Middle East Advertising-Based Video on Demand (AVOD) Market Overview

- The Middle East Advertising-Based Video on Demand (AVOD) Market is valued at USD 1.3 billion, based on a five-year historical analysis and benchmarked against regional online video and streaming revenues within the wider Middle East media and entertainment market. This growth is primarily driven by the increasing penetration of the internet, the rise of mobile devices, and a growing preference for on-demand and mobile-first video content among consumers. The shift from traditional satellite and cable TV to over-the-top (OTT) and digital platforms, along with a rapid increase in programmatic and connected TV (CTV) advertising, has significantly contributed to the expansion of the AVOD market in the region.

- Key players in this market include countries like Saudi Arabia and the United Arab Emirates, which dominate due to their high disposable incomes, advanced fiber and 5G digital infrastructure, and a young, tech-savvy population with high video consumption. Saudi Arabia accounts for close to two-fifths of the regional media and entertainment revenue, while smartphone penetration in core Gulf markets exceeds 90%, underpinning strong demand for streaming and ad-supported video. The presence of major international streaming services and strong regional platforms such as Shahid, OSN+, Starzplay, and YouTube, combined with telecom-bundled offers and local broadcasters’ OTT extensions, further enhances the market's growth potential in these regions.

- In 2023, content and media services in Saudi Arabia continued to be governed by the Implementing Regulations of the Audio-Visual Media Law, issued by the General Commission for Audiovisual Media (GCAM) in 2019, which set licensing and content standards for on-demand and audiovisual media services operating in the Kingdom. Under these rules, on-demand and streaming platforms distributing in Saudi Arabia are required to obtain appropriate audiovisual media service licences, comply with national content classification and censorship guidelines, and align with local cultural, religious, and language standards, encouraging investment in Arabic and locally relevant content catalogs. While various local investment and cultural programs under Vision 2030 incentivize Saudi content development, platforms generally respond through voluntary content quotas, commissioning of Saudi productions, and partnerships with local studios rather than a fixed statutory percentage obligation on AVOD catalogues.

Market.png)

