Region:Asia

Author(s):Shubham

Product Code:KRAA8476

Pages:85

Published On:November 2025

By Type:The wound care market is segmented into various types, including advanced wound dressings, traditional/basic wound care, surgical wound care, antimicrobial dressings, hydrocolloid dressings, foam dressings, alginate dressings, biologics, therapy devices, and others. Among these, advanced wound dressings are gaining significant traction due to their effectiveness in promoting faster healing and reducing infection rates. The increasing incidence of chronic wounds, such as diabetic foot ulcers and pressure sores, is driving the demand for these advanced solutions. Technological advancements in dressing materials and the shift towards evidence-based care are further accelerating adoption of advanced wound care products.

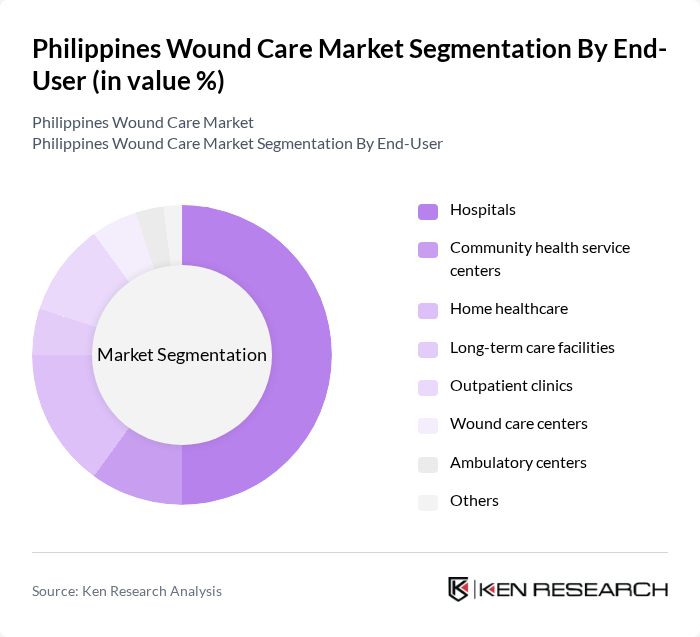

By End-User:The end-user segmentation includes hospitals, community health service centers, home healthcare, long-term care facilities, outpatient clinics, wound care centers, ambulatory centers, and others. Hospitals are the leading end-users due to their extensive patient base and the need for advanced wound management solutions. The increasing number of surgical procedures and the prevalence of chronic conditions in hospital settings are driving the demand for wound care products. Home healthcare is also expanding, supported by telemedicine and remote monitoring technologies, which enhance wound management outside traditional clinical settings.

The Philippines Wound Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson, Medtronic, Smith & Nephew, 3M Health Care, B. Braun Melsungen AG, ConvaTec Group plc, Mölnlycke Health Care, Coloplast A/S, Derma Sciences, Inc., Paul Hartmann AG, KCI Medical (now part of 3M), Acelity L.P. Inc. (now part of 3M), Medline Industries, LP, Integra LifeSciences Holdings Corporation, Systagenix Wound Management (now part of Acelity/3M), Hollister Incorporated, Cardinal Health, Local Distributors (e.g., Metro Drug Inc., Zuellig Pharma, United Laboratories Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines wound care market is poised for significant growth, driven by demographic shifts and technological advancements. As the population ages and the prevalence of chronic wounds rises, healthcare providers are increasingly focusing on improving wound care management. The integration of telemedicine and home healthcare solutions is expected to enhance patient access to care. Furthermore, ongoing investments in healthcare infrastructure will facilitate the adoption of innovative wound care technologies, ultimately improving patient outcomes and market dynamics in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Advanced wound dressings Traditional/basic wound care Surgical wound care Antimicrobial dressings Hydrocolloid dressings Foam dressings Alginate dressings Biologics Therapy devices Others |

| By End-User | Hospitals Community health service centers Home healthcare Long-term care facilities Outpatient clinics Wound care centers Ambulatory centers Others |

| By Distribution Channel | Retail pharmacies Online pharmacies Direct tenders Hospitals and clinics Others |

| By Region | Luzon Visayas Mindanao Others |

| By Product Formulation | Liquid formulations Gel formulations Powder formulations Others |

| By Application Area | Chronic wounds Acute wounds Pressure ulcers Diabetic foot ulcers Venous leg ulcers Arterial ulcers Burns & trauma Surgical wounds Others |

| By Policy Support | Government subsidies Tax incentives Regulatory support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Wound Care Departments | 45 | Wound Care Specialists, Nurses, Hospital Administrators |

| Home Healthcare Providers | 38 | Home Health Aides, Care Coordinators, Patient Care Managers |

| Pharmaceutical Distributors | 32 | Sales Representatives, Product Managers, Distribution Managers |

| Wound Care Product Manufacturers | 42 | Product Development Managers, Marketing Directors, Regulatory Affairs Specialists |

| Patient Advocacy Groups | 28 | Patient Advocates, Community Health Workers, Support Group Leaders |

The Philippines Wound Care Market is valued at approximately USD 105 million, driven by the increasing prevalence of chronic wounds, rising healthcare expenditure, and advancements in wound care technologies.