Region:Asia

Author(s):Rebecca

Product Code:KRAD8491

Pages:93

Published On:December 2025

By Type:The argon market can be segmented into various types based on purity levels. The primary subsegments include 4N Argon (99.99% purity), 5N Argon (99.999% purity), 6N Argon (99.9999% purity), and others. Among these, 4N Argon is the most widely used due to its cost-effectiveness and suitability for a range of applications, particularly in welding and metal fabrication. The demand for higher purity grades, such as 5N and 6N, is also increasing, especially in specialized industries like electronics and pharmaceuticals.

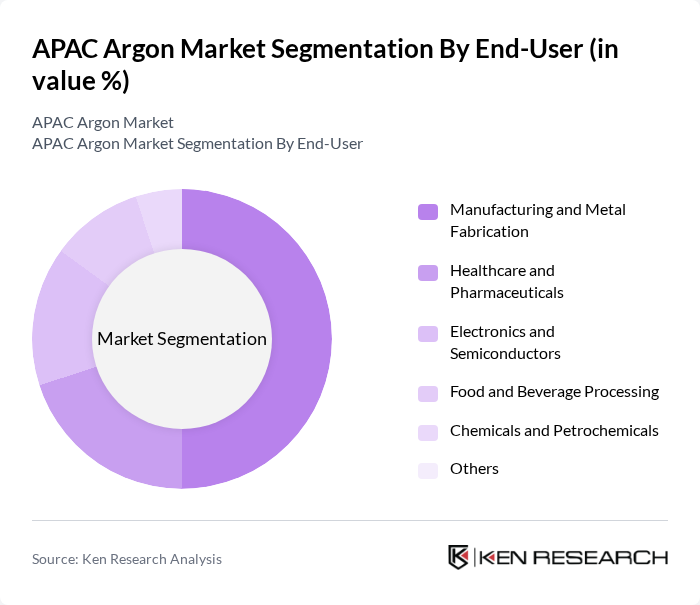

By End-User:The end-user segmentation of the argon market includes manufacturing and metal fabrication, healthcare and pharmaceuticals, electronics and semiconductors, food and beverage processing, chemicals and petrochemicals, and others. The manufacturing and metal fabrication sector is the largest consumer of argon, driven by its essential role in welding processes. The healthcare sector is also witnessing growth due to the increasing use of argon in medical applications, including cryotherapy and laser surgeries.

The APAC Argon Market is characterized by a dynamic mix of regional and international players. Leading participants such as Linde Group, Air Liquide S.A., Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corporation, Praxair Technology, Inc., Airgas, Inc., Messer Group GmbH, Yingde Gases Co., Ltd., Iwatani Corporation, WISCO (Wuhan Iron and Steel Group) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC argon market is poised for significant developments as industries increasingly adopt sustainable practices and innovative technologies. The integration of automation in production processes is expected to enhance efficiency and reduce costs. Additionally, the growing focus on renewable energy applications, such as solar panel manufacturing, will further drive argon demand. As companies invest in research and development, the market is likely to witness the emergence of new applications, positioning argon as a critical component in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | N Argon (99.99% Purity) N Argon (99.999% Purity) N Argon (99.9999% Purity) Others |

| By End-User | Manufacturing and Metal Fabrication Healthcare and Pharmaceuticals Electronics and Semiconductors Food and Beverage Processing Chemicals and Petrochemicals Others |

| By Region | China India Japan South Korea Southeast Asia (Indonesia, Malaysia, Thailand, Vietnam, Philippines) Rest of APAC (Australia, New Zealand, Pakistan, Bangladesh) |

| By Application | Welding and Cutting Inerting and Blanketing Laser Applications Medical and Life-support Applications Others |

| By Storage, Distribution & Transportation | Merchant Liquid/Bulk Cylinder Gas On-site Production |

| By Technology | Cryogenic Distillation Pressure Swing Adsorption Membrane Separation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Welding Industry Applications | 120 | Welding Engineers, Production Managers |

| Electronics Manufacturing | 100 | Process Engineers, Quality Assurance Managers |

| Food Packaging Sector | 90 | Packaging Engineers, Supply Chain Managers |

| Healthcare Applications | 80 | Medical Device Manufacturers, Laboratory Managers |

| Metal Fabrication Industry | 110 | Fabrication Supervisors, Operations Directors |

The APAC Argon Market is valued at approximately USD 3.7 billion, driven by increasing demand across various sectors such as welding, electronics, and healthcare, along with advancements in gas production technologies.