Region:Asia

Author(s):Shubham

Product Code:KRAD6585

Pages:82

Published On:December 2025

By Product Type:The product type segmentation includes various ointments designed for burn treatment, broadly aligned with global burn ointment categories. The leading sub-segment is Topical Antibiotic Ointments, which continue to generate the largest revenue share globally because of clinical familiarity, low unit cost, and their effectiveness in preventing infections in superficial and partial-thickness burn wounds. Silver-based Ointments are also gaining traction, especially in hospital settings, due to their broad-spectrum antimicrobial and anti-biofilm properties and their growing reimbursement support in several Asia Pacific markets. Aloe vera and Plant-based Soothing Gels are popular among consumers seeking natural and over-the-counter remedies for minor burns and sunburn, while Honey and Hydrogel-based Burn Ointments are recognized in clinical literature for maintaining a moist wound environment, supporting debridement, and promoting healing. The market is characterized by a growing trend towards herbal and organic products and bioactive formulations, reflecting consumer preferences for safer, more natural options and the broader shift in wound care towards products that combine infection control with tissue regeneration.

By Depth of Burn:The depth of burn segmentation categorizes ointments based on the severity of burns they are designed to treat, aligning with clinical burn-severity classifications used in wound care and burn centers. Minor (Superficial) Burns dominate the market in volume terms due to their high prevalence in everyday domestic and occupational accidents and their frequent management with over-the-counter products. Partial-Thickness Burns are also significant, as they require more specialized antimicrobial and moisture-balancing topical preparations and contribute meaningfully to prescription and hospital sales. Full-Thickness Burns, while less common, necessitate advanced treatment options, including adjuvant topical therapy alongside surgical management for wound-bed preparation, infection prevention, and graft support. The increasing awareness of proper burn care protocols, expanding burn units in Asia Pacific, and the availability of specialized products for each burn type are driving growth and product differentiation in this segment.

The APAC Burn Ointment Market is characterized by a dynamic mix of regional and international players, mirroring the global competitive environment in burn and advanced wound care. Leading participants such as Johnson & Johnson (Biafine, Neosporin, OTC burn care portfolio), Smith & Nephew plc, 3M Company, Mölnlycke Health Care AB, PAUL HARTMANN AG, ConvaTec Group plc, Sun Pharmaceutical Industries Ltd. (Burnheal and other topical burn products), Dr. Reddy’s Laboratories Ltd., Cipla Limited, Glenmark Pharmaceuticals Ltd., Viatris Inc. (including legacy Mylan topical portfolio), Bharat Serums and Vaccines Limited (burn and wound management portfolio), MEDIWOUND Ltd., Coloplast A/S, Local and Regional APAC Brands (e.g., Burnaid – Mundipharma; regional OTC burn gels and ointments) contribute to innovation, geographic expansion, and service delivery in this space through a combination of prescription and OTC offerings, hospital-focused product lines, and retail pharmacy and e-commerce-based burn care ranges.

The APAC burn ointment market is poised for transformative growth, driven by technological advancements and increasing healthcare investments. As telemedicine services expand, patients will gain easier access to consultations and prescriptions for burn treatments. Additionally, the shift towards preventive healthcare will encourage consumers to prioritize burn safety and treatment options. These trends indicate a robust future for the market, with innovative products and improved accessibility likely to enhance overall consumer engagement and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Topical Antibiotic Ointments (e.g., bacitracin, neomycin, polymyxin B) Silver-based Ointments (e.g., silver sulfadiazine) Iodine-based Ointments Aloe vera and Plant-based Soothing Gels Honey and Hydrogel-based Burn Ointments Other Combination and Specialty Ointments |

| By Depth of Burn | Minor (Superficial) Burns Partial-Thickness Burns Full-Thickness Burns (adjuvant topical therapy) |

| By Application | First Aid and Household Use Hospital-based Acute Burn Care Post-surgical and Scar Management Occupational and Industrial Burn Care |

| By End-User | Hospitals Burn Care Centers and Specialty Clinics General Clinics Home Care Users Pharmacies & Drugstores |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies & Drugstores Online Pharmacies and E-commerce Platforms Direct Tenders and Institutional Sales |

| By Nature / Ingredient Origin | Synthetic / Conventional Ointments Herbal and Ayurvedic Ointments Natural and Organic-certified Ointments Others |

| By Country | China India Japan South Korea Australia & New Zealand Southeast Asia (Indonesia, Malaysia, Thailand, Vietnam, Philippines, Singapore, etc.) Rest of Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement for Burn Care | 100 | Procurement Managers, Medical Directors |

| Pharmacy Sales of Burn Ointments | 80 | Pharmacists, Store Managers |

| Dermatology Clinics' Product Usage | 70 | Dermatologists, Nurse Practitioners |

| Consumer Preferences in Burn Treatment | 90 | Patients, Caregivers |

| Market Insights from Healthcare Distributors | 60 | Distribution Managers, Sales Representatives |

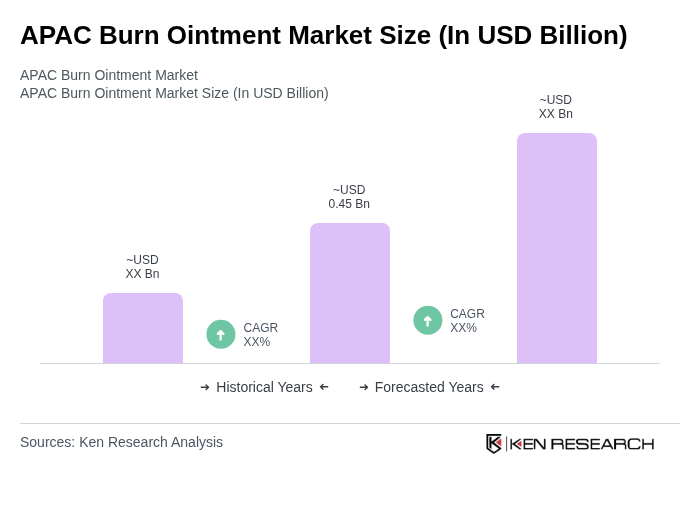

The APAC Burn Ointment Market is valued at approximately USD 0.45 billion, driven by increasing burn injury incidences and rising awareness about effective burn care treatments in both hospital and home-care settings.