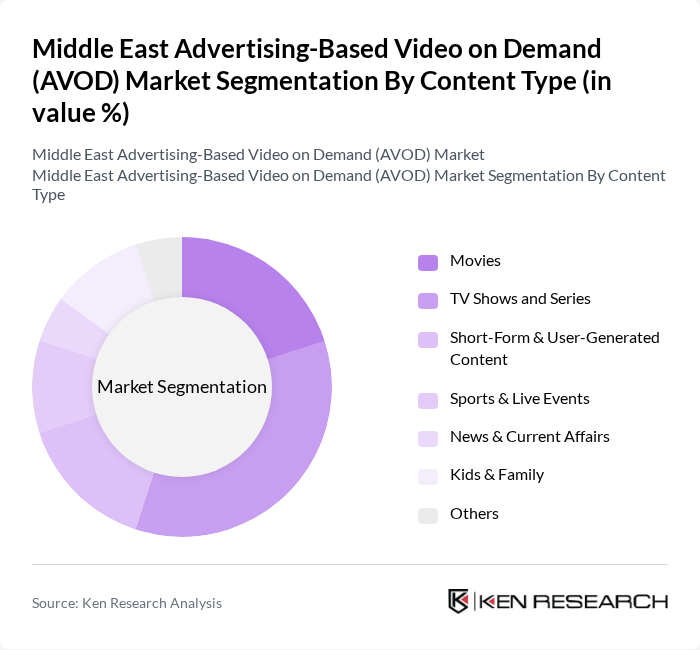

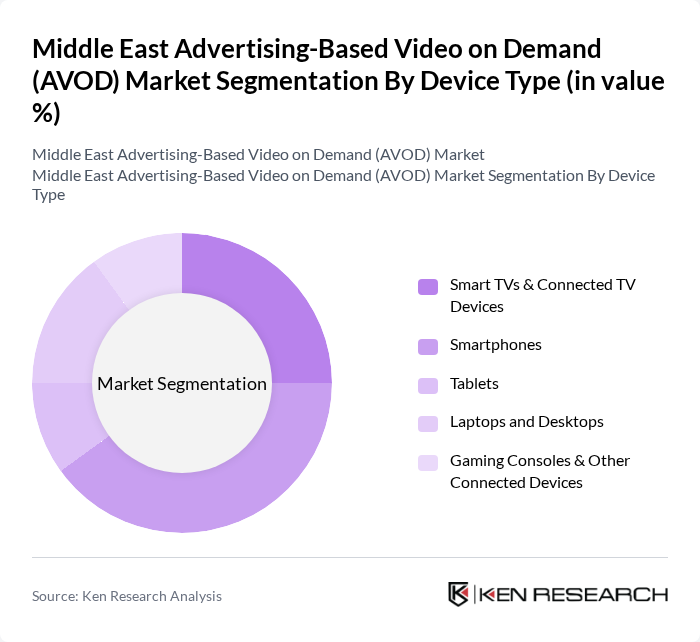

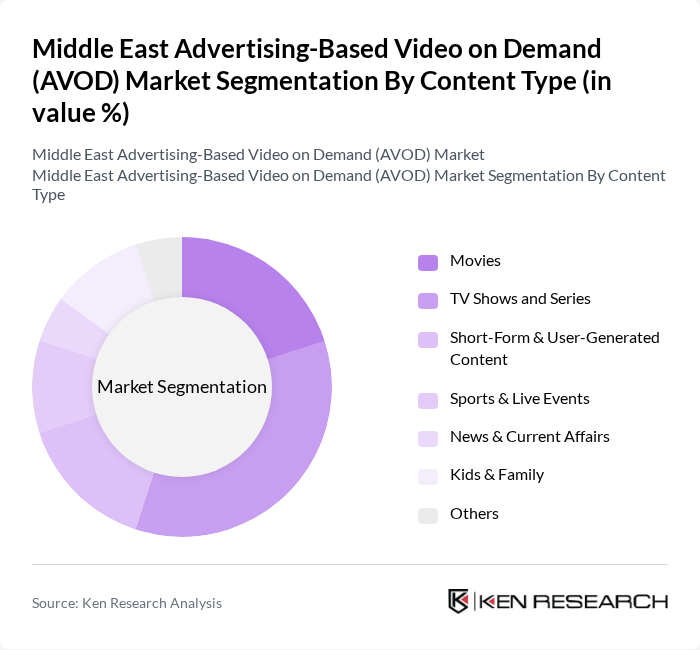

Middle East Advertising-Based Video on Demand (AVOD) Market Segmentation

By Content Type:The content type segmentation of the AVOD market includes various categories such as Movies, TV Shows and Series, Short-Form & User-Generated Content, Sports & Live Events, News & Current Affairs, Kids & Family, and Others. Among these, TV Shows and Series are currently dominating the professionally produced, long-form AVOD segment due to the increasing demand for binge-watching, serialized storytelling, and catch-up viewing of network and satellite TV shows. The rise of platforms offering exclusive series, premium Arabic dramas, Turkish and Asian series, and localized originals has significantly influenced consumer preferences, leading to a surge in viewership in this segment, particularly in Saudi Arabia and the UAE.

By Device Type:The device type segmentation includes Smart TVs & Connected TV Devices, Smartphones, Tablets, Laptops and Desktops, and Gaming Consoles & Other Connected Devices. The Smartphones segment is leading the market, driven by the widespread use of mobile devices for streaming content and regional smartphone penetration levels above 90% in key Middle Eastern markets. The convenience of accessing AVOD services on-the-go, telco-zero-rated or bundled video packages, and the increasing availability of high-speed fiber and 5G networks have made smartphones the preferred choice for consumers in the region for both short-form and long-form ad-supported video.

