Region:Asia

Author(s):Dev

Product Code:KRAC8751

Pages:82

Published On:November 2025

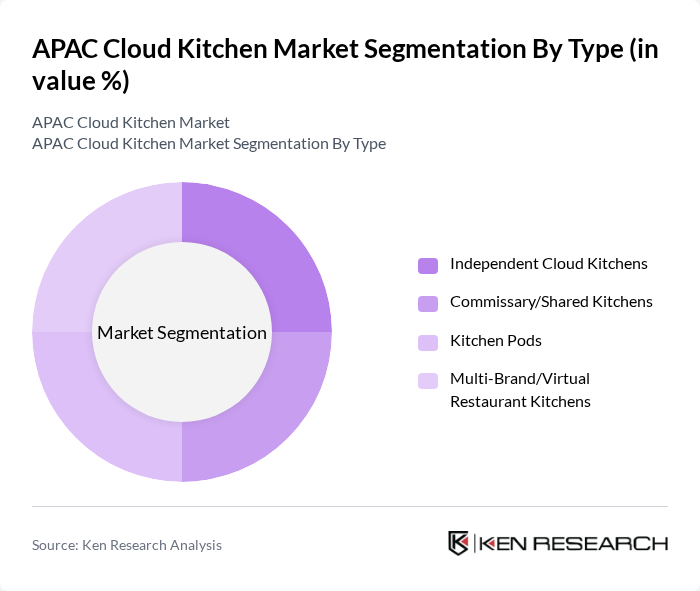

By Type:The cloud kitchen market is segmented into various types, including Independent Cloud Kitchens, Commissary/Shared Kitchens, Kitchen Pods, and Multi-Brand/Virtual Restaurant Kitchens. Each type serves distinct operational needs and consumer preferences, contributing to the overall market dynamics. Independent Cloud Kitchens are standalone facilities focused on delivery-only brands; Commissary/Shared Kitchens provide space and infrastructure for multiple brands or operators; Kitchen Pods are modular, often mobile, kitchens; Multi-Brand/Virtual Restaurant Kitchens operate several brands from a single location, maximizing resource utilization .

TheIndependent Cloud Kitchenssegment is currently dominating the market due to their ability to operate with lower overhead costs and greater flexibility. These kitchens allow entrepreneurs to launch food brands without the need for a physical storefront, catering to the growing demand for diverse food options. The trend towards personalization, unique culinary experiences, and operational efficiency has further propelled the popularity of independent cloud kitchens, making them a preferred choice for many food entrepreneurs .

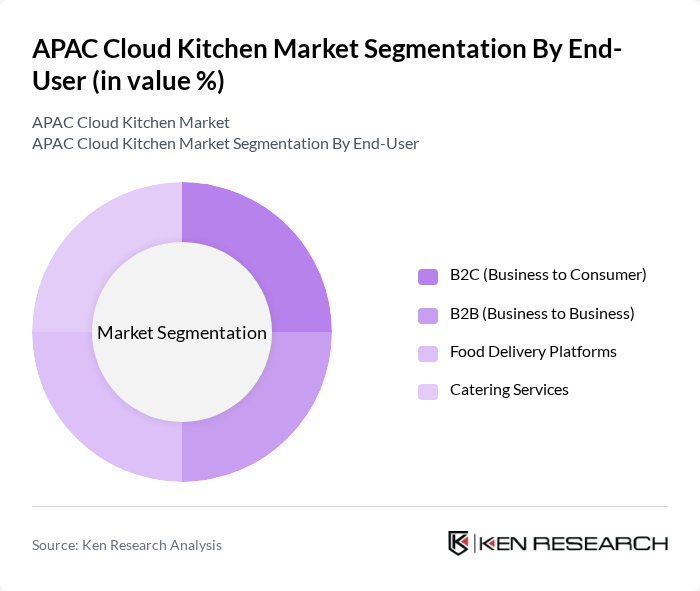

By End-User:The market is segmented by end-user into B2C (Business to Consumer), B2B (Business to Business), Food Delivery Platforms, and Catering Services. Each segment caters to different customer needs and preferences, influencing the overall market landscape. B2C includes direct-to-consumer delivery brands; B2B involves partnerships with other businesses (e.g., corporate catering); Food Delivery Platforms focus on aggregating orders for multiple brands; Catering Services provide large-scale meal solutions for events and institutions .

TheB2C segmentis leading the market, driven by the increasing consumer preference for convenience and the growing trend of online food ordering. The rise of mobile applications and food delivery services has made it easier for consumers to access a variety of cuisines from the comfort of their homes. This shift in consumer behavior has significantly boosted the demand for cloud kitchens that cater directly to end-users .

The APAC Cloud Kitchen Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rebel Foods, CloudKitchens (Kitchen Infrastructure Company, founded by Travis Kalanick), Zomato, Swiggy, Kitopi, Keatz, Foodpanda, FreshMenu, Faasos, Box8, Wow! Momo, Dahmakan (now rebranded as Pop Meals), Yummy Corporation, Hangry, Deliveroo contribute to innovation, geographic expansion, and service delivery in this space .

The future of the APAC cloud kitchen market appears promising, driven by technological advancements and evolving consumer preferences. As urban populations continue to grow, the demand for convenient food options will likely increase. Additionally, the integration of AI and data analytics in operations will enhance efficiency and customer experience. Cloud kitchens that adapt to these trends and focus on sustainability will be well-positioned to capture market share and drive innovation in the food service industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Independent Cloud Kitchens Commissary/Shared Kitchens Kitchen Pods Multi-Brand/Virtual Restaurant Kitchens |

| By End-User | B2C (Business to Consumer) B2B (Business to Business) Food Delivery Platforms Catering Services |

| By Country | China India Japan South Korea Southeast Asia (e.g., Singapore, Thailand, Indonesia, Malaysia, Vietnam) Australia & New Zealand Rest of APAC |

| By Cuisine Type | Asian Cuisine (Chinese, Indian, Japanese, Thai, Korean, etc.) Western Cuisine Fast Food Health-Focused/Plant-Based Cuisine Others |

| By Service Model | Subscription-Based Services Pay-Per-Order Services Franchise/White-Label Services Others |

| By Technology Utilization | AI-Driven Operations Cloud-Based Management Systems Robotics & Automation Others |

| By Delivery Method | Third-Party Delivery Services In-House Delivery Hybrid Delivery Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 100 | Founders, Operations Managers |

| Food Delivery Service Providers | 80 | Logistics Managers, Business Development Heads |

| Consumer Preferences | 120 | Frequent Users of Food Delivery Apps |

| Market Analysts | 40 | Industry Experts, Market Researchers |

| Regulatory Bodies | 40 | Policy Makers, Food Safety Inspectors |

The APAC Cloud Kitchen Market is valued at approximately USD 73 billion, driven by the increasing demand for food delivery services and changing consumer preferences towards convenience. This market is expected to continue growing as digital platforms facilitate online orders.