Region:Asia

Author(s):Shubham

Product Code:KRAD0903

Pages:99

Published On:November 2025

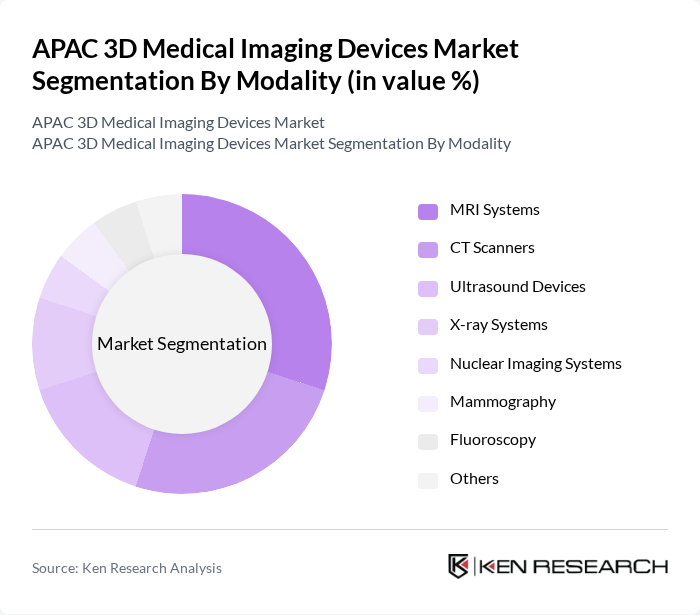

By Modality:The 3D medical imaging devices market is segmented by modality into MRI Systems, CT Scanners, Ultrasound Devices, X-ray Systems, Nuclear Imaging Systems, Mammography, Fluoroscopy, and Others. Each modality serves distinct diagnostic purposes, with MRI and CT scanners being the most widely used due to their advanced imaging capabilities and high demand in clinical settings. Hybrid imaging systems and 3D ultrasound are emerging trends, supporting more accurate and comprehensive diagnostics .

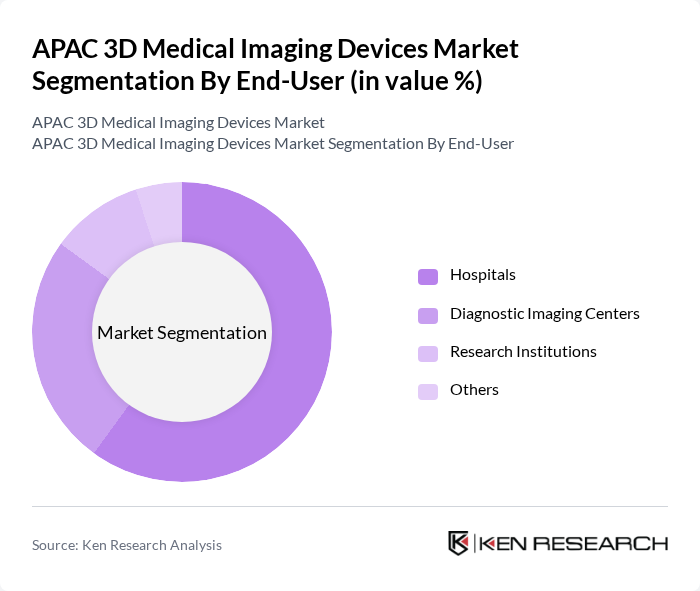

By End-User:The market is also segmented by end-user, including Hospitals, Diagnostic Imaging Centers, Research Institutions, and Others. Hospitals remain the primary end-users, driven by the increasing number of diagnostic procedures and the need for advanced imaging technologies to enhance patient care. Diagnostic imaging centers are expanding rapidly, supported by private sector investments and government initiatives to improve healthcare access .

The APAC 3D Medical Imaging Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Hitachi, Ltd. (Healthcare Business Unit), United Imaging Healthcare Co., Ltd., Mindray Medical International Limited, Samsung Medison Co., Ltd., Carestream Health, Inc., Hologic, Inc., Varian Medical Systems, Inc., Agfa-Gevaert Group, Bracco Imaging S.p.A., Shimadzu Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC 3D medical imaging devices market appears promising, driven by technological advancements and increasing healthcare investments. As healthcare systems evolve, there will be a greater emphasis on integrating artificial intelligence and machine learning into imaging solutions, enhancing diagnostic capabilities. Additionally, the expansion of telemedicine will further facilitate remote diagnostics, making advanced imaging more accessible. These trends are expected to shape the market landscape significantly in the coming years, fostering innovation and improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Modality | MRI Systems CT Scanners Ultrasound Devices X-ray Systems Nuclear Imaging Systems Mammography Fluoroscopy Others |

| By End-User | Hospitals Diagnostic Imaging Centers Research Institutions Others |

| By Application | Oncology Cardiology Neurology Orthopedics Gastroenterology Gynecology Others |

| By Technology | D Reconstruction Technology Image Processing Software Visualization Tools Artificial Intelligence (AI) Integration Hybrid Imaging Systems Others |

| By Region | China Japan India South Korea Australia Southeast Asia Rest of APAC |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Model | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitals and Healthcare Facilities | 100 | Radiologists, Imaging Technologists |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

| Research Institutions | 40 | Clinical Researchers, Academic Professors |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Private Clinics and Outpatient Centers | 50 | Clinic Managers, Healthcare Administrators |

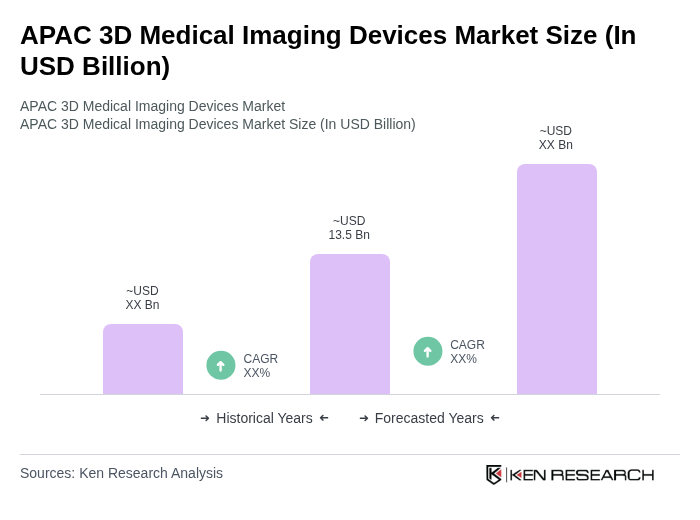

The APAC 3D Medical Imaging Devices Market is valued at approximately USD 13.5 billion, driven by advancements in imaging technologies and the rising prevalence of chronic diseases, alongside increasing demand for minimally invasive procedures.