Region:Asia

Author(s):Rebecca

Product Code:KRAD4302

Pages:81

Published On:December 2025

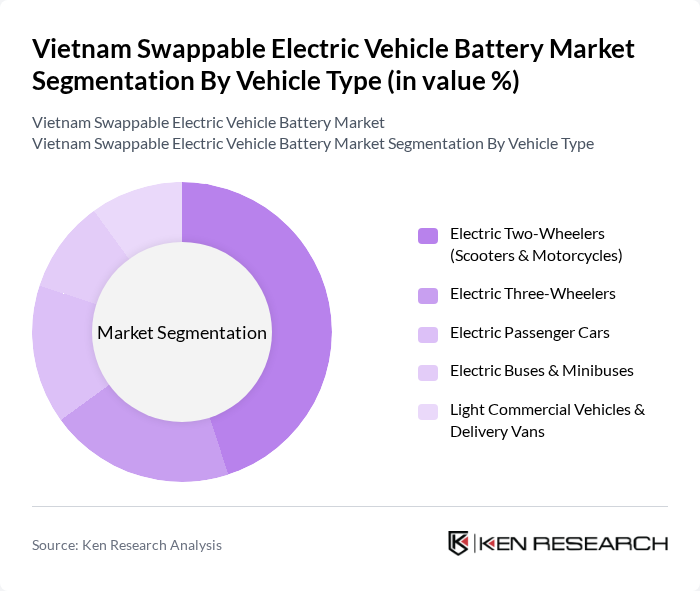

By Vehicle Type:The vehicle type segmentation includes Electric Two-Wheelers (Scooters & Motorcycles), Electric Three-Wheelers, Electric Passenger Cars, Electric Buses & Minibuses, and Light Commercial Vehicles & Delivery Vans. Among these, Electric Two-Wheelers dominate the market due to their affordability, ease of use, and suitability for urban commuting. The increasing number of ride-hailing services and the growing trend of eco-friendly transportation options further boost the demand for electric scooters and motorcycles. Electric Three-Wheelers are also gaining traction, particularly in rural areas, where they serve as an efficient mode of transport.

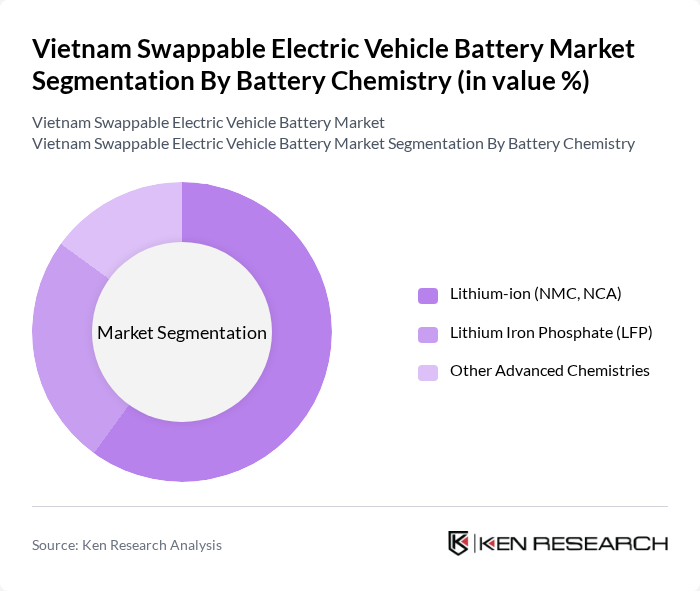

By Battery Chemistry:The battery chemistry segmentation includes Lithium-ion (NMC, NCA), Lithium Iron Phosphate (LFP), and Other Advanced Chemistries. Lithium-ion batteries, particularly those using NMC and NCA chemistries, dominate the market due to their high energy density and efficiency. The growing demand for longer-range electric vehicles and the need for rapid charging capabilities further enhance the preference for lithium-ion batteries. Lithium Iron Phosphate (LFP) is also gaining popularity due to its safety and cost-effectiveness, especially in commercial applications.

