Vietnam Water Treatment Chemicals Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD2376

November 2024

85

About the Report

Vietnam Water Treatment Chemicals Market Overview

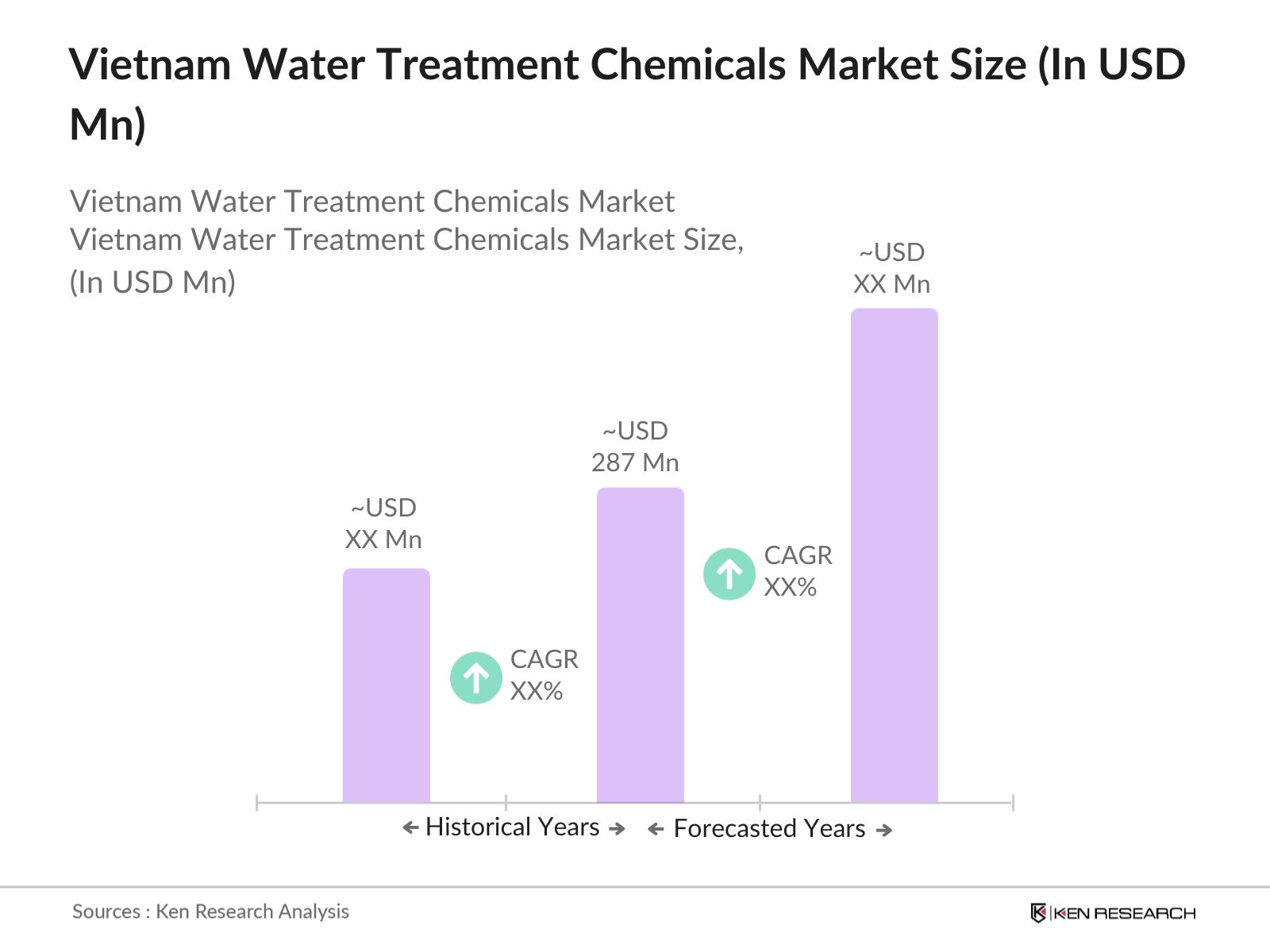

- The Vietnam water treatment chemicals market was valued at USD 287 million. This growth is driven by the increasing demand for clean water, rising industrialization, and stringent environmental regulations aimed at controlling water pollution.

