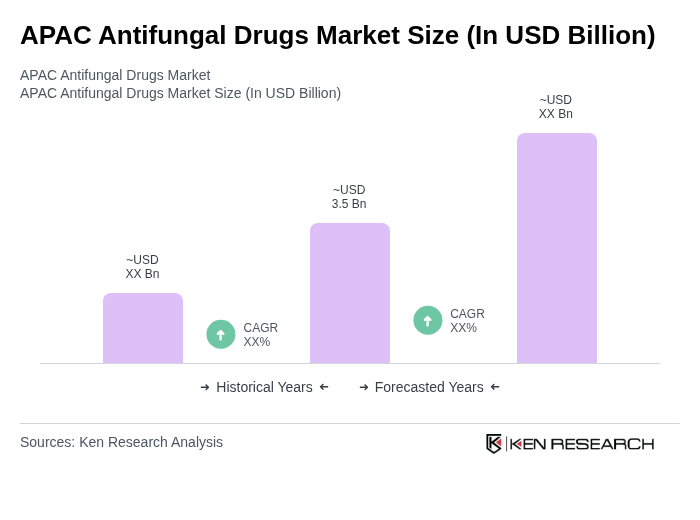

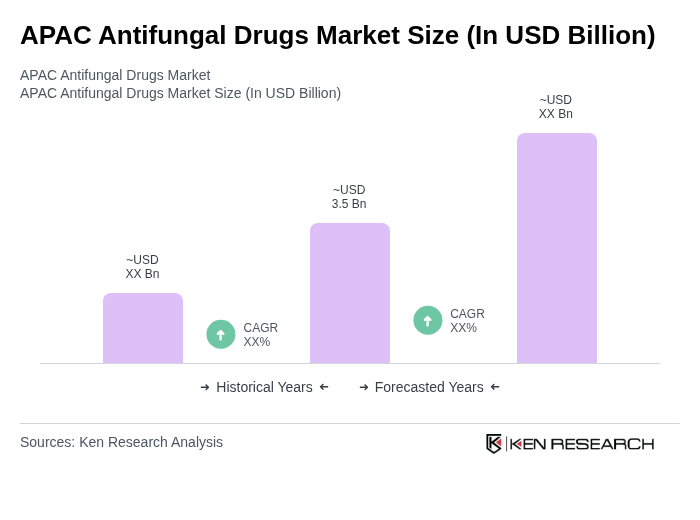

APAC Antifungal Drugs Market Overview

- The APAC Antifungal Drugs Market is valued at USD 3.5 billion, based on a five-year historical analysis. This growth is primarily driven by the rising incidence of fungal infections, increased awareness regarding antifungal treatments, and advancements in drug formulations. The market is also supported by the growing healthcare infrastructure, expanding health insurance coverage, and the increasing number of hospitals and clinics across the region. Additional growth drivers include the adoption of advanced pharmaceutical technologies, the availability of affordable generic drugs, and the rising geriatric population, which is more susceptible to fungal infections .

- Key players in this market include China, India, and Japan, which dominate due to their large populations, increasing healthcare expenditure, and a high prevalence of fungal infections. These countries have also made significant investments in healthcare infrastructure and research and development, further facilitating the growth of the antifungal drugs market. The rapid adoption of new technologies and favorable reimbursement policies in these countries are also contributing to market expansion .

- The National List of Essential Medicines (NLEM), 2022, issued by the Ministry of Health and Family Welfare, Government of India, mandates the inclusion of various antifungal medications in the essential drug list. This regulation ensures improved access to antifungal treatments, particularly in rural and underserved areas, and is part of a broader initiative to enhance healthcare outcomes and address the rising threat of fungal infections. The NLEM requires all public health facilities to stock listed antifungal drugs and mandates compliance with procurement and distribution standards .

