Vietnam Soft Drinks Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD8534

December 2024

97

About the Report

Vietnam Soft Drinks Market Overview

- The Vietnam soft drinks market is valued at USD 6.7 billion based on recent market analysis. This growth is primarily driven by the rising demand for healthier beverage options, including bottled water, functional drinks, and low-sugar beverages. Post-pandemic recovery and a growing focus on health and wellness have further propelled the market. Key categories such as bottled water, ready-to-drink (RTD) teas, and carbonated beverages continue to dominate due to product innovation and consumer preferences.

- The soft drinks market in Vietnam is largely concentrated in major cities such as Ho Chi Minh City and Hanoi. These regions dominate the market due to their higher population density, greater disposable income, and more modernized consumer preferences. Urbanization and a robust retail infrastructure in these cities, including supermarkets, convenience stores, and online platforms, have also contributed to the market dominance in these regions.

- In 2024, the Vietnamese government will introduce a beverage tax policy aimed at reducing the consumption of high-sugar and unhealthy beverages. The policy will impose a tax on beverages with excessive sugar content, motivating soft drink manufacturers to reformulate their products. This initiative is designed to encourage the production and consumption of healthier beverages and will affect the pricing strategies of leading players in the market.

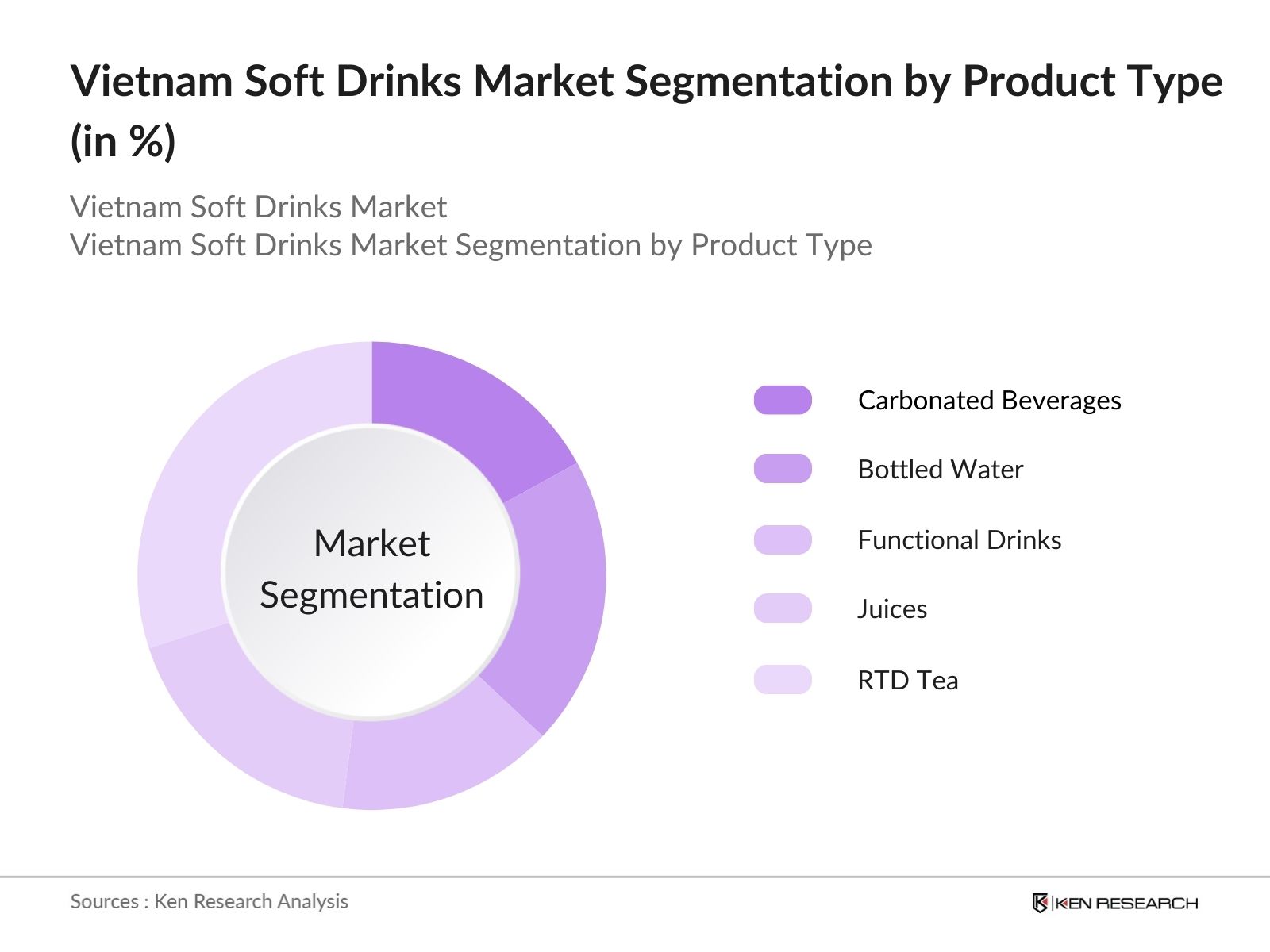

Vietnam Soft Drinks Market Segmentation

By Product Type: The market is segmented by product type into carbonated beverages, bottled water, functional drinks, juices, and RTD tea. In recent years, bottled water has taken a leading market share. This dominance can be attributed to the rising consumer awareness of health and hydration, as well as increasing concerns over water quality. Leading brands like Lavie and Suntory PepsiCo have capitalized on this by offering purified and mineral water variants that resonate with health-conscious consumers.

