APAC Dermatological Drugs Market Overview

- The APAC Dermatological Drugs Market is valued at USD 9 billion, based on a five-year historical analysis. Growth is primarily driven by the increasing prevalence of skin disorders such as psoriasis, eczema, and acne, rising awareness about dermatological health, and advancements in drug formulations. The market is further supported by the growing demand for effective treatment options, expansion of healthcare infrastructure, and the introduction of innovative therapies, including biologics and biosimilars, across the region .

- Key players in this market include China, Japan, and India, which dominate due to their large populations and increasing healthcare expenditure. China leads with rapid urbanization and rising disposable incomes, while Japan benefits from an advanced healthcare system and high demand for innovative treatments. India is experiencing a surge in dermatological conditions and increased manufacturing of biosimilars, further propelling market growth .

- In 2023, the Indian government implemented the National Health Mission, which aims to enhance healthcare access and affordability, including dermatological services. This initiative focuses on increasing the availability of essential medicines and improving healthcare infrastructure, thereby supporting the growth of the dermatological drugs market in the region. The National Health Mission, 2023, issued by the Ministry of Health and Family Welfare, mandates increased funding for essential medicines, including dermatological drugs, and sets operational standards for public health facilities .

APAC Dermatological Drugs Market Segmentation

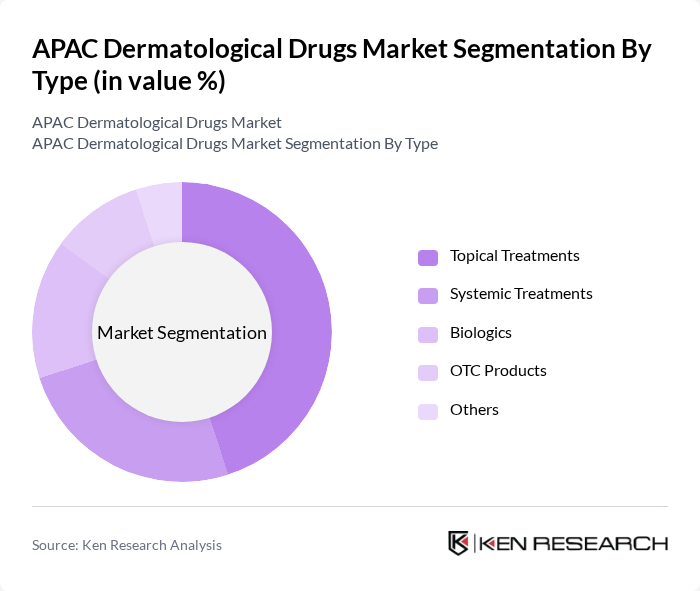

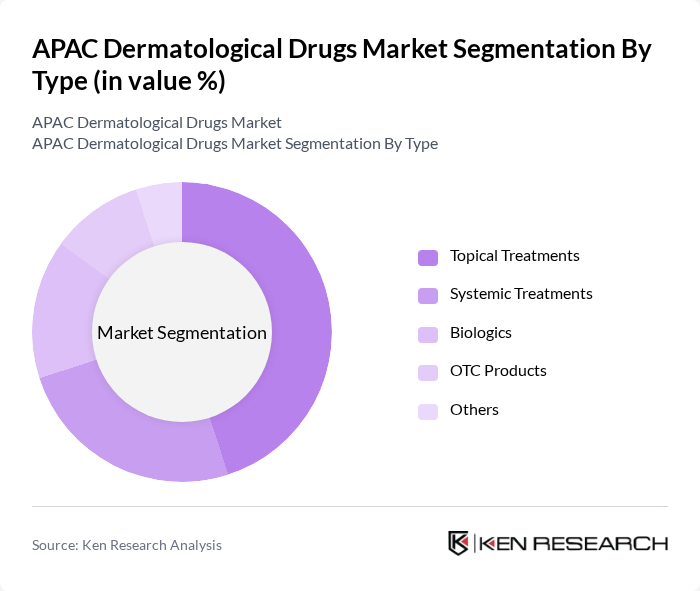

By Type:The market is segmented into various types of dermatological drugs, including topical treatments, systemic treatments, biologics, OTC products, and others. Among these, topical treatments are the most widely used due to their direct application and effectiveness in managing localized skin conditions. Systemic treatments are gaining traction as they address more severe dermatological issues, while biologics are becoming increasingly popular for chronic conditions like psoriasis and atopic dermatitis. OTC products are also significant, driven by consumer preference for self-medication and the growing availability of non-prescription dermatological solutions .

