Region:Asia

Author(s):Rebecca

Product Code:KRAB0227

Pages:83

Published On:August 2025

By Service Type:The service type segmentation includes categories such as Traditional Taxi Services, Ride-Hailing Services, Luxury Taxi Services, Electric Taxi Services, Shared Taxi Services, Airport Transfer Services, and Others. Among these, Ride-Hailing Services have emerged as the dominant segment due to their convenience, competitive pricing, and the widespread adoption of smartphones. Consumers increasingly prefer the flexibility and ease of booking rides through mobile applications, leading to a significant shift from traditional taxi services. The rise of digital booking platforms and the integration of real-time tracking and cashless payment options have further accelerated this shift.

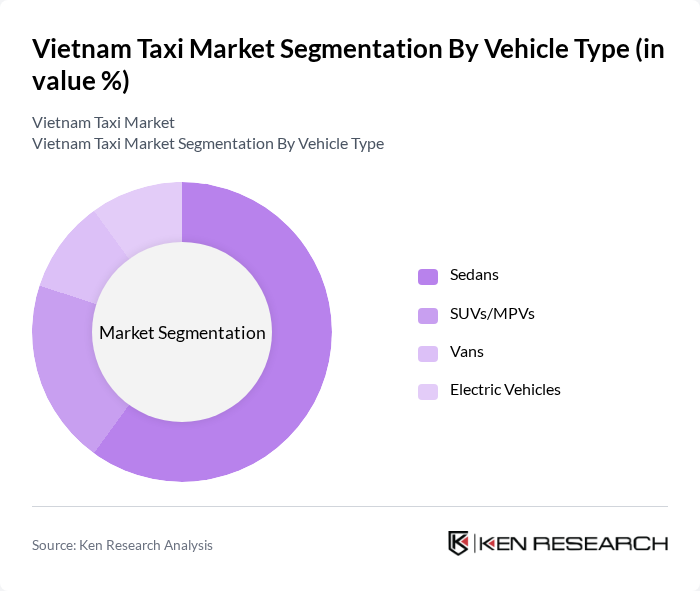

By Vehicle Type:The vehicle type segmentation encompasses Sedans, SUVs/MPVs, Vans, and Electric Vehicles. Sedans dominate the market due to their affordability and fuel efficiency, making them the preferred choice for both individual consumers and corporate clients. The increasing focus on sustainability and government incentives is gradually boosting the adoption of Electric Vehicles, although they currently hold a smaller market share compared to traditional vehicles.

The Vietnam Taxi Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grab Holdings Inc., Mai Linh Group, Vinasun Corporation, Be Group JSC, Gojek Vietnam, FastGo Vietnam JSC, Taxi Group Hanoi, Thanh Cong Taxi, Hoang Long Taxi, Sasco Taxi, Phuong Trang Taxi, Thang Long Taxi, Hanh Trinh Taxi, Vietstar Taxi, VinaTaxi contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam taxi market is poised for significant transformation as urbanization accelerates and technology integration deepens. In future, the demand for eco-friendly transportation options is expected to rise, driven by consumer awareness and government initiatives. Additionally, the increasing reliance on mobile applications for booking services will reshape customer experiences. As the market evolves, companies that adapt to these trends and invest in innovative solutions will likely gain a competitive edge, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Traditional Taxi Services Ride-Hailing Services Luxury Taxi Services Electric Taxi Services Shared Taxi Services Airport Transfer Services Others |

| By Vehicle Type | Sedans SUVs/MPVs Vans Electric Vehicles |

| By Customer Segment | Individual Consumers Corporate Clients Tourists Government Agencies |

| By Booking Channel | Mobile Apps Websites Phone Reservations Street Hailing |

| By Province/Region | Ho Chi Minh City Hanoi Da Nang Quang Ninh Others |

| By Pricing Model | Metered Fare Flat Rate Subscription-Based Dynamic Pricing |

| By Propulsion Type | Internal Combustion Engine (ICE) Electric & Hybrid |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Taxi Fleet Operators | 50 | Fleet Managers, Business Owners |

| Ride-Hailing Service Users | 100 | Regular Commuters, Occasional Users |

| Taxi Drivers | 60 | Full-time Drivers, Part-time Drivers |

| Government Transportation Officials | 40 | Policy Makers, Urban Planners |

| Tourists Using Taxi Services | 50 | International Tourists, Domestic Travelers |

The Vietnam taxi market is valued at approximately USD 2.1 billion, driven by urbanization, rising disposable incomes, and the popularity of ride-hailing services. This growth reflects a significant shift towards digital platforms enhancing consumer convenience and accessibility.