Middle East Advertising-Based Video on Demand (AVOD) Market Competitive Landscape

The Middle East Advertising-Based Video on Demand (AVOD) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shahid (MBC Group), OSN+ (OSN Group), Starzplay, Netflix, Amazon Prime Video, YouTube, MBC Group, beIN CONNECT (beIN Media Group), TOD (beIN Media Group), Disney+, Viu, Jawwy TV (stc Group), Watch iT!, ADtv (Abu Dhabi Media), EshailSat / Other Regional Free AVOD & FAST Channels contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Advertising-Based Video on Demand (AVOD) Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:The Middle East has seen a significant rise in internet penetration, reaching approximately 80% of individuals using the Internet, according to the International Telecommunication Union. This increase has facilitated access to AVOD platforms, enabling more users to engage with on-demand content. The region's internet user base is estimated at over 200 million people when aggregating Arab States and neighboring Middle East markets. Enhanced connectivity, particularly in urban areas, supports the growth of AVOD services, driving advertising revenue.

- Rising Demand for On-Demand Content:The demand for on-demand content in the Middle East is surging, with a reported one third of consumers preferring streaming services over traditional television. This shift is driven by changing viewing habits, particularly among younger demographics. The region's population, with over one third under 30 years old in many Middle East and North Africa countries, is increasingly seeking personalized content experiences. As a result, AVOD platforms are expanding their libraries, catering to diverse tastes and preferences, which in turn attracts more advertisers looking to reach these audiences.

- Growth of Mobile Streaming Services:Mobile streaming services are experiencing rapid growth in the Middle East, with mobile broadband subscriptions in the Arab States region exceeding 400 subscriptions per 100 inhabitants, implying well over 150 million mobile broadband subscriptions in total. This trend is fueled by the increasing affordability of smartphones and data plans. As consumers increasingly access AVOD content via mobile devices, advertisers are capitalizing on this trend by creating mobile-optimized ad campaigns. The convenience of mobile streaming is reshaping content consumption patterns, making it a critical driver for the AVOD market's expansion in the region.

Market Challenges

- Intense Competition from Subscription Services:The AVOD market in the Middle East faces fierce competition from subscription-based services, which are gaining traction among consumers. Major players like Netflix and Disney+ are investing heavily in local content, making it challenging for AVOD platforms to retain viewers. It is expected that subscription services will capture over 40% of the streaming market share, compelling AVOD providers to innovate and differentiate their offerings to attract and maintain audiences.

- Regulatory Hurdles:Regulatory challenges pose significant obstacles for AVOD platforms in the Middle East. Governments are increasingly implementing content censorship policies, which can restrict the availability of certain content. It is estimated that over 30% of AVOD content may face regulatory scrutiny, impacting the diversity of offerings. Additionally, compliance with advertising standards and data protection regulations complicates operations, requiring AVOD providers to navigate a complex legal landscape to succeed in the region.

Middle East Advertising-Based Video on Demand (AVOD) Market Future Outlook

The future of the AVOD market in the Middle East appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, more users will engage with AVOD platforms, leading to increased advertising revenues. Furthermore, the growing trend of mobile-first strategies will enhance user experiences, making content more accessible. The market is likely to see innovations in interactive content and personalized advertising, which will further attract viewers and advertisers alike, fostering a dynamic ecosystem.

Market Opportunities

- Partnerships with Local Content Creators:Collaborating with local content creators presents a significant opportunity for AVOD platforms. By leveraging regional talent, platforms can offer culturally relevant content that resonates with local audiences. This strategy not only enhances viewer engagement but also attracts advertisers seeking to connect with specific demographics, potentially increasing ad revenues significantly.

- Expansion into Emerging Markets:Expanding into emerging markets within the Middle East can provide AVOD platforms with new growth avenues. Countries like Iraq and Yemen, with increasing internet access, represent untapped audiences. By tailoring content and advertising strategies to these markets, AVOD providers can capture a share of the growing demand for on-demand services, enhancing their overall market presence and profitability.

Market.png)