly salary for a skilled security worker in urban areas reaching $500 in 2024, maintaining a well-trained workforce is expensive. Additionally, the cost of deploying advanced technologies, such as AI surveillance systems and biometric access controls, has increased. Companies have reported operational expenses accounting for up to 40% of their total revenue in 2023, affecting profitability.

- Limited Skilled Workforce (Training Gaps in Specialized Security): The security services industry in Vietnam faces a shortage of skilled workers, particularly in specialized areas such as cybersecurity, VIP protection, and advanced surveillance systems. In 2024, the Ministry of Labor estimated that less than 15% of the workforce in the security sector had undergone formal training for specialized security roles. This skills gap has led to increased pressure on companies to invest in in-house training programs, raising operational costs and limiting the scalability of services.

Vietnam Security Services Market Future Outlook

The Vietnam Security Services market is poised for significant growth in the coming years, driven by rising security concerns, increasing urbanization, and the adoption of advanced technologies. Over the next five years, the market is expected to benefit from continuous government support in regulating and improving security services, as well as the rapid development of industrial zones that require heightened security protocols. Technological advancements such as AI-based surveillance, biometric systems, and IoT-driven security solutions are expected to further accelerate market growth.

Market Opportunities

- Expanding Demand in Residential Security Services (Rising Middle-Class Population): Vietnams middle-class population has been expanding rapidly, with more than 49 million people falling into this income bracket by 2024. This demographic shift has led to increased demand for residential security services, particularly in gated communities and high-rise apartment complexes. Households are increasingly investing in home security systems, CCTV cameras, and security personnel to ensure safety, driving growth in this segment of the security market.

- Growth in Outsourcing Security Services (Corporate Sectors): Vietnamese businesses are increasingly outsourcing their security needs to third-party providers to focus on core operations. In 2024, the corporate outsourcing market for security services is expected to grow as more companies in manufacturing, logistics, and retail sectors shift to managed security services. Companies find it cost-effective and efficient to partner with specialized security firms that offer comprehensive packages, including surveillance, access control, and on-site personnel. The outsourcing trend is particularly strong in industrial zones, where businesses need to comply with strict safety and security regulations.

Scope of the Report

|

Manned Guarding Cash-in-Transit Services Electronic Security Services Monitoring and Response Services |

|

|

By End User |

Residential Commercial Industrial Government |

|

By Deployment Type |

On-Premise Security Remote Monitoring |

|

By Technology Integration |

Artificial Intelligence (AI) Biometrics and Access Control CCTV and Surveillance Systems |

|

By Region |

North East West South |

Products

Key Target Audience

Corporate Security Departments

Financial Institutions (Banks, Investment Firms)

Real Estate Developers

Industrial and Manufacturing Units

Government and Regulatory Bodies (Ministry of Public Security)

Event Management Companies

IT and Data Center Operators

Banks and financial institutes

Investors and Venture Capitalist Firms

Companies

Players Mention in the Report:

G4S Secure Solutions

Prosegur

Securitas

Allied Universal

Viettel Group

VinGroup Security

FPT Securities

ANZ Security Services

ISS Facility Services Vietnam

DaiAn Security

Vietnam Manpower Supply and Security Service JSC

Cong Ty Binh An Security

Tan Bao Security Services

Thien Bao Security Services

East West Security Services

Table of Contents

1. Vietnam Security Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Security Services Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Security Services Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Corporate Security Services (Driven by Business Expansion)