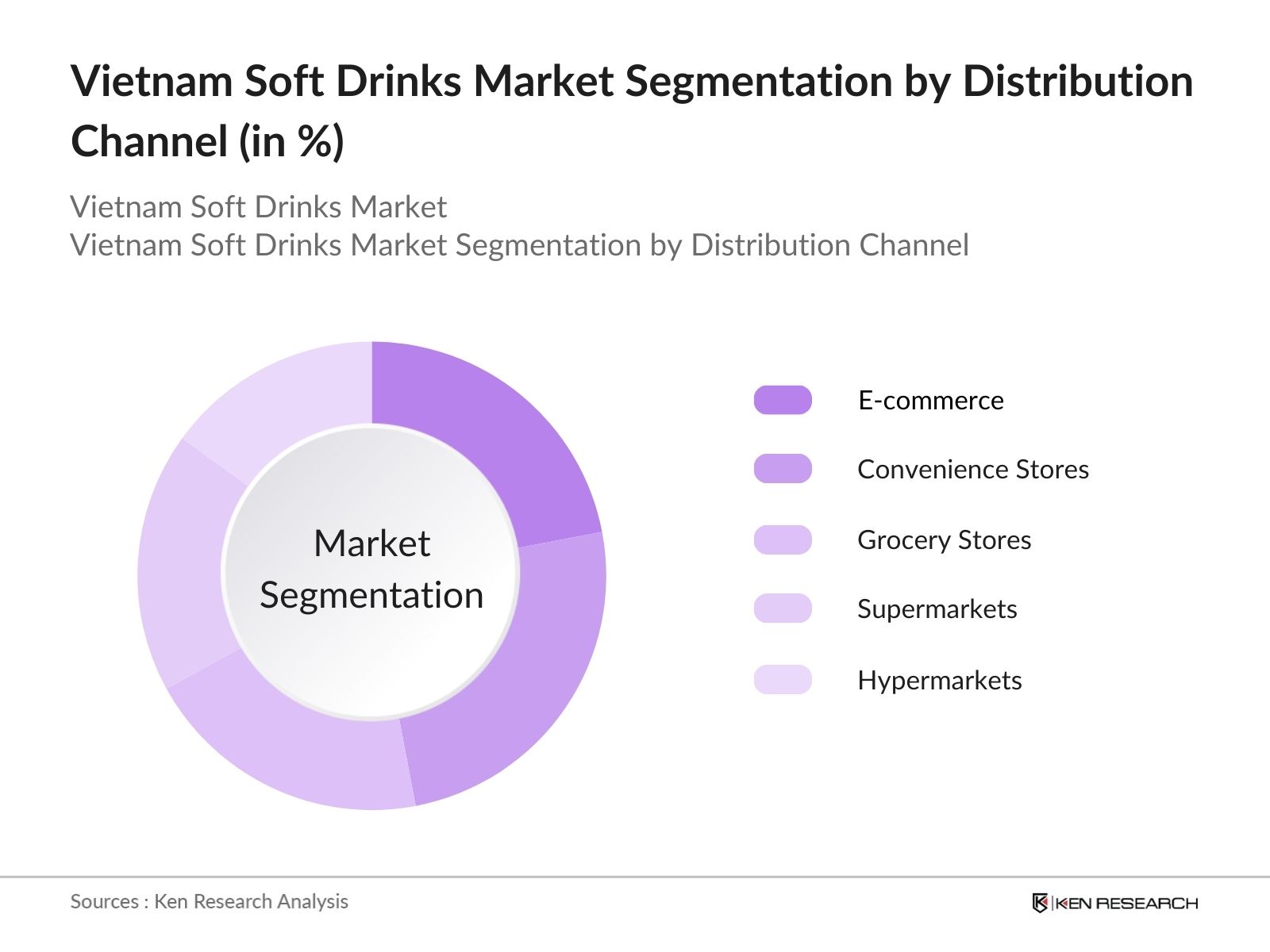

By Distribution Channel: The market is also segmented by distribution channels, including e-commerce, convenience stores, grocery stores, supermarkets, and hypermarkets. E-commerce is rapidly growing, fueled by Vietnams increasing internet penetration and consumer preference for home delivery. Platforms like Tiki and Lazada have expanded their food and beverage categories, making it easier for consumers to purchase their preferred drinks online.

Vietnam Soft Drinks Market Competitive Landscape

The market is dominated by a mix of global and local players. Leading companies such as Suntory PepsiCo Vietnam Beverage Co. Ltd and Coca-Cola Beverages Vietnam Co. Ltd maintain a strong market presence through extensive distribution networks, continuous product innovation, and effective marketing strategies.

Vietnam Soft Drinks Market Analysis

Market Growth Drivers

- Increased Demand for Healthy Beverage Alternatives: Consumers in Vietnam are increasingly shifting towards healthy and natural soft drink options such as fruit-based beverages, functional drinks, and organic drinks. In 2024, over 30 million consumers are expected to seek out beverages free from artificial ingredients and preservatives, fueling the growth of this segment. The demand for such products has surged, driven by health consciousness and a desire for immune-boosting products.