- Key players in the Vietnam water treatment chemicals market include BASF SE, Kemira Oyj, Ecolab Inc., SUEZ Water Technologies, and Veolia Water Technologies. These companies have established a strong presence in Vietnam, leveraging the country's industrial growth and increasing government initiatives to improve water quality across various sectors.

- Solenis has acquired CedarChem to enhance its water and wastewater treatment capabilities in the Southeastern U.S. This acquisition expands Solenis's portfolio, adding CedarChem's innovative products, which serve over 300 customers and support the treatment of 1.5 billion gallons of water daily.

- Ho Chi Minh City emerged as the leading region in the Vietnam water treatment chemicals market, due to the city's high population density, rapid industrialization, and the presence of major manufacturing hubs requiring extensive water treatment processes.

Vietnam Water Treatment Chemicals Market Segmentation

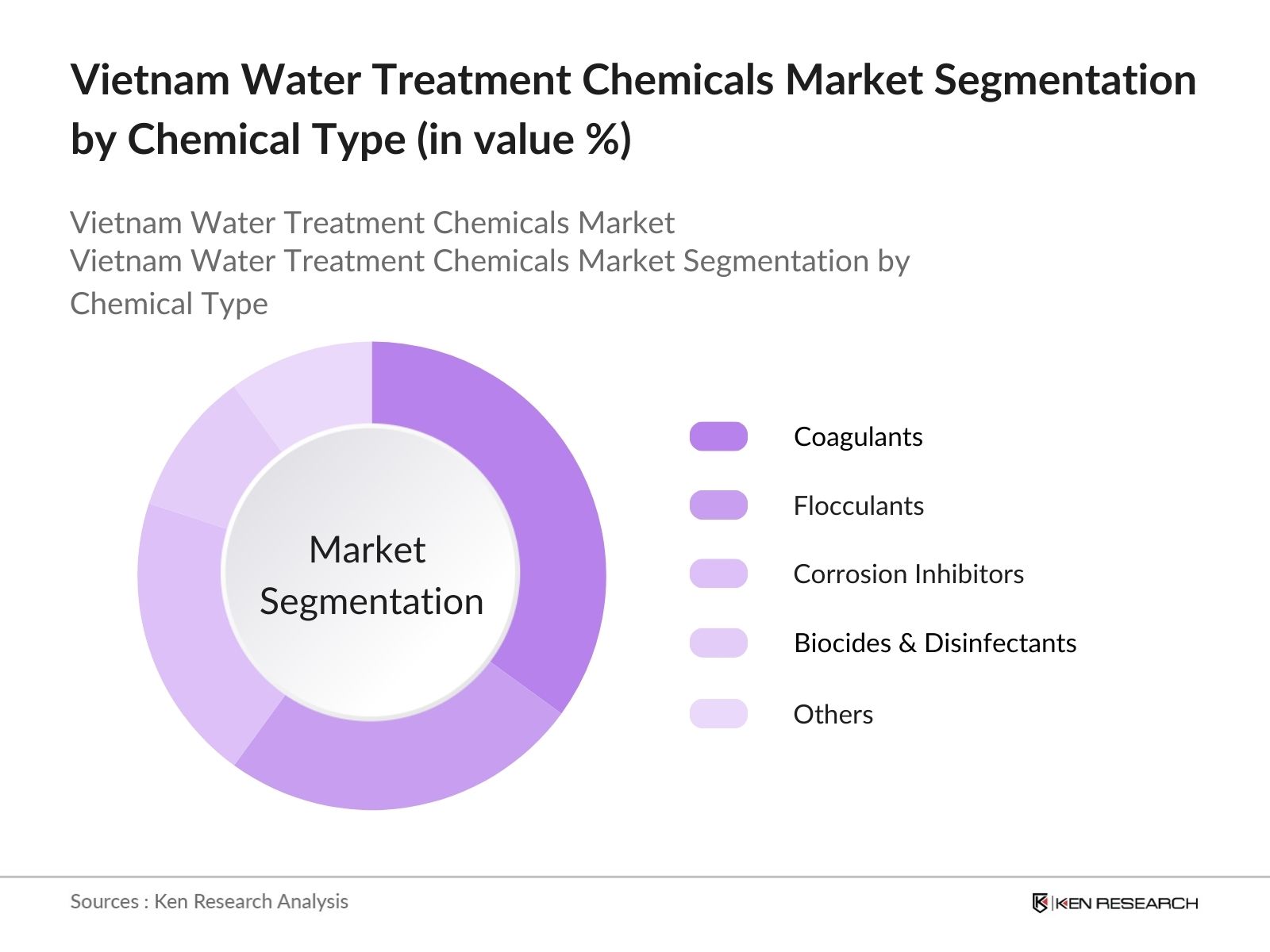

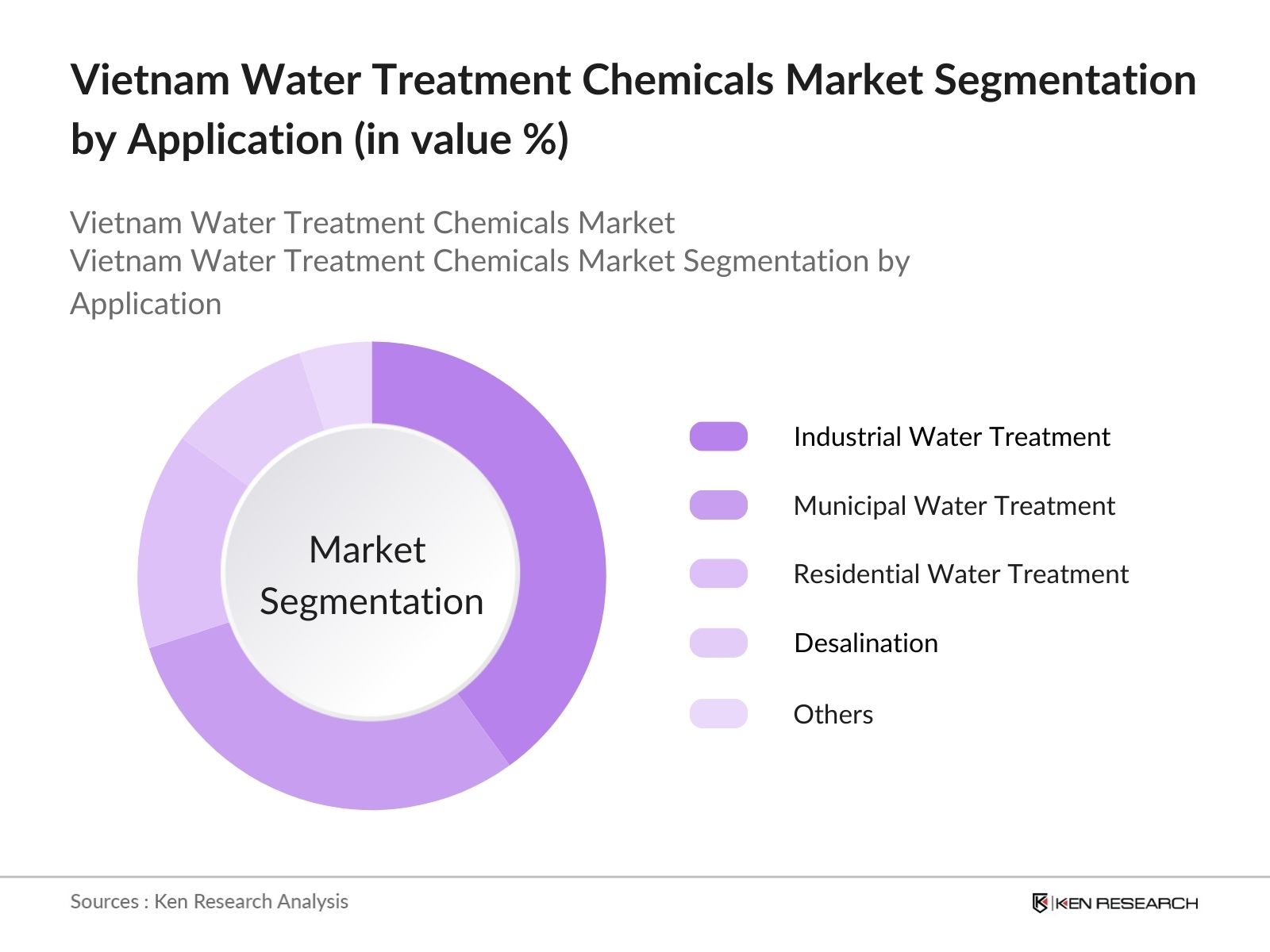

The Vietnam Water Treatment Chemicals Market is segmented by chemical type, application, and region.