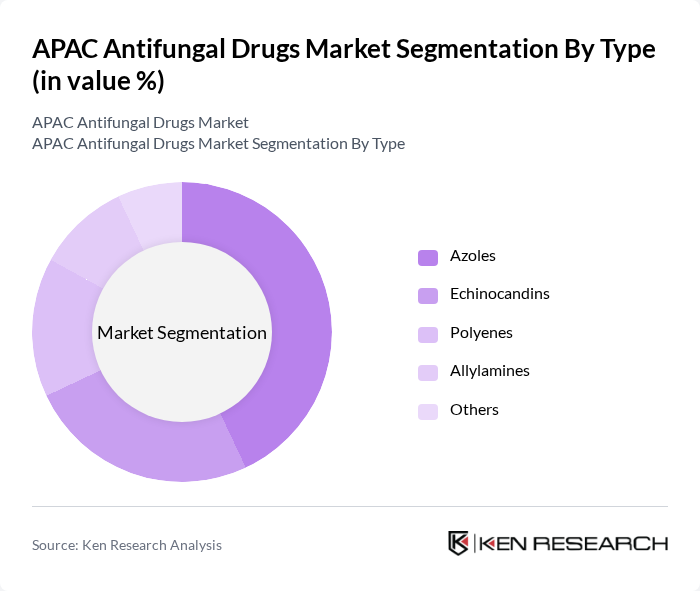

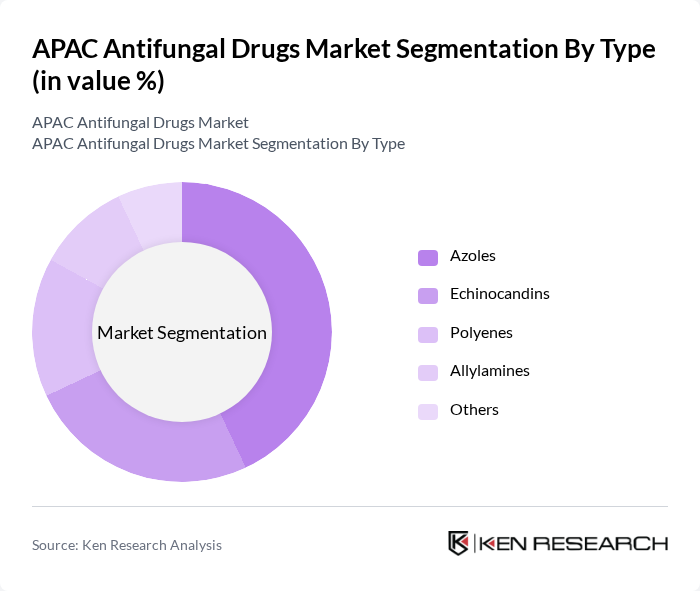

APAC Antifungal Drugs Market Segmentation

By Type:The antifungal drugs market can be segmented into Azoles, Echinocandins, Polyenes, Allylamines, and Others. Azoles remain the most widely used segment due to their broad-spectrum activity, lower toxicity, and extensive application in treating both superficial and systemic fungal infections. The increasing prevalence of systemic and opportunistic fungal infections, combined with the availability of both branded and generic azole formulations, has driven demand for this drug class, making it the dominant sub-segment in the market .

By End-User:The market can also be segmented based on end-users, which include Hospitals, Clinics, Homecare, and Others. Hospitals are the leading end-user segment, attributed to the high volume of patients requiring antifungal treatments for severe and systemic infections. The increasing number of hospital admissions due to the rising burden of fungal diseases, especially among immunocompromised and elderly populations, has significantly contributed to the growth of this segment. Clinics and homecare settings are also witnessing increased adoption of antifungal therapies, driven by the availability of over-the-counter formulations and greater patient awareness .

APAC Antifungal Drugs Market Competitive Landscape

The APAC Antifungal Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Merck & Co., Inc., Gilead Sciences, Inc., Novartis AG, Johnson & Johnson, Astellas Pharma Inc., Bristol-Myers Squibb Company, GlaxoSmithKline plc, Sanofi S.A., AbbVie Inc., F. Hoffmann-La Roche AG, Bayer AG, Hikma Pharmaceuticals PLC, Cipla Limited, Mylan N.V., Abbott Laboratories, Enzon Pharmaceuticals, Kramer Laboratories, Sanofi-Aventis, Alternaria, and Aspergillus contribute to innovation, geographic expansion, and service delivery in this space .

APAC Antifungal Drugs Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Fungal Infections:The APAC region has witnessed a significant rise in fungal infections, with an estimated 1.5 million cases reported annually. According to the World Health Organization, the incidence of invasive fungal infections has increased by 20% over the past decade. This surge is attributed to factors such as climate change, urbanization, and increased immunocompromised populations, driving demand for effective antifungal treatments and contributing to market growth.

- Rising Awareness and Diagnosis Rates:Enhanced public awareness and improved diagnostic capabilities have led to a notable increase in the identification of fungal infections. In future, it is projected that diagnostic testing for fungal infections will rise by 30%, driven by initiatives from health organizations. This increase in diagnosis not only facilitates timely treatment but also boosts the demand for antifungal drugs, thereby propelling market expansion in the APAC region.

- Advancements in Antifungal Drug Formulations:The development of novel antifungal agents and formulations has significantly improved treatment outcomes. In future, the introduction of at least five new antifungal drugs is anticipated, targeting resistant strains of fungi. These advancements are supported by a 15% increase in R&D investments in the pharmaceutical sector, enhancing the efficacy and safety profiles of antifungal treatments, which is expected to stimulate market growth.

Market Challenges

- High Cost of Antifungal Treatments:The financial burden of antifungal therapies remains a significant challenge, with treatment costs averaging $1,200 per patient annually in the APAC region. This high cost limits accessibility, particularly in low-income countries, where healthcare expenditure is constrained. As a result, many patients may forgo necessary treatments, hindering overall market growth and patient outcomes in the region.

- Drug Resistance Issues:The emergence of antifungal resistance poses a critical challenge, with studies indicating that up to 30% of patients with invasive fungal infections exhibit resistance to standard treatments. This growing resistance complicates treatment protocols and increases healthcare costs, as alternative therapies are often more expensive. Addressing this issue is essential for ensuring effective treatment options and sustaining market growth in the APAC region.

APAC Antifungal Drugs Market Future Outlook

The APAC antifungal drugs market is poised for transformative growth, driven by technological advancements and evolving healthcare paradigms. The increasing integration of telemedicine is expected to enhance patient access to antifungal treatments, particularly in underserved areas. Additionally, the focus on personalized medicine will likely lead to tailored treatment regimens, improving patient outcomes. As healthcare infrastructure continues to develop, the market is set to expand, addressing both the rising prevalence of fungal infections and the challenges posed by drug resistance.

Market Opportunities

- Expansion of Telemedicine Services:The growth of telemedicine in the APAC region presents a unique opportunity for antifungal drug distribution. With an estimated 40% increase in telehealth consultations expected in future, patients can access timely diagnoses and treatments, improving adherence to antifungal therapies and ultimately enhancing market penetration.

- Development of Novel Antifungal Agents:The ongoing research into innovative antifungal agents offers significant market potential. With over 100 new compounds currently in various stages of clinical trials, the introduction of effective treatments targeting resistant strains could revolutionize patient care and expand market share for pharmaceutical companies in the APAC region.