- Expanding Middle-Class Population: The growing middle-class population in Vietnam, which is projected to exceed 45 million people in 2024, is driving the consumption of premium and international soft drink brands. The purchasing power of this demographic has increased significantly, leading to higher consumption of non-essential goods such as soft drinks.

- Rising Consumption of On-the-Go Beverages: The trend towards urban mobility and on-the-go lifestyles has increased the demand for convenient, ready-to-drink soft beverages in Vietnam. With over 10 million working professionals in key urban cities in 2024, this segment of consumers actively seeks beverages that are portable and convenient for consumption during commuting or work breaks.

Market Challenges

- High Sugar Taxation and Health Regulations: Vietnams government has been proactive in curbing the consumption of sugary soft drinks by implementing stringent regulations and taxes. In 2024, the sugar tax is expected to reach VND 5,000 per liter for certain soft drinks, discouraging mass consumption and leading to a decline in the sales of high-sugar beverages.

- Intense Competition from Local and International Brands: The soft drinks market in Vietnam is highly competitive, with over 200 active brands fighting for market share. In 2024, leading international brands like Coca-Cola and PepsiCo face increasing competition from local brands that offer more affordable, culturally relevant alternatives.

Vietnam Soft Drinks Market Future Outlook

Over the next five years, the Vietnam soft drinks industry is projected to experience robust growth, driven by a combination of increasing consumer demand for health-oriented beverages and continued product innovation.