- By Chemical Type: The market is segmented into coagulants, flocculants, corrosion inhibitors, biocides & disinfectants, and others (pH adjusters, anti-foaming agents). Coagulants dominated the market due to their wide use in municipal water treatment facilities and industrial processes.

- By Application: The market is segmented by application into municipal water treatment, industrial water treatment, residential water treatment, desalination, and others. Industrial water treatment held the largest market share, owing to the growth of key industries such as manufacturing, chemicals, and food & beverages, which require water treatment processes.

- By Region: The market is segmented by region into North, South, East, and West. The South region dominated the market due to its well-developed industrial infrastructure, high population density, and growing demand for industrial and municipal water treatment solutions.

Vietnam Water Treatment Chemicals Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|

Ecolab Inc. |

1923 |

St. Paul, Minnesota, USA |

|

Solenis LLC |

2014 |

Wilmington, Delaware, USA |

|

Kemira Oyj |

1920 |

Helsinki, Finland |

|

Kurita Water Industries Ltd. |

1949 |

Tokyo, Japan |

- BASF SE: BASF showcased innovative water treatment solutions at WETEX 2016, focusing on the Middle East's growing desalination and wastewater treatment market. Their new products, including Sokalan RO 3500, enhance efficiency and sustainability, addressing the region's water scarcity challenges amid rising demand for reliable water supply.

- Ecolab Inc.: Ecolab has launched its new Global Chemical organization, merging its Heavy Chemical and Downstream Chemical Process Industries groups. This initiative aims to address water scarcity, projected to impact 70% of the global economy by 2030, leveraging nearly 100 years of expertise in water management.

Vietnam Water Treatment Chemicals Market Analysis

Vietnam Water Treatment Chemicals Market Growth Drivers:

- Urbanization and Industrialization: Urbanization and industrialization in Vietnam have led to a population growth rate of about 0.935 per 1,000 people in 2023, reflecting a 2.07% increase from the previous year. This urban influx intensifies the demand for clean water, necessitating advanced water treatment solutions.

- Stricter Environmental Regulations: Stricter environmental regulations are driving the market, with the Vietnamese government focusing on reducing water pollution. Reports indicate that 80% of medical cases related to diseases like cholera and typhoid stem from polluted water, emphasizing the urgent need for effective water treatment chemicals across various sectors.

- Rising Awareness of Water Scarcity: Rising awareness of water scarcity is evident, as Vietnam generated about 2,868 million m of household wastewater in 2020, with only 12% collected for treatment. This highlights the critical need for water recycling and reuse solutions, further propelling the demand for water treatment chemicals in urban and industrial areas.

Vietnam Water Treatment Chemicals Market Challenges:

- High Cost of Advanced Chemicals: The high cost of advanced water treatment chemicals can reach up to 30% more than traditional options, creating financial barriers for smaller industries and municipal bodies. This limits their ability to adopt necessary technologies for effective water treatment and pollution control.

- Dependence on Imports: Vietnam's chemical sector relies on imports for over 90% of basic inorganic chemicals, such as chlorine and sulfuric acid. This dependence creates supply chain vulnerabilities, leading to price fluctuations and impacting the overall pricing structure of the water treatment chemicals market. In 2019, Vietnam's chemicals import turnover was 3.29 times higher than the export turnover.

Vietnam Water Treatment Chemicals Market Government Initiatives:

- National Water Treatment Plan: The Vietnamese government has implemented a National Water Treatment Plan aimed at achieving universal access to clean water by 2030. This initiative includes modernizing water treatment plants and increasing the use of eco-friendly chemicals, with a target to ensure 95%-100% clean water access for urban populations by 2025.

- Establishment of Industrial Parks: Vietnam has established industrial parks, such as the Vietnam Water Technology Park, to foster innovation in water treatment technologies. Currently, only 30% of industrial parks in Hanoi have centralized wastewater treatment plants. The government aims to substantially enhance investment in the water treatment sector, targeting an increase in efficient practices and technologies over the next decade.

Vietnam Water Treatment Chemicals Market Future Market Outlook

The Vietnam Water Treatment Chemicals Market is expected to grow over the next five years, driven by industrial expansion and the increasing focus on environmental sustainability. The market is expected to see a rise in demand for advanced chemical solutions for wastewater treatment, with industrial and municipal applications leading the growth.

