Region:Middle East

Author(s):Shubham

Product Code:KRAD2014

Pages:83

Published On:December 2025

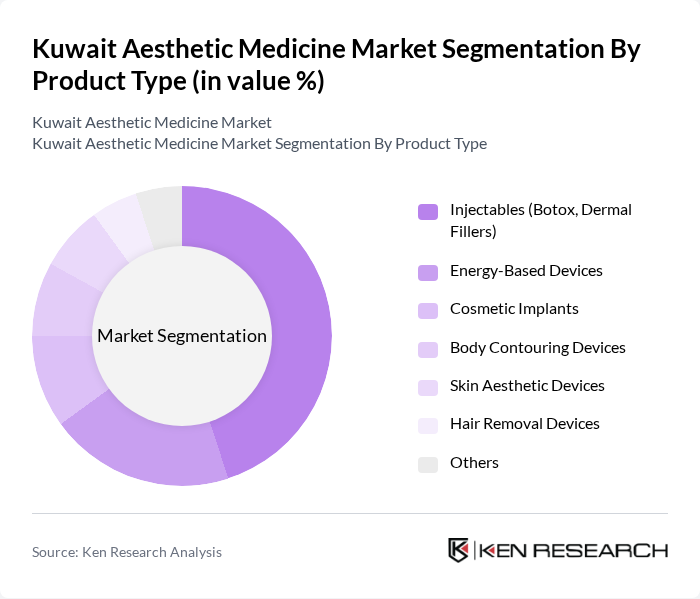

By Product Type:The product type segmentation includes various categories such as injectables, energy-based devices, cosmetic implants, body contouring devices, skin aesthetic devices, hair removal devices, and others. Among these, injectables, particularly botulinum toxin and dermal fillers, dominate the market due to their popularity and effectiveness in non-surgical aesthetic enhancements. The increasing preference for minimally invasive procedures has led to a surge in demand for these products, making them a key driver of market growth.

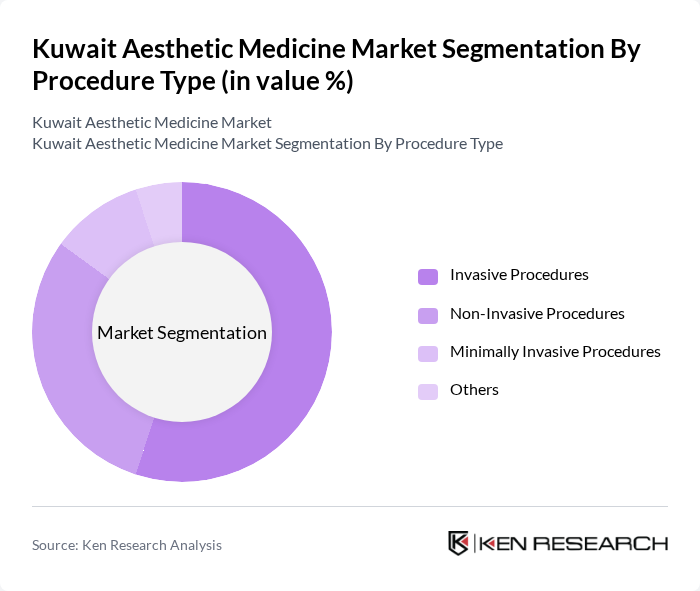

By Procedure Type:The procedure type segmentation encompasses invasive, non-invasive, minimally invasive procedures, and others. Invasive procedures currently hold the largest share of the market, driven by the demand for surgical enhancements such as liposuction and facelifts. However, non-invasive procedures are rapidly gaining traction due to their lower risk profiles and shorter recovery times, appealing to a broader demographic seeking aesthetic improvements.

The Kuwait Aesthetic Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Dar Aesthetic Clinic, NewMe Aesthetic Clinic, The White Clinic, Dr. Nour Aesthetic Center, Al-Hamra Medical Center, Kuwait Aesthetic Center, DermaCare Clinic, The Aesthetic Clinic, Al-Mohalab Medical Center, Skin & Laser Clinic, Aesthetic Medical Center, Al-Sabah Medical Center, Beauty & Aesthetic Clinic, The Skin Clinic, Al-Farabi Medical Center contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait aesthetic medicine market appears promising, driven by a growing acceptance of minimally invasive procedures and a rising demand for aesthetic injectables. With the minimally invasive surgery market valued at **USD 771.5 million** in future, there is a clear trend towards less invasive treatments. Additionally, the aesthetic injectable segment, which generated **USD 29.3 million** in future, is expected to continue expanding, reflecting consumer preferences for non-surgical options. This evolving landscape presents significant opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Injectables (Botox, Dermal Fillers) Energy-Based Devices Cosmetic Implants Body Contouring Devices Skin Aesthetic Devices Hair Removal Devices Others |

| By Procedure Type | Invasive Procedures Non-Invasive Procedures Minimally Invasive Procedures Others |

| By End-User | Clinics, Hospitals, and Medical Spas Beauty Centers Home Care Others |

| By Application | Anti-Aging and Wrinkles Facial and Skin Rejuvenation Body Shaping and Cellulite Tattoo Removal Others |

| By Gender | Male Female Others |

| By Distribution Channel | Direct Tender Retail Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 100 | Dermatologists, Clinic Managers |

| Plastic Surgery Centers | 80 | Plastic Surgeons, Administrative Staff |

| Aesthetic Treatment Patients | 120 | Recent Patients, Prospective Clients |

| Medical Spas | 70 | Spa Owners, Treatment Providers |

| Regulatory Bodies | 40 | Health Policy Makers, Regulatory Officials |

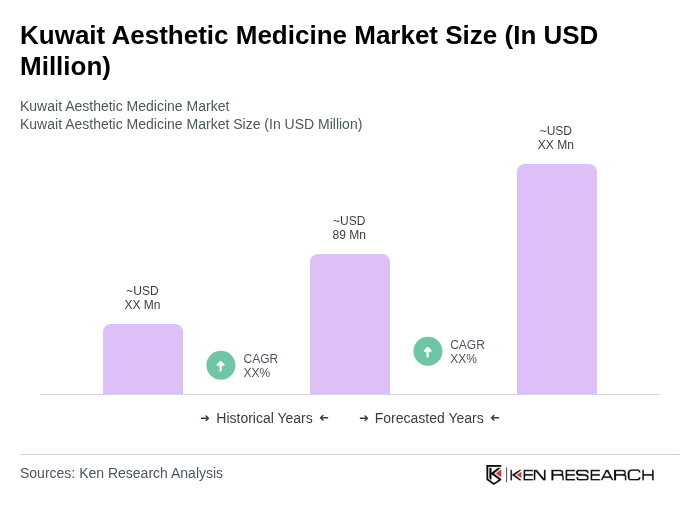

The Kuwait Aesthetic Medicine Market is valued at approximately USD 89 million, reflecting a robust consumer interest in both invasive and non-invasive aesthetic procedures, driven by rising disposable incomes and increased awareness of cosmetic treatments.