Region:Asia

Author(s):Rebecca

Product Code:KRAC9671

Pages:92

Published On:November 2025

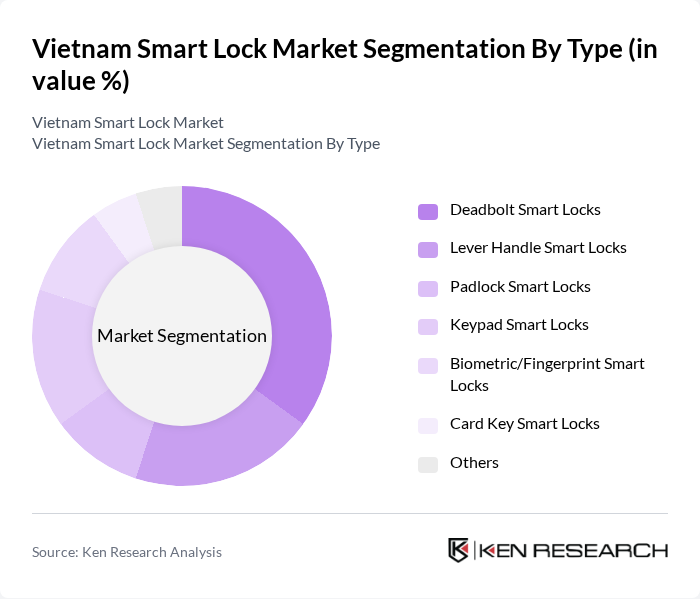

By Type:The smart lock market can be segmented into various types, including Deadbolt Smart Locks, Lever Handle Smart Locks, Padlock Smart Locks, Keypad Smart Locks, Biometric/Fingerprint Smart Locks, Card Key Smart Locks, and Others. Among these, Deadbolt Smart Locks are gaining significant traction due to their robust security features and ease of installation, making them a preferred choice for residential and commercial applications. The market also sees increasing demand for biometric and keypad smart locks, reflecting consumer preference for convenience and advanced access control .

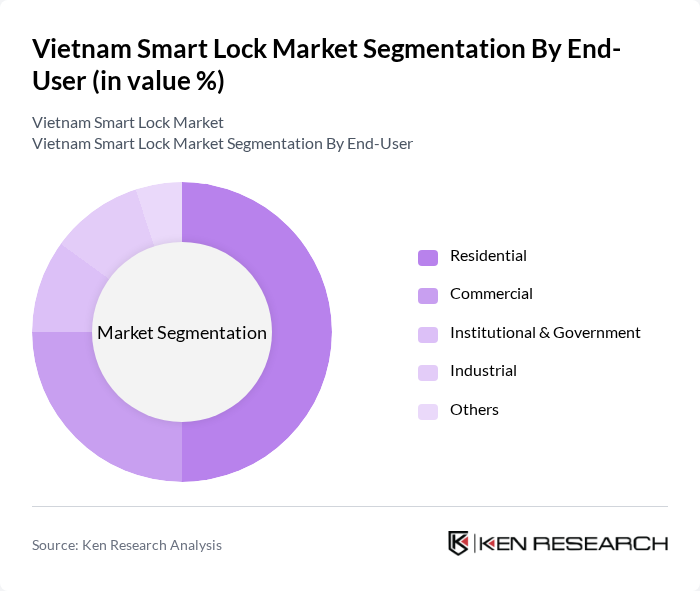

By End-User:The smart lock market is segmented by end-users into Residential, Commercial, Institutional & Government, Industrial, and Others. The Residential segment is leading the market due to the increasing focus on home security and the growing trend of smart home integration. Consumers are increasingly investing in smart locks to enhance their home security systems, driving the demand in this segment. The commercial sector is also experiencing notable growth as businesses seek advanced access control solutions for offices and facilities .

The Vietnam Smart Lock Market is characterized by a dynamic mix of regional and international players. Leading participants such as Assa Abloy, Yale, Samsung SDS, Kaadas, PHGLock, Vi?t-Ti?p, Bosch, Aqara, Xiaomi, Hafele, Dessmann, Unicor, Locpro, ZKTeco, Epic Systems contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam smart lock market is poised for substantial growth, driven by increasing urbanization and a heightened focus on security. As consumer awareness improves and technological advancements continue, the market is expected to see a shift towards more affordable and user-friendly solutions. Additionally, the integration of smart locks into broader smart home ecosystems will enhance their appeal, making them a staple in modern households. This evolving landscape presents significant opportunities for innovation and market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Deadbolt Smart Locks Lever Handle Smart Locks Padlock Smart Locks Keypad Smart Locks Biometric/Fingerprint Smart Locks Card Key Smart Locks Others |

| By End-User | Residential Commercial Institutional & Government Industrial Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam |

| By Technology | Bluetooth Smart Locks Wi-Fi Smart Locks Zigbee Smart Locks Z-Wave Smart Locks Others |

| By Application | Home Security Office Security Rental Properties Smart Home Integration Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies for Smart Lock Adoption Tax Exemptions for Manufacturers Regulatory Support for Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Smart Lock Users | 100 | Homeowners, Renters |

| Commercial Property Managers | 60 | Facility Managers, Security Directors |

| Retail Sector Decision Makers | 50 | Store Managers, Security Consultants |

| Smart Home Technology Enthusiasts | 40 | Tech Bloggers, Early Adopters |

| Security System Installers | 40 | Installation Technicians, Service Managers |

The Vietnam Smart Lock Market is valued at approximately USD 10 million, driven by urbanization, rising disposable incomes, and increased awareness of home security solutions among consumers. This market is expected to grow significantly as demand for advanced security features rises.