Future Market Opportunities

- Expansion of Low-Sugar and Sugar-Free Options: In response to increasing government regulations on sugar content and consumer preferences for healthier alternatives, the market for low-sugar and sugar-free soft drinks will experience substantial growth. By 2028, the majority of new product launches in the soft drinks market will focus on sugar-free options, with companies leveraging natural sweeteners such as stevia to meet regulatory requirements and consumer demand.

- Increased Adoption of Sustainable Packaging Solutions: As Vietnam continues to implement stricter environmental policies, soft drink companies will be forced to adopt more sustainable packaging solutions. By 2028, it is expected that a significant proportion of soft drinks sold in the market will use biodegradable, reusable, or recyclable packaging.

Scope of the Report

|

By Product Type |

Carbonated Beverages Bottled Water Juice Functional Beverages RTD Tea |

|

By Distribution Channel |

E-commerce Grocery Stores Convenience Stores Supermarkets & Hypermarkets Specialty Stores |

|

By Consumer Demographics |

Health-Conscious Consumers Young Population Rural vs Urban Consumers |

|

By Packaging Type |

PET Bottles Glass Bottles Cans Tetra Pak |

|

By Region |

North West East South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Beverage Manufacturers

Packaging Companies

Banks and Financial Institution

Private Equity Firms

Government and Regulatory Bodies (Ministry of Industry and Trade)

Health and Wellness Organizations

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Suntory PepsiCo Vietnam Beverage Co. Ltd.

Coca-Cola Beverages Vietnam Co. Ltd.

Tan Hiep Phat Group

URC Vietnam Co. Ltd.

Lavie Co. Ltd (Nestle Waters)

Red Bull Vietnam

TH Group

Hanoi Beer Alcohol and Beverage Corporation (Habeco)

Kirin Holdings Vietnam

Monster Beverage Vietnam

Table of Contents

Vietnam Soft Drinks Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

Vietnam Soft Drinks Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

Vietnam Soft Drinks Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of E-commerce (Online Sales Penetration)

3.1.2 Government Tax Policies (VAT Reduction)

3.1.3 Rising Health Consciousness (Demand for Healthier Beverages)

3.1.4 Increase in Outdoor Activities (Post-COVID Economic Recovery)

3.2 Market Challenges

3.2.1 Competition from Local and Global Players

3.2.2 Consumer Shift Towards Healthier Alternatives

3.2.3 Logistics and Distribution Barriers in Rural Areas

3.2.4 Price Sensitivity among Consumers

3.3 Opportunities

3.3.1 Functional and Low-Sugar Beverages (Health-Oriented Market)

3.3.2 Sustainable Packaging (Circular Economy Initiatives)

3.3.3 Increasing Demand for Premium Products

3.3.4 Collaborations with Local Retailers and E-commerce Platforms

3.4 Trends

3.4.1 Growth of Plant-Based Protein Drinks (Niche Market Segment)

3.4.2 Rise of Ready-to-Drink (RTD) Teas

3.4.3 Product Innovation with Vitamins and Minerals

3.4.4 Expansion of Bottled Water Market

3.5 Government Regulations

3.5.1 Food Safety Standards (Regulatory Compliance)

3.5.2 Tax Incentives for Local Manufacturers

3.5.3 Environmental Protection (Recycling and Waste Reduction)

3.5.4 Consumer Protection Laws (Product Transparency)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

Vietnam Soft Drinks Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Carbonated Beverages

4.1.2 Bottled Water

4.1.3 Juice

4.1.4 Functional Beverages (Energy, Sports, and Protein Drinks)

4.1.5 Ready-to-Drink (RTD) Tea

4.2 By Distribution Channel (In Value %)

4.2.1 E-commerce

4.2.2 Grocery Stores

4.2.3 Convenience Stores

4.2.4 Supermarkets & Hypermarkets

4.2.5 Specialty Stores

4.3 By Consumer Demographics (In Value %)

4.3.1 Health-Conscious Consumers

4.3.2 Young Population (Millennials and Gen Z)

4.3.3 Rural vs Urban Consumers

4.4 By Packaging Type (In Value %)

4.4.1 PET Bottles

4.4.2 Glass Bottles

4.4.3 Cans

4.4.4 Tetra Pak

4.5 By Region (In Value %)

4.5.1 North

4.5.2 East

4.5.3 West

4.5.4 South

Vietnam Soft Drinks Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Suntory PepsiCo Vietnam Beverage Co. Ltd.

5.1.2 Coca-Cola Beverages Vietnam Co. Ltd.

5.1.3 Tan Hiep Phat Group

5.1.4 URC Vietnam Co. Ltd.

5.1.5 Lavie Co. Ltd. (Nestle Waters)

5.1.6 Red Bull Vietnam

5.1.7 Saigon Beverage Co.

5.1.8 Vietnam National Beverage Corporation (Vinamilk)

5.1.9 Danone Vietnam

5.1.10 Fosters Vietnam

5.1.11 Kirin Holdings Vietnam

5.1.12 Monster Beverage Vietnam

5.1.13 TH Group

5.1.14 Hanoi Beer Alcohol and Beverage Corporation (Habeco)

5.1.15 TNG Holdings Vietnam

5.2 Cross Comparison Parameters (Revenue, Market Share, Headquarters, Product Innovation, Packaging Initiatives, Distribution Network, Sustainability Efforts, Health-Oriented Offerings)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Collaborations, New Product Launches)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Support

5.8 Private Equity Investments

Vietnam Soft Drinks Market Regulatory Framework

6.1 Food Safety and Standards

6.2 Labeling and Advertising Guidelines

6.3 Import and Export Regulations

6.4 Recycling and Environmental Compliance

Vietnam Soft Drinks Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

Vietnam Soft Drinks Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Consumer Demographics (In Value %)

8.4 By Packaging Type (In Value %)

8.5 By Region (In Value %)

Vietnam Soft Drinks Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior Insights

9.3 White Space Opportunity Analysis

9.4 Strategic Marketing Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase focuses on mapping the Vietnam soft drinks market, involving key stakeholders such as manufacturers, distributors, and e-commerce platforms. Through extensive desk research, we identify the primary drivers and challenges impacting market growth, including changing consumer preferences and regulatory frameworks.

Step 2: Market Analysis and Construction

In this step, historical data from 2018 to 2023 is analyzed to understand market trends. Metrics such as market penetration rates, consumption patterns, and product preferences are used to evaluate revenue growth and establish market projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by conducting interviews with industry professionals from leading soft drink companies. These discussions provide insight into operational challenges, product development strategies, and financial performance, allowing for a refined market analysis.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing insights from both secondary data and expert consultations. We compile market forecasts, competitive landscape assessments, and key growth opportunities, ensuring that the final output is comprehensive and aligned with market realities.

Frequently Asked Questions

01. How big is the Vietnam Soft Drinks Market?

The Vietnam soft drinks market is valued at USD 6.7 billion, driven by increasing demand for healthier beverage options such as bottled water and RTD teas.

02. What are the challenges in the Vietnam Soft Drinks Market?

The Vietnam soft drinks market faces challenges including high competition from global and local players, the shift towards healthier beverages, and the logistical complexities of rural distribution.

03. Who are the major players in the Vietnam Soft Drinks Market?

Major players in the Vietnam soft drinks market include Suntory PepsiCo Vietnam Beverage Co. Ltd., Coca-Cola Beverages Vietnam Co. Ltd., and Tan Hiep Phat Group. These companies have extensive distribution networks and diverse product portfolios.

04. What are the growth drivers of the Vietnam Soft Drinks Market?

The growth in the Vietnam soft drinks market is driven by increasing health consciousness, rising e-commerce sales, and innovative product launches such as low-sugar and functional beverages.

05. What is the outlook for the Vietnam Soft Drinks Market?

The Vietnam soft drinks market is expected to grow steadily over the next five years, with bottled water and RTD tea leading in demand due to their health benefits and convenience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.