3.1.2. Increasing Crime Rates (Urban and Industrial Regions)

3.1.3. Technological Integration (Use of AI, Biometrics, and CCTV)

3.1.4. Government Support for Security Standardization (Industry Regulations)

3.2. Market Challenges

3.2.1. High Operational Costs (Security Infrastructure and Personnel)

3.2.2. Limited Skilled Workforce (Training Gaps in Specialized Security)

3.2.3. Increasing Competition from Low-Cost Players (Price Sensitivity)

3.3. Opportunities

3.3.1. Expanding Demand in Residential Security Services (Rising Middle-Class Population)

3.3.2. Growth in Outsourcing Security Services (Corporate Sectors)

3.3.3. Investment in Advanced Surveillance Technologies (Drones, IoT Integration)

3.4. Trends

3.4.1. Shift Toward Managed Security Services (Remote Monitoring and Control)

3.4.2. Expansion in Event Security Services (Corporate and Government Events)

3.4.3. Increased Demand for Personal Protection Services (VIP and Corporate Executives)

3.5. Government Regulation

3.5.1. Licensing Requirements for Security Companies

3.5.2. Labor Laws Impacting Security Workforce

3.5.3. Public-Private Collaboration for Security Initiatives

3.5.4. National Security Standards for Security Equipment

4. Vietnam Security Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Manned Guarding

4.1.2. Cash-in-Transit Services

4.1.3. Electronic Security Services

4.1.4. Monitoring and Response Services

4.2. By End User (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Government

4.3. By Deployment Type (In Value %)

4.3.1. On-Premise Security

4.3.2. Remote Monitoring

4.4. By Technology Integration (In Value %)

4.4.1. Artificial Intelligence (AI)

4.4.2. Biometrics and Access Control

4.4.3. CCTV and Surveillance Systems

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. Vietnam Security Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. G4S Secure Solutions

5.1.2. Prosegur

5.1.3. Securitas

5.1.4. Allied Universal

5.1.5. Viettel Group

5.1.6. VinGroup Security

5.1.7. FPT Securities

5.1.8. ANZ Security Services

5.1.9. ISS Facility Services Vietnam

5.1.10. DaiAn Security

5.1.11. Vietnam Manpower Supply and Security Service JSC

5.1.12. Cong Ty Binh An Security

5.1.13. Tan Bao Security Services

5.1.14. Thien Bao Security Services

5.1.15. East West Security Services

5.2. Cross Comparison Parameters (Number of Security Personnel, Revenue, Headquarters Location, Service Specialization)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Contracts

5.8. Private Sector Investments

6. Vietnam Security Services Market Regulatory Framework

6.1. Security Services Licensing Requirements

6.2. Compliance with National Security Standards

6.3. Security Equipment Certification Processes

7. Vietnam Security Services Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Security Services Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By End User (In Value %)

8.3. By Deployment Type (In Value %)

8.4. By Technology Integration (In Value %)

8.5. By Region (In Value %)

9. Vietnam Security Services Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Risk Management Strategies

9.3. White Space Opportunities

9.4. Business Model Innovation

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves mapping out the ecosystem of the Vietnam Security Services Market, focusing on stakeholders such as security service providers, government agencies, and corporate clients. Desk research is conducted using secondary databases to gather relevant industry insights.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed, including security service penetration across various sectors and revenue generation statistics. Market share and service performance metrics are carefully evaluated to ensure reliable estimates.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with security experts, managers, and stakeholders are conducted to validate the market assumptions. These consultations provide operational insights and help refine market projections.

Step 4: Research Synthesis and Final Output

Engagement with security service providers is done to acquire detailed data on service types, client preferences, and emerging trends. The insights are synthesized to produce a final, comprehensive analysis of the Vietnam Security Services Market.

Frequently Asked Questions

01. How big is the Vietnam Security Services Market?

The Vietnam Security Services Market is valued at USD 101 million, driven by increased demand for commercial and residential security solutions, along with rapid urbanization in major cities.

02. What are the challenges in the Vietnam Security Services Market?

Key challenges in Vietnam Security Services Market include high operational costs, limited skilled labor in advanced security technologies, and increasing competition from low-cost service providers.

03. Who are the major players in the Vietnam Security Services Market?

Major players in Vietnam Security Services Market include G4S Secure Solutions, Prosegur, Securitas, Viettel Group, and VinGroup Security, which dominate through strong brand presence and advanced security offerings.

04. What drives growth in the Vietnam Security Services Market?

Growth is driven in Vietnam Security Services Market by rising security concerns across residential, commercial, and industrial sectors, as well as the adoption of advanced security technologies such as AI and biometrics.

05. Which sectors dominate the Vietnam Security Services Market?

In Vietnam Security Services Market commercial sector dominates, primarily due to the rising number of corporate offices, retail chains, and hotels, which require robust security infrastructure to ensure business continuity.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.