Region:Asia

Author(s):Dev

Product Code:KRAC8784

Pages:83

Published On:November 2025

The APAC Baby Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as BabyGap, Carter's, Inc., H&M, Mothercare, Gymboree, OshKosh B'gosh, Zara Kids, Petit Bateau, Next, Uniqlo, Jacadi, Seed Heritage, Bonpoint, The Children's Place, Mamas & Papas, Pigeon Corporation, Minimoto, Tongtai, Les Enphants, Pureborn contribute to innovation, geographic expansion, and service delivery in this space.

The APAC baby apparel market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The rise of smart baby apparel, integrating health-monitoring features, is expected to gain traction among tech-savvy parents. Additionally, the increasing focus on sustainability will likely push brands to innovate eco-friendly products. As e-commerce continues to expand, companies that leverage digital marketing and influencer collaborations will be well-positioned to capture emerging market segments and enhance brand visibility.

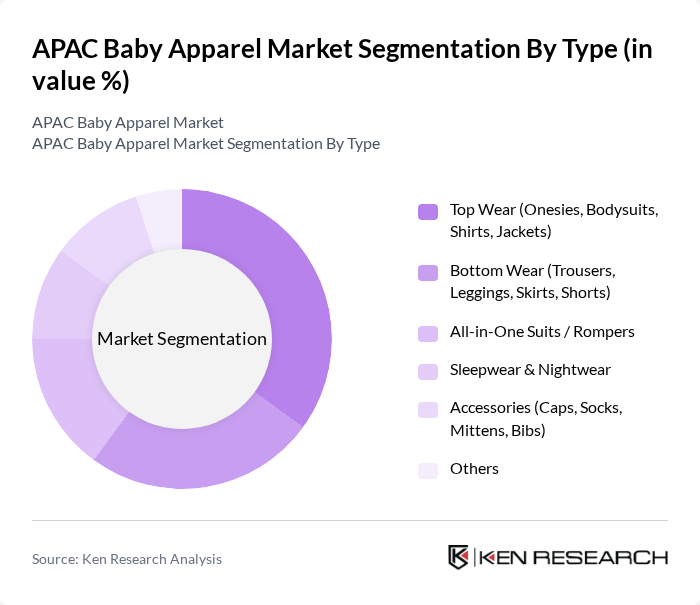

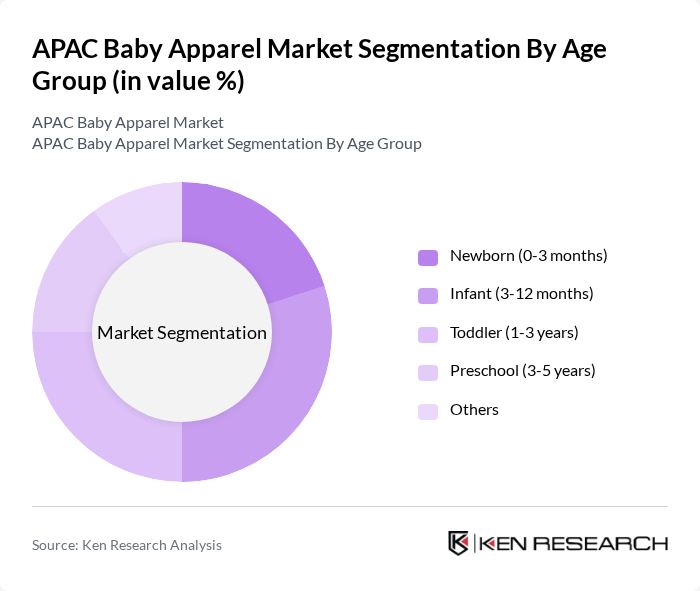

| Segment | Sub-Segments |

|---|---|

| By Type | Top Wear (Onesies, Bodysuits, Shirts, Jackets) Bottom Wear (Trousers, Leggings, Skirts, Shorts) All-in-One Suits / Rompers Sleepwear & Nightwear Accessories (Caps, Socks, Mittens, Bibs) Others |

| By Age Group | Newborn (0-3 months) Infant (3-12 months) Toddler (1-3 years) Preschool (3-5 years) Others |

| By Gender | Boys Girls Unisex Others |

| By Distribution Channel | Online Retail (E-commerce, Brand Websites) Offline Retail (Department Stores, Baby Specialty Stores) Supermarkets/Hypermarkets Others |

| By Material | Cotton Organic Cotton Polyester Wool Bamboo Fabric Recycled Materials Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Region | China India Japan Southeast Asia (Indonesia, Vietnam, Thailand, etc.) South Korea Australia & New Zealand Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Baby Apparel Sales | 100 | Store Managers, Retail Buyers |

| Online Baby Apparel Purchases | 80 | eCommerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Baby Apparel | 120 | Parents, Expecting Mothers |

| Trends in Sustainable Baby Apparel | 60 | Sustainability Advocates, Product Designers |

| Market Entry Strategies for New Brands | 50 | Business Development Managers, Brand Strategists |

The APAC Baby Apparel Market is valued at approximately USD 26.5 billion, driven by increasing birth rates, rising disposable incomes, and a growing preference for premium and organic baby clothing among parents in the region.