Region:Asia

Author(s):Dev

Product Code:KRAC8787

Pages:97

Published On:November 2025

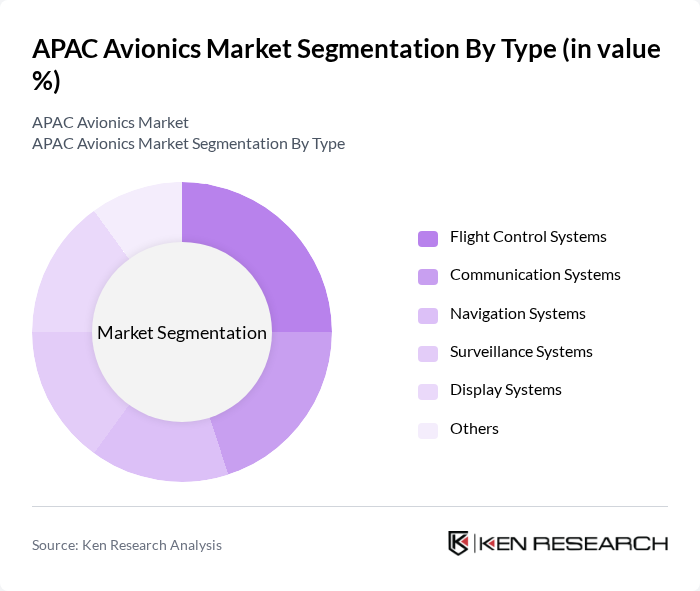

By Type:The avionics market can be segmented into various types, including Flight Control Systems, Communication Systems, Navigation Systems, Surveillance Systems, Display Systems, and Others. Each of these segments plays a crucial role in enhancing the safety, efficiency, and operational capabilities of aircraft.

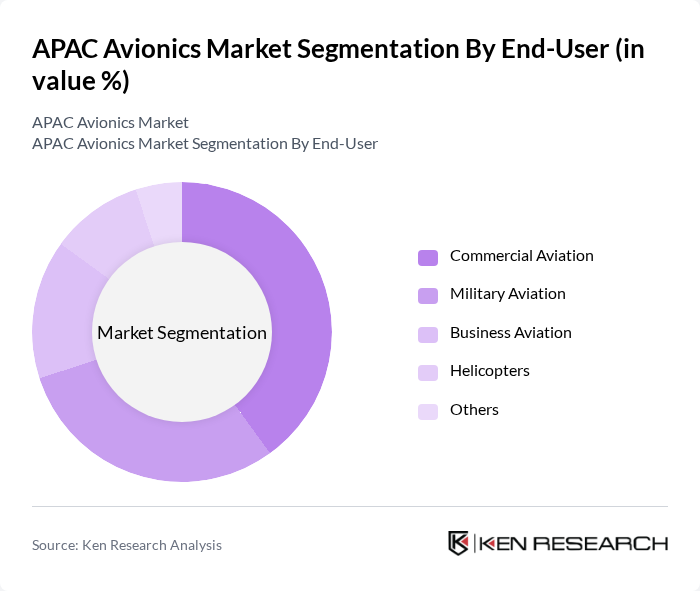

By End-User:The end-user segmentation includes Commercial Aviation, Military Aviation, Business Aviation, Helicopters, and Others. Each segment reflects the diverse applications of avionics systems across different aviation sectors.

The APAC Avionics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell Aerospace, Collins Aerospace (RTX Corporation), Thales Group, Garmin Ltd., BAE Systems, Northrop Grumman, L3Harris Technologies, Safran Electronics & Defense, Mitsubishi Electric Corporation, Elbit Systems Ltd., Leonardo S.p.A., General Dynamics, Raytheon Technologies (UTC Aerospace Systems), Honeywell International Inc., Textron Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC avionics market appears promising, driven by technological advancements and increasing air traffic. The integration of artificial intelligence and digital technologies is expected to enhance operational efficiency and safety. Additionally, the shift towards sustainable aviation solutions will likely gain momentum, with governments and companies focusing on reducing emissions and improving fuel efficiency. As the region continues to invest in aviation infrastructure, the demand for innovative avionics systems will remain strong, fostering a competitive landscape for industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Flight Control Systems Communication Systems Navigation Systems Surveillance Systems Display Systems Others |

| By End-User | Commercial Aviation Military Aviation Business Aviation Helicopters Others |

| By Region | North Asia Southeast Asia South Asia Oceania |

| By Technology | Analog Avionics Digital Avionics Integrated Avionics Others |

| By Application | Commercial Flights Cargo Operations Military Operations Training and Simulation Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Avionics | 120 | Avionics Engineers, Product Development Managers |

| Military Avionics Systems | 100 | Defense Procurement Officers, Systems Analysts |

| Helicopter Avionics Solutions | 80 | Maintenance Managers, Flight Operations Directors |

| Unmanned Aerial Vehicle (UAV) Avionics | 70 | UAV Engineers, R&D Managers |

| Avionics Software Development | 90 | Software Engineers, Quality Assurance Managers |

The APAC Avionics Market is valued at approximately USD 11 billion, driven by the demand for advanced aircraft systems, fleet modernization, and the need for enhanced safety and efficiency in aviation operations.