Region:Asia

Author(s):Geetanshi

Product Code:KRAD4842

Pages:96

Published On:December 2025

Market.png)

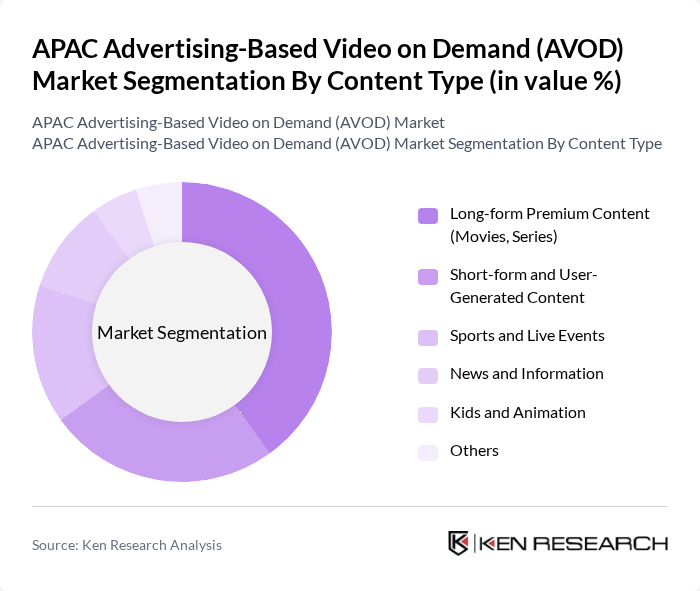

By Content Type:The content type segmentation of the AVOD market includes various subsegments such as Long-form Premium Content (Movies, Series), Short-form and User-Generated Content, Sports and Live Events, News and Information, Kids and Animation, and Others. Among these, Long-form Premium Content is currently the leading subsegment, driven by the increasing demand for high-quality movies and series on both global and regional platforms. Consumers are increasingly willing to engage with longer content formats, which provide immersive storytelling experiences, particularly when delivered as original series, dramas, and films tailored to local tastes. This trend is further supported by the rise of original programming from major platforms and regional services, attracting a larger audience base and encouraging higher engagement and ad monetisation opportunities for AVOD providers.

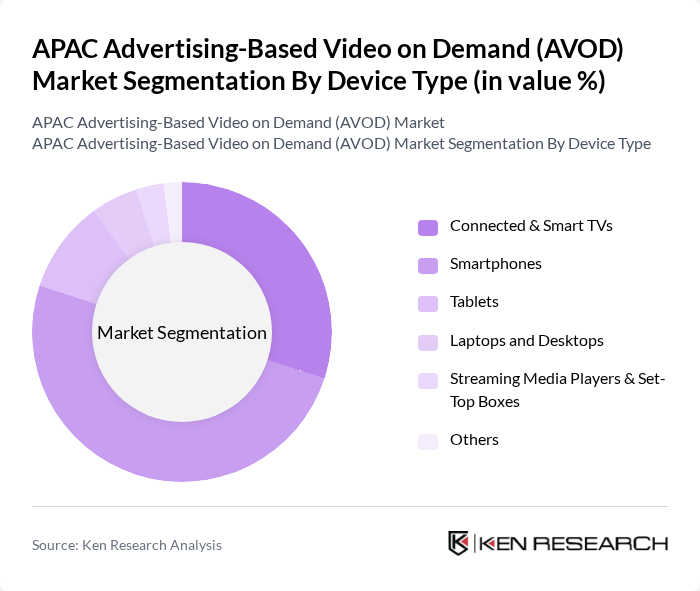

By Device Type:The device type segmentation includes Connected & Smart TVs, Smartphones, Tablets, Laptops and Desktops, Streaming Media Players & Set-Top Boxes, and Others. Currently, Smartphones dominate this segment, as they provide easy access to AVOD services and are widely used across various demographics in mobile-first APAC markets. The convenience of mobile viewing, coupled with the increasing availability of high-speed mobile broadband and affordable data plans, has led to a surge in smartphone usage for streaming content, making it the preferred device for many consumers, while connected and smart TVs are rapidly gaining share as connected TV adoption rises across the region.

The APAC Advertising-Based Video on Demand (AVOD) Market is characterized by a dynamic mix of regional and international players. Leading participants such as YouTube (Google LLC), Tencent Video (Tencent Holdings Ltd.), iQIYI Inc., Youku Tudou (Alibaba Group), Bilibili Inc., MX Player (Times Internet), Disney+ Hotstar (The Walt Disney Company), Sony LIV (Sony Pictures Networks India), ZEE5 (Zee Entertainment Enterprises), Viu (PCCW Media), TVer Inc. (Japan Broadcaster Consortium), Tubi (Fox Corporation), Rakuten Viki (Rakuten Group), WeTV (Tencent / iflix), Netflix – Ad-Supported Tier contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AVOD market in APAC appears promising, driven by technological advancements and evolving consumer preferences. As internet connectivity continues to improve, more users will access streaming services, leading to increased advertising opportunities. Additionally, the integration of artificial intelligence in content recommendations will enhance user engagement, making platforms more appealing. The rise of niche content platforms catering to specific audiences will also create new avenues for growth, allowing advertisers to target their campaigns more effectively.

| Segment | Sub-Segments |

|---|---|

| By Content Type | Long-form Premium Content (Movies, Series) Short-form and User-Generated Content Sports and Live Events News and Information Kids and Animation Others |

| By Device Type | Connected & Smart TVs Smartphones Tablets Laptops and Desktops Streaming Media Players & Set-Top Boxes Others |

| By Advertising Model | Pre-roll Ads Mid-roll Ads Post-roll Ads Display and Overlay Ads Sponsored & Branded Content Interactive and Shoppable Ads Others |

| By User Demographics | By Age Group By Gender By Income Level By Language Preference Others |

| By Geographic Distribution | China Japan India South Korea Southeast Asia Australia & New Zealand Rest of APAC |

| By Monetization / Access Type | Free Ad-Supported Only Hybrid AVOD–SVOD Tiers Freemium with Upsell TV Everywhere / Broadcaster-Backed AVOD Others |

| By Content Genre | Drama & Romance Comedy & Variety Action & Thriller Reality, Talent & Game Shows Anime & K-Content Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AVOD Platform Executives | 60 | CEOs, CMOs, Product Managers |

| Advertisers in Digital Media | 80 | Marketing Directors, Brand Managers |

| Content Creators and Producers | 70 | Content Strategists, Production Heads |

| Consumer Insights on AVOD Usage | 150 | Regular AVOD Users, Non-Users |

| Regulatory and Policy Experts | 50 | Media Regulators, Policy Analysts |

The APAC Advertising-Based Video on Demand (AVOD) Market is valued at approximately USD 29 billion, driven by increased internet penetration, smart device usage, and consumer demand for on-demand content.