Region:Asia

Author(s):Dev

Product Code:KRAC2663

Pages:96

Published On:October 2025

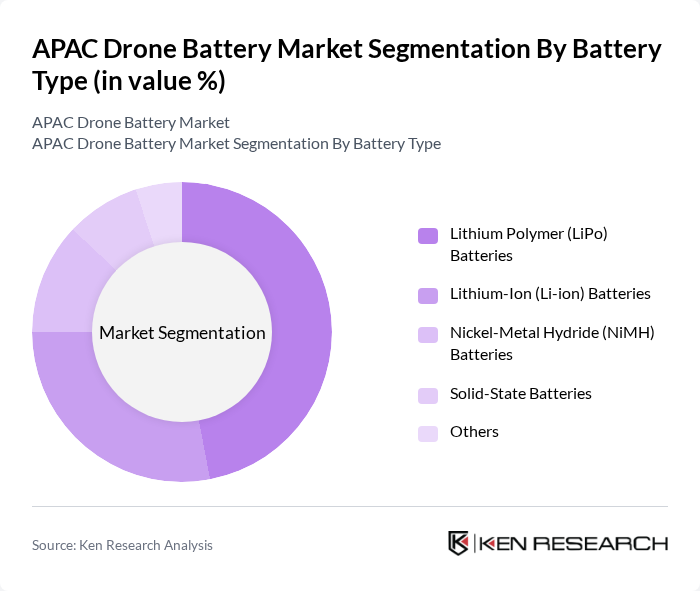

By Battery Type:The battery type segment includes various technologies that power drones, each with unique characteristics and applications. The leading sub-segment is Lithium Polymer (LiPo) batteries, favored for their high energy density, lightweight construction, and discharge capability, making them ideal for commercial, industrial, and military drone applications. Lithium-Ion (Li-ion) batteries are also widely used for their long cycle life and stability, particularly in consumer and enterprise drones. Nickel-Metal Hydride (NiMH) batteries and emerging solid-state batteries play significant roles in specialized and next-generation drone platforms, with NiMH often used in entry-level or cost-sensitive applications.

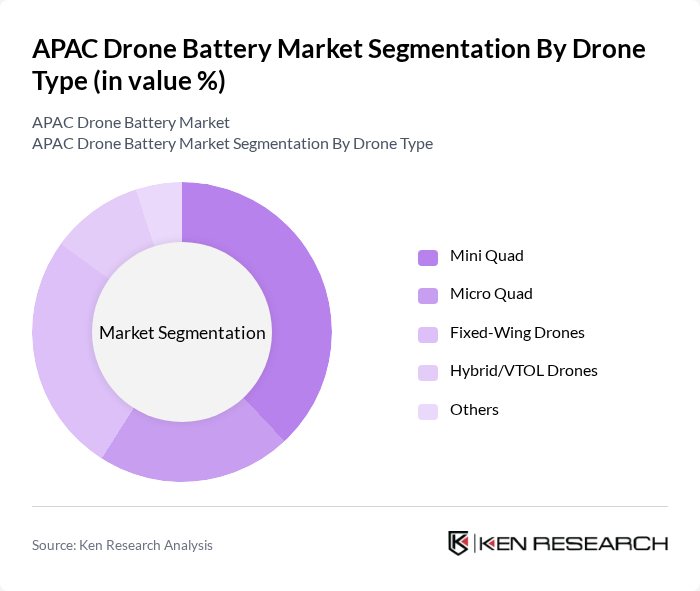

By Drone Type:The drone type segment encompasses various categories of drones, including mini quads, micro quads, fixed-wing drones, and hybrid/VTOL drones. Mini quad drones are currently the most popular due to their versatility, ease of use, and suitability for both recreational and commercial applications. Fixed-wing drones are gaining traction for their efficiency in covering large areas, particularly in agricultural monitoring, surveying, and logistics, while hybrid/VTOL drones are increasingly adopted for their ability to combine vertical takeoff with extended range.

The APAC Drone Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., SZ DJI Baiwang Technology Co., Ltd. (Tattu / Grepow Battery), Panasonic Corporation, Samsung SDI Co., Ltd., LG Energy Solution Ltd., Amperex Technology Limited (ATL), BYD Company Limited, EHang Holdings Limited, Hunan Copower EV Battery Co., Ltd., Parrot Drones S.A., Yuneec International Co., Ltd., Autel Robotics Co., Ltd., Thunder Power Battery, Shenzhen Grepow Battery Co., Ltd., Sony Group Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The APAC drone battery market is poised for transformative growth, driven by technological advancements and increasing applications across various sectors. As battery technologies evolve, particularly with the rise of solid-state batteries, operational efficