Region:Asia

Author(s):Geetanshi

Product Code:KRAA0112

Pages:98

Published On:August 2025

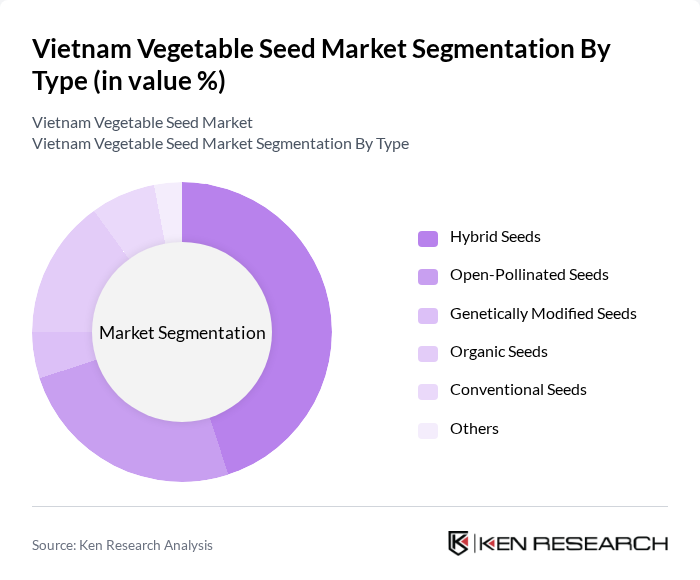

By Type:The vegetable seed market can be segmented into various types, including hybrid seeds, open-pollinated seeds, genetically modified seeds, organic seeds, conventional seeds, and others. Among these, hybrid seeds are gaining significant traction due to their higher yield potential and disease resistance, making them the preferred choice for commercial farmers. Open-pollinated seeds are also popular among smallholder farmers for their cost-effectiveness and ease of use. The demand for organic seeds is on the rise as consumers increasingly seek sustainable and chemical-free produce. Genetically modified seeds remain a minor segment due to regulatory constraints and consumer preferences .

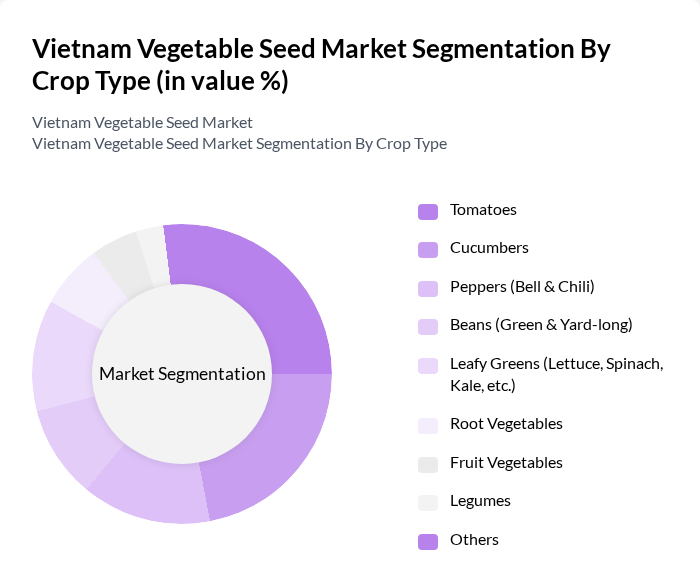

By Crop Type:The market can also be segmented based on crop types, including tomatoes, cucumbers, peppers (bell & chili), beans (green & yard-long), leafy greens (lettuce, spinach, kale, etc.), root vegetables, fruit vegetables, legumes, and others. Tomatoes and cucumbers are among the leading crops due to their high consumption rates and versatility in culinary applications. Leafy greens are also gaining popularity as health-conscious consumers seek nutritious options, driving demand for quality seeds in this segment. Cucurbits (such as cucumbers and melons) represent the largest crop family by market share, reflecting their importance in Vietnamese diets and export markets .

The Vietnam Vegetable Seed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta, Bayer Crop Science, East-West Seed, Limagrain, Takii Seed, Vietnam National Seed Group (Vinaseed), Southern Seed Corporation (SSC), Nong Lam Seed, Hanh Phuc Seed, Hoang Long Seed, Green Seed, C.P. Vietnam, Agri Seeds, Seed Asia, and Vina Seed contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnamese vegetable seed market appears promising, driven by increasing investments in agricultural technology and a growing focus on sustainability. As urban agriculture initiatives gain traction, the demand for innovative seed varieties is expected to rise. Furthermore, collaboration with international seed companies will likely enhance local expertise and access to advanced seed technologies, positioning Vietnam as a competitive player in the regional agricultural market.

| Segment | Sub-Segments |

|---|---|

| By Type | Hybrid Seeds Open-Pollinated Seeds Genetically Modified Seeds Organic Seeds Conventional Seeds Others |

| By Crop Type | Tomatoes Cucumbers Peppers (Bell & Chili) Beans (Green & Yard-long) Leafy Greens (Lettuce, Spinach, Kale, etc.) Root Vegetables Fruit Vegetables Legumes Others |

| By Cultivation Mechanism | Open Field Cultivation Protected Cultivation (Greenhouse, Net House, etc.) |

| By Distribution Channel | Direct Sales (Company-owned Outlets) Retailers and Dealers Online Platforms Agricultural Cooperatives Others |

| By End-User | Commercial Farmers Smallholder Farmers Home Gardeners Vegetable Processing Industry Agricultural Enterprises Research Institutions Others |

| By Seed Treatment Method | Chemical Treatment Biological Treatment Physical Treatment Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seed Retailers | 60 | Store Managers, Sales Representatives |

| Commercial Farmers | 100 | Farm Owners, Agricultural Managers |

| Seed Producers | 40 | Production Managers, Quality Control Officers |

| Agricultural Consultants | 50 | Agronomists, Crop Advisors |

| Government Agricultural Officials | 40 | Policy Makers, Regulatory Officers |

The Vietnam Vegetable Seed Market is valued at approximately USD 73 million, reflecting a significant growth trend driven by the demand for high-quality seeds and advancements in agricultural technology.