Region:Asia

Author(s):Dev

Product Code:KRAD3377

Pages:99

Published On:November 2025

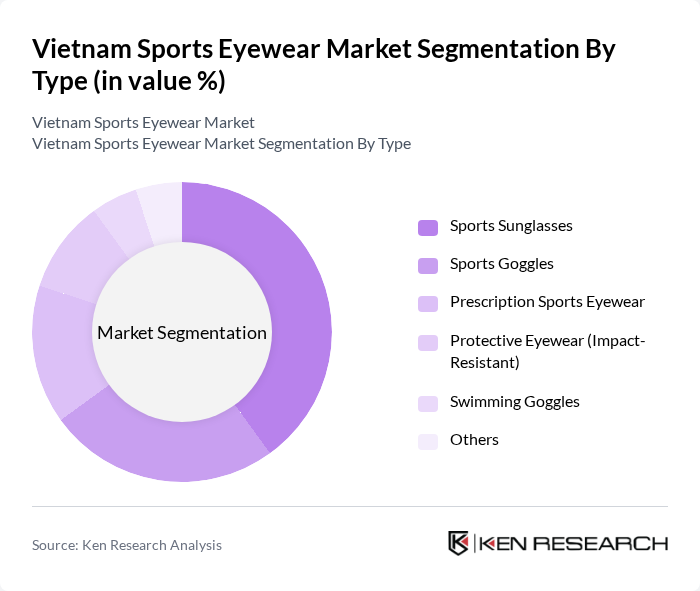

By Type:The market is segmented into Sports Sunglasses, Sports Goggles, Prescription Sports Eyewear, Protective Eyewear (Impact-Resistant), Swimming Goggles, and Others. Sports Sunglasses remain the most popular segment due to their versatility, style, and suitability for both athletes and casual users. The demand for Prescription Sports Eyewear is also rising, driven by an increasing number of individuals seeking corrective lenses that accommodate active lifestyles and digital screen protection .

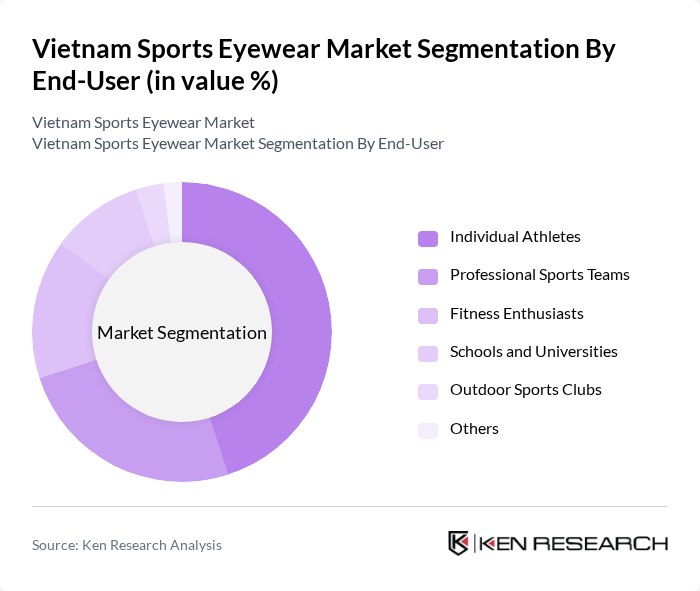

By End-User:End-user segmentation includes Individual Athletes, Professional Sports Teams, Fitness Enthusiasts, Schools and Universities, Outdoor Sports Clubs, and Others. Individual Athletes represent the largest segment, reflecting the growing number of people engaging in sports and fitness activities for health and wellness. Professional Sports Teams and Fitness Enthusiasts also contribute significantly, as they increasingly require specialized eyewear for performance and protection .

The Vietnam Sports Eyewear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oakley, Ray-Ban, Nike Vision, Adidas Eyewear, Under Armour Eyewear, Bollé, Smith Optics, Tifosi Optics, Rudy Project, Serengeti Eyewear, Maui Jim, Rudy Project Vietnam, SEESON Eyewear, Concept Eyewear, Luxottica Group, and Rodenstock GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam sports eyewear market is poised for significant growth, driven by increasing health consciousness and a shift towards active lifestyles. As more consumers prioritize eye protection during sports, the demand for specialized eyewear is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate easier access to a variety of products, enhancing consumer choice. Innovations in sustainable materials and smart eyewear technology will further shape the market, appealing to environmentally conscious consumers and tech-savvy athletes alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Sports Sunglasses Sports Goggles Prescription Sports Eyewear Protective Eyewear (Impact-Resistant) Swimming Goggles Others |

| By End-User | Individual Athletes Professional Sports Teams Fitness Enthusiasts Schools and Universities Outdoor Sports Clubs Others |

| By Gender | Male Female Unisex |

| By Age Group | Children Teenagers Adults Seniors |

| By Activity Type | Running Cycling Water Sports Winter Sports Ball Sports (Football, Tennis, etc.) Others |

| By Distribution Channel | Online Retail Specialty Sports Stores Optical Stores Supermarkets/Hypermarkets Sports Equipment Stores Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Sales Representatives |

| Consumer Preferences Survey | 120 | Athletes, Fitness Enthusiasts |

| Industry Expert Interviews | 40 | Product Designers, Brand Managers |

| Distribution Channel Analysis | 80 | Distributors, Wholesalers |

| Market Trend Evaluation | 60 | Market Analysts, Retail Consultants |

The Vietnam Sports Eyewear Market is valued at approximately USD 50 million, reflecting a growing trend in sports participation and increased awareness of eye protection among athletes and fitness enthusiasts.