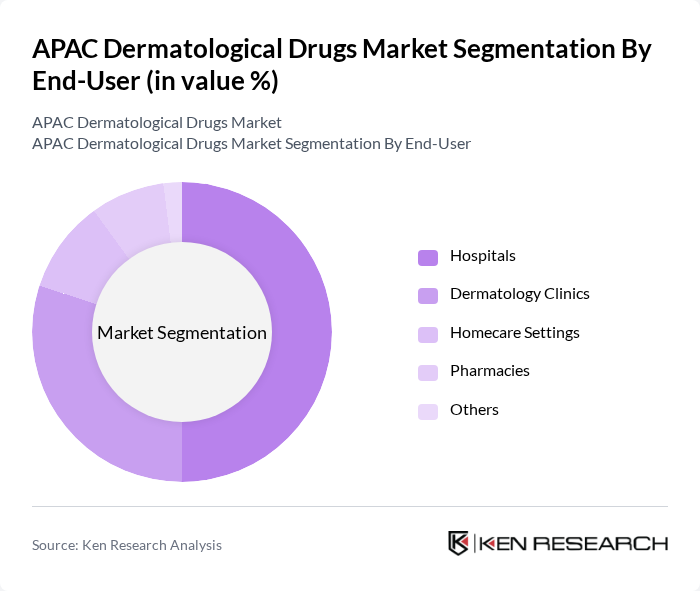

By End-User:The end-user segmentation includes hospitals, dermatology clinics, homecare settings, pharmacies, and others. Hospitals are the leading end-users due to their comprehensive facilities and specialized dermatology departments. Dermatology clinics are also significant, providing focused care and advanced treatment options. Homecare settings are gaining popularity as patients prefer convenience and remote care, while pharmacies serve as accessible points for OTC products and consultations, especially in urban and semi-urban areas .

APAC Dermatological Drugs Market Competitive Landscape

The APAC Dermatological Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson, Novartis AG, Pfizer Inc., GlaxoSmithKline plc, AbbVie Inc., Merck & Co., Inc., Sanofi S.A., Amgen Inc., Bayer AG, Astellas Pharma Inc., Eli Lilly and Company, Galderma S.A., Sun Pharmaceutical Industries Ltd., Leo Pharma A/S, Maruho Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

APAC Dermatological Drugs Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Skin Disorders:The APAC region is witnessing a significant rise in skin disorders, with an estimated 1.6 billion people affected by various conditions such as eczema, psoriasis, and acne. According to the World Health Organization, skin diseases account for approximately 30% of all consultations in dermatology. This growing prevalence is driving demand for dermatological drugs, as healthcare systems strive to address the increasing burden of skin-related health issues.

- Rising Awareness About Dermatological Health:Public awareness regarding skin health is on the rise, with campaigns and educational programs reaching millions. In future, it is projected that over 65% of the population in urban areas will actively seek information about skin care and treatments. This heightened awareness is leading to increased consultations with dermatologists and a surge in demand for effective dermatological products, thereby propelling market growth in the APAC region.

- Advancements in Drug Formulations and Delivery Systems:The dermatological drugs market is benefiting from innovations in drug formulations, including the development of targeted therapies and advanced delivery systems. In future, the introduction of novel drug delivery methods, such as microneedles and transdermal patches, is expected to enhance treatment efficacy. These advancements are anticipated to improve patient compliance and satisfaction, further driving the demand for dermatological drugs across the APAC region.

Market Challenges

- High Cost of Dermatological Treatments:The cost of dermatological treatments remains a significant barrier for many patients in the APAC region. For instance, the average cost of biologic therapies can exceed USD 35,000 annually, making them inaccessible for a large segment of the population. This financial burden limits treatment options and can lead to untreated skin conditions, posing a challenge for market growth in the region.

- Stringent Regulatory Requirements:The dermatological drugs market faces challenges due to stringent regulatory frameworks imposed by health authorities. In future, it is estimated that the average time for drug approval in the APAC region will be around 16 months, significantly delaying market entry for new products. These regulatory hurdles can stifle innovation and limit the availability of new treatments, impacting overall market dynamics.

APAC Dermatological Drugs Market Future Outlook

The APAC dermatological drugs market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. The integration of digital health solutions, such as teledermatology, is expected to enhance patient access to dermatological care. Additionally, the shift towards personalized medicine will enable tailored treatment approaches, improving patient outcomes. As the market adapts to these trends, stakeholders must focus on innovation and collaboration to capitalize on emerging opportunities and address existing challenges effectively.

Market Opportunities

- Expansion of Telemedicine Services:The rise of telemedicine presents a significant opportunity for the dermatological drugs market. In future, it is projected that telemedicine consultations will increase by 45%, allowing patients in remote areas to access dermatological care. This shift can lead to higher treatment adherence and increased demand for dermatological products, ultimately benefiting the market.

- Development of Personalized Medicine:The trend towards personalized medicine is gaining momentum in dermatology, with advancements in genomics and biomarker research. In future, it is anticipated that personalized treatment plans will become standard practice for managing skin disorders. This approach not only enhances treatment efficacy but also opens new avenues for drug development, creating substantial growth opportunities in the dermatological drugs market.