Future Market Trends:

- Increased Focus on Green Chemistry: In the coming years, the focus on green chemistry in water treatment is expected to increase, with companies adopting environmentally friendly chemicals to align with government regulations. This shift will enhance sustainability practices, promoting the use of safer, biodegradable substances in water purification processes.

- Technological Advancements in Water Treatment: In the coming years, the adoption of smart water management technologies, including AI and IoT for water quality monitoring, will drive demand for specialized chemicals tailored for advanced water treatment systems. These innovations will enhance efficiency and effectiveness, ensuring better management of water resources amid growing global demands.

Scope of the Report

|

By Chemical Type |

Coagulants Flocculants Biocides Corrosion Inhibitors Others |

|

By Application |

Municipal Water Treatment Industrial Water Treatment Residential Water Treatment Desalination Others |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Water Treatment Chemical Manufacturers

Industrial Water Users (Manufacturing, Power Plants)

Water Utilities and Service Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

BASF SE

Kemira Oyj

Ecolab Inc.

SUEZ Water Technologies

Veolia Water Technologies

Solvay S.A.

Dow Chemical Company

Lonza Group

AkzoNobel N.V.

SNF Floerger

Buckman Laboratories International

Kurita Water Industries Ltd.

Dupont de Nemours Inc.

Shandong Taihe Water Treatment Technologies

BWA Water Additives

Table of Contents

1. Vietnam Water Treatment Chemicals Market Overview

1.1 Definition and Scope (Market Definition, Water Treatment Chemical Types, Industry Boundaries)

1.2 Market Taxonomy (By Chemical Type, Application, Region)

1.3 Market Growth Rate (CAGR, Key Trends, Market Dynamics)

1.4 Market Segmentation Overview (Segmentation by Chemical Type, Application, Region)

1.5 Overview of Key Market Developments (Technological Advancements, Environmental Regulations, Government Initiatives)

2. Vietnam Water Treatment Chemicals Market Size (in USD Million)

2.1 Historical Market Size (2018-2023 Market Data, Analysis)

2.2 Year-on-Year Growth Analysis (Growth Trends, Performance Indicators)

2.3 Key Market Developments and Milestones (Investments, Government Initiatives)

2.4 Current Market Valuation (2023 Valuation, Key Contributions to Water Treatment Infrastructure)

3. Vietnam Water Treatment Chemicals Market Analysis

3.1 Growth Drivers

3.1.1 Urbanization and Industrialization (Population Growth, Industrial Expansion)

3.1.2 Stricter Environmental Regulations (Government Focus on Reducing Water Pollution)

3.1.3 Rising Awareness of Water Scarcity (Water Recycling, Reuse Solutions)

3.1.4 Government Investments in Water Infrastructure (National Water Treatment Plan)

3.2 Restraints

3.2.1 High Cost of Advanced Chemicals (Financial Barriers for Small Industries)

3.2.2 Dependence on Imports (Vulnerability in Supply Chains, Price Fluctuations)

3.3 Opportunities

3.3.1 Growth in Industrial Water Treatment (Manufacturing, Chemical, Food & Beverages Industries)

3.3.2 Adoption of Green Chemistry Solutions (Sustainable Water Treatment Technologies)

3.3.3 Increasing Demand for Water Recycling and Reuse (Municipal and Industrial Applications)

3.4 Trends

3.4.1 Focus on Green Chemistry (Eco-Friendly, Biodegradable Chemicals)

3.4.2 Technological Advancements in Water Treatment (Smart Water Management, AI, IoT)

3.4.3 Expansion of Desalination Projects (Sea Water Treatment Solutions)

3.5 SWOT Analysis

3.5.1 Strengths

3.5.2 Weaknesses

3.5.3 Opportunities

3.5.4 Threats

4. Vietnam Water Treatment Chemicals Market Segmentation

4.1 By Chemical Type (in Value %)

4.1.1 Coagulants

4.1.2 Flocculants

4.1.3 Corrosion Inhibitors

4.1.4 Biocides & Disinfectants

4.1.5 Others (pH Adjusters, Anti-foaming Agents)

4.2 By Application (in Value %)

4.2.1 Municipal Water Treatment

4.2.2 Industrial Water Treatment

4.2.3 Residential Water Treatment

4.2.4 Desalination

4.2.5 Others (Agriculture, Commercial Use)

4.3 By Region (in Value %)

4.3.1 North

4.3.2 South

4.3.3 East

4.3.4 West

5. Vietnam Water Treatment Chemicals Market Competitive Landscape

5.1 Market Share Analysis (Top Companies, Market Shares in 2023)

5.2 Strategic Initiatives (Partnerships, Acquisitions, Product Launches)

5.3 Competitive Benchmarking (Revenue, Product Portfolio, R&D Investments)

5.4 Detailed Profiles of Major Players

5.4.1 BASF SE

5.4.2 Kemira Oyj

5.4.3 Ecolab Inc.

5.4.4 SUEZ Water Technologies

5.4.5 Veolia Water Technologies

5.4.6 Solenis LLC

5.4.7 Kurita Water Industries Ltd.

5.4.8 Dow Chemical Company

5.4.9 Lonza Group

5.4.10 AkzoNobel N.V.

5.4.11 SNF Floerger

5.4.12 Buckman Laboratories International

5.4.13 Dupont de Nemours Inc.

5.4.14 Shandong Taihe Water Treatment Technologies

5.4.15 BWA Water Additives

6. Vietnam Water Treatment Chemicals Financial and Investment Landscape

6.1 Investment Analysis

6.1.1 Government Investments in Water Treatment and Wastewater Management

6.1.2 Venture Capital Funding in Water Treatment Startups

6.1.3 Private Equity Investments (Mergers and Acquisitions in Water Treatment Sector)

6.2 R&D Expenditure of Key Players (Innovations in Water Treatment Technologies)

6.3 Investment Trends (Focus on Sustainability, Technological Innovations)

7. Vietnam Water Treatment Chemicals Market Regulatory Framework

7.1 Environmental Regulations (Vietnam Government Water Pollution Control Policies)

7.2 Compliance Requirements (Environmental Impact Assessments, Water Treatment Certifications)

7.3 Certification Processes (ISO Standards, Industry-Specific Certifications)

7.4 Trade and Import/Export Regulations (Impact on Raw Material Imports for Water Treatment Chemicals)

8. Vietnam Water Treatment Chemicals Future Market Size (in USD Million)

8.1 Future Market Size Projections (Forecast Growth Rate, Market Valuation)

8.2 Key Factors Driving Future Market Growth (Sustainability Focus, Industrial Expansion)

8.3 Future Technological Developments in Water Treatment Chemicals (Smart Water Management Systems, Eco-Friendly Chemicals)

9. Vietnam Water Treatment Chemicals Future Market Segmentation

9.1 By Chemical Type (in Value %)

9.2 By Application (in Value %)

9.3 By Region (in Value %)

10. Vietnam Water Treatment Chemicals Market Analysts Recommendations

10.1 TAM/SAM/SOM Analysis

10.2 Customer Cohort Analysis

10.3 Marketing Initiatives

10.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the Vietnam Water Treatment Chemicals market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our research team approaches multiple water treatment chemical manufacturers and service providers to understand product segments, sales trends, consumer preferences, and other parameters. This approach supports us in validating the statistics derived from the bottom-up approach of these water treatment chemical manufacturers and service providers.

Frequently Asked Questions

01. How big is the Vietnam Water Treatment Chemicals Market?

The Vietnam Water Treatment Chemicals Market was valued at USD 287 million, driven by industrial expansion, environmental regulations, and increasing investments in water infrastructure.

02. Who are the major players in the Vietnam Water Treatment Chemicals market?

Major players in the Vietnam Water Treatment Chemicals Market include BASF SE, Kemira Oyj, Ecolab Inc., SUEZ Water Technologies, and Veolia Water Technologies. These companies play a crucial role in shaping the market by providing innovative and sustainable solutions for water treatment.

03. What are the growth drivers of the Vietnam Water Treatment Chemicals market?

The Vietnam Water Treatment Chemicals Market is primarily driven by rapid industrialization, government regulations on wastewater management, increasing demand for clean water, and major investments in water treatment infrastructure, especially in industrial and municipal applications.

04. What are the Vietnam Water Treatment Chemicals market challenges?

The Vietnam Water Treatment Chemicals Market faces challenges such as the high cost of advanced chemicals, dependence on imported raw materials, and the need for specialized skills to handle complex treatment processes, which impact market growth and operational efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.