Region:Middle East

Author(s):Rebecca

Product Code:KRAD1338

Pages:97

Published On:November 2025

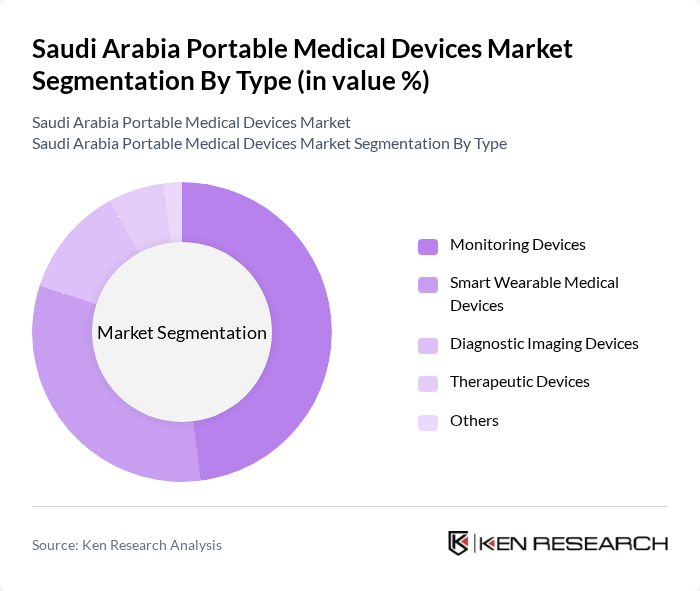

By Type:The market is segmented into various types of portable medical devices, including Smart Wearable Medical Devices, Diagnostic Imaging Devices, Therapeutic Devices, Monitoring Devices, and Others. Among these, Monitoring Devices currently hold the largest market share, primarily due to their widespread use in hospitals and home care for chronic disease management and real-time patient monitoring. Smart Wearable Medical Devices are gaining significant traction as the fastest-growing segment, driven by consumer demand for personal health management and remote monitoring capabilities .

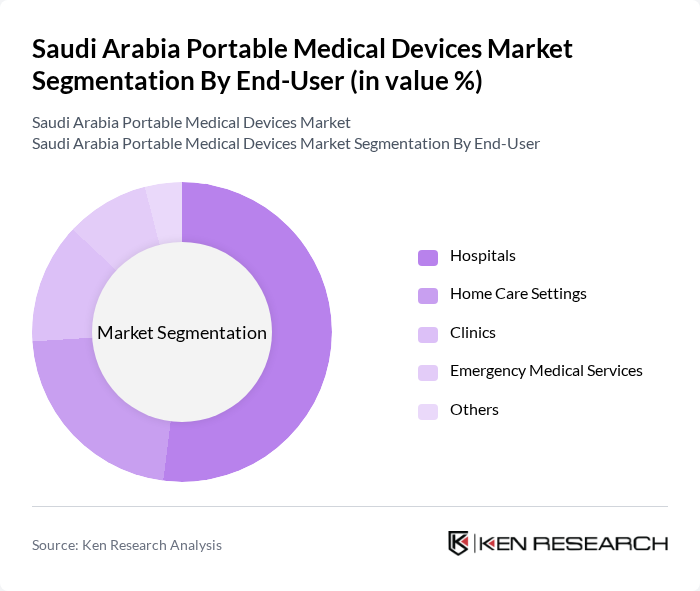

By End-User:The end-user segmentation includes Hospitals, Home Care Settings, Clinics, Emergency Medical Services, and Others. Hospitals are the leading end-user segment, driven by the increasing adoption of portable medical devices for patient monitoring and diagnostics, which enhances patient care and operational efficiency. Home care settings are rapidly expanding, reflecting a shift toward remote monitoring and personalized care, supported by government initiatives and consumer demand .

The Saudi Arabia Portable Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE Healthcare, Medtronic plc, Abbott Laboratories, Johnson & Johnson (including subsidiary LifeScan), Boston Scientific Corporation, B. Braun Melsungen AG, Omron Healthcare Co., Ltd., Roche Diagnostics, Stryker Corporation, Canon Medical Systems Corporation, Hitachi Healthcare (Hitachi, Ltd.), Mindray Medical International Limited, Nihon Kohden Corporation, Samsung Medison Co., Ltd., Vyaire Medical, Inc., Nox Medical, Al Faisaliah Medical Systems (FMS), Saudi Arabia, Gulf Medical Co. Ltd., Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the portable medical devices market in Saudi Arabia appears promising, driven by increasing healthcare investments and a focus on technological integration. The government’s commitment to enhancing healthcare infrastructure, alongside the rising adoption of telemedicine, is expected to create a conducive environment for market growth. Additionally, the integration of artificial intelligence and machine learning in portable devices will likely enhance their capabilities, making them more appealing to both healthcare providers and patients.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Wearable Medical Devices Diagnostic Imaging Devices Therapeutic Devices Monitoring Devices Others |

| By End-User | Hospitals Home Care Settings Clinics Emergency Medical Services Others |

| By Application | Cardiovascular Applications Respiratory Applications Diabetes Management Neurological Applications Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Technology | Wearable Technology Portable Imaging Technology Mobile Health Applications Telehealth Solutions Others |

| By Region | Riyadh Region Makkah & Madinah Region Eastern Province Qassim Region Southern Region |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Healthcare Devices | 100 | Patients, Caregivers, Home Health Aides |

| Portable Diagnostic Equipment | 60 | Healthcare Practitioners, Laboratory Technicians |

| Wearable Health Monitors | 70 | Fitness Trainers, Health Coaches, Patients |

| Telehealth Solutions | 50 | Telehealth Providers, IT Managers in Healthcare |

| Emergency Medical Devices | 40 | Emergency Responders, Hospital Emergency Room Staff |

The Saudi Arabia Portable Medical Devices Market is valued at approximately USD 380 million, reflecting a significant growth driven by factors such as the increasing prevalence of chronic diseases and advancements in technology.