Region:Global

Author(s):Shubham

Product Code:KRAD2454

Pages:82

Published On:January 2026

By Product Type:The product type segmentation of the baby apparel market includes various categories such as bodysuits & onesies, tops & t-shirts, bottoms & pants, dresses & skirts, sleepwear & loungewear, outerwear, underwear & socks, accessories, footwear, and others. This structure aligns with common industry classifications, where core garments (bodysuits, tops, bottoms, sleepwear, outerwear) are complemented by socks, underwear, accessories, and footwear. Among these, bodysuits & onesies remain one of the most widely used product categories due to their practicality, ease of changing, and comfort for infants, particularly in the first year of life. Parents prefer these items for their ease of use and the convenience they offer in dressing and changing babies, while demand is increasingly influenced by the availability of organic cotton, breathable fabrics, and sustainable materials across all key product types.

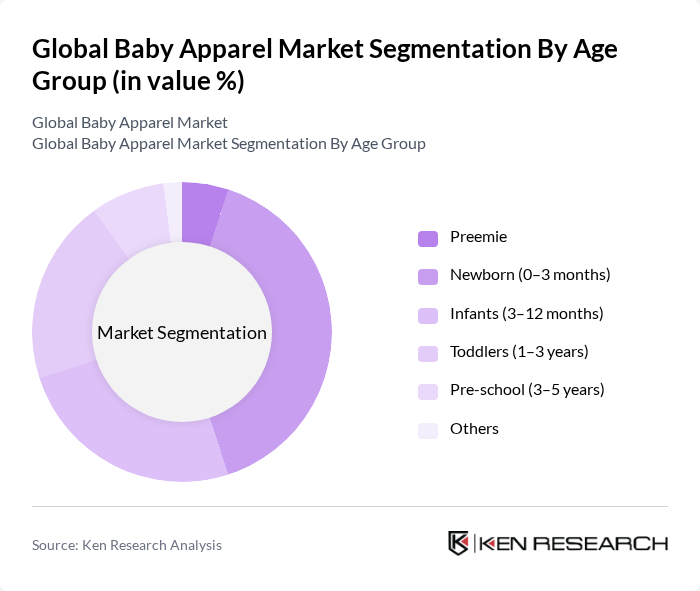

By Age Group:The age group segmentation includes preemie, newborn (0–3 months), infants (3–12 months), toddlers (1–3 years), pre-school (3–5 years), and others. This breakdown is consistent with market practice, where manufacturers and retailers typically distinguish between newborns, infants, and toddlers as core demand groups. The newborn and infant segments together account for a substantial share of demand, as parents prioritize purchasing clothing for younger babies who require frequent size changes and multiple daily outfit changes, driving higher garment turnover and purchase frequency. These segments are characterized by a high demand for soft, breathable, and easy-to-wear clothing with features such as flat seams, nickel-free snaps, and tagless labels, which drives ongoing innovation, design variety, and premium fabric adoption in product offerings.

The Global Baby Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carter's, Inc., Gerber Childrenswear LLC, The Children's Place, Inc., H&M Hennes & Mauritz AB, Gap Inc. (including BabyGap), Nike, Inc., Adidas AG, Inditex (Zara Kids), Mothercare plc, Cotton On Group (Cotton On Kids), Ralph Lauren Corporation, Uniqlo Co., Ltd., Gymboree Group, Inc., Petit Bateau, Jacadi Paris, Bonpoint contribute to innovation, geographic expansion, and service delivery in this space.

The future of the baby apparel market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are increasingly adopting eco-friendly practices, which will likely resonate with environmentally conscious consumers. Additionally, the rise of digital marketing and social media will facilitate direct engagement with target audiences, enhancing brand loyalty and driving sales. Companies that adapt to these trends will be well-positioned to capture market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Bodysuits & Onesies Tops & T-shirts Bottoms & Pants Dresses & Skirts Sleepwear & Loungewear Outerwear Underwear & Socks Accessories Footwear Others |

| By Age Group | Preemie Newborn (0–3 months) Infants (3–12 months) Toddlers (1–3 years) Pre-school (3–5 years) Others |

| By Material | Cotton Organic Cotton Polyester Wool Blends Bamboo & Other Sustainable Fibers |

| By Distribution Channel | Specialty Stores Department Stores Supermarkets/Hypermarkets Mass Market/Retail Chains Boutique/Independent Retail Online Retail/E-commerce Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Mass/Budget Mid-range Premium Luxury Others |

| By Brand Type | National & International Brands Private Labels/Store Brands Designer & Boutique Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Baby Apparel Sales | 120 | Store Managers, Retail Buyers |

| Online Baby Apparel Purchases | 90 | eCommerce Managers, Digital Marketing Specialists |

| Consumer Insights on Baby Apparel | 150 | Parents, Caregivers |

| Manufacturing Insights in Baby Apparel | 80 | Production Managers, Quality Control Officers |

| Trends in Sustainable Baby Apparel | 70 | Sustainability Officers, Product Designers |

The Global Baby Apparel Market is valued at approximately USD 220 billion, reflecting a significant growth driven by increasing birth rates, rising disposable incomes, and a trend towards premium and eco-friendly baby clothing.