The Vietnam Swappable Electric Vehicle Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as VinFast Trading and Production LLC, Selex Motors Joint Stock Company, Dat Bike Co., Ltd., PEGA Electric Vehicle Joint Stock Company, GSM Green & Smart Mobility JSC, EVGO E-Mobility Joint Stock Company, Vepower Energy Solutions Co., Ltd., VinES Energy Solutions Joint Stock Company, Gotion – VinES Battery Joint Venture in Vietnam, Tera Energy Vietnam Co., Ltd., Jing-Jin Electric (JJE) Vietnam, BYD Vietnam Co., Ltd., Contemporary Amperex Technology Co., Limited (CATL) – Vietnam Operations, LG Energy Solution – Vietnam, Panasonic Energy Vietnam Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the swappable electric vehicle battery market in Vietnam appears promising, driven by technological advancements and supportive government policies. As battery technology continues to improve, the cost of production is expected to decrease, making EVs more accessible. Additionally, the government’s commitment to enhancing charging infrastructure will facilitate the adoption of electric vehicles. With increasing investments in research and development, the market is poised for significant growth, aligning with global sustainability trends and consumer preferences for cleaner transportation solutions.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Electric Two-Wheelers (Scooters & Motorcycles) Electric Three-Wheelers Electric Passenger Cars Electric Buses & Minibuses Light Commercial Vehicles & Delivery Vans |

| By Battery Chemistry | Lithium-ion (NMC, NCA) Lithium Iron Phosphate (LFP) Other Advanced Chemistries |

| By Station Type | Automated Swapping Stations Semi-automated Swapping Stations Manual Swapping Points |

| By Service Model | Battery-as-a-Service (BaaS) Subscriptions Pay-per-Swap Fleet Contracts & Leasing |

| By End-User | Individual Consumers Ride-hailing & Bike-taxi Operators E-commerce & Last-mile Delivery Fleets Public Transport Operators Corporate & Industrial Fleets |

| By Region | Hanoi & Northern Key Provinces Da Nang & Central Vietnam Ho Chi Minh City & Southern Key Provinces |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturers | 60 | Production Managers, R&D Directors |

| Electric Vehicle Users | 150 | Private Vehicle Owners, Fleet Operators |

| Government Officials | 50 | Policy Makers, Transportation Planners |

| Charging Infrastructure Providers | 80 | Business Development Managers, Operations Directors |

| Environmental NGOs | 40 | Sustainability Advocates, Program Managers |

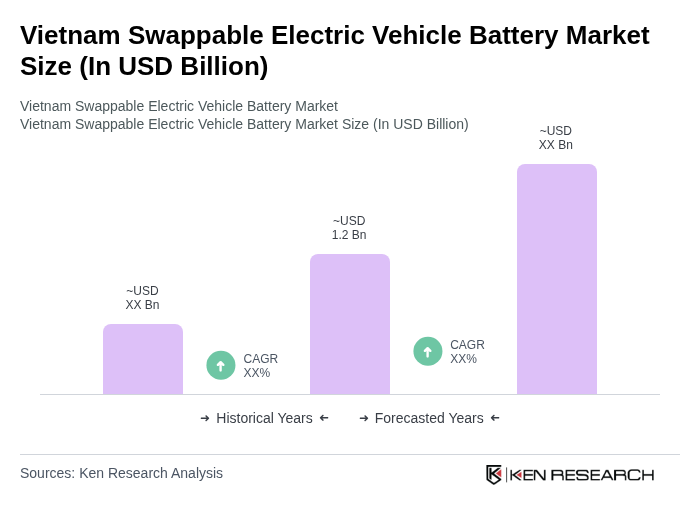

The Vietnam Swappable Electric Vehicle Battery Market is valued at approximately USD 1.2 billion, driven by the increasing adoption of electric vehicles, government initiatives for sustainable transportation, and advancements in battery technology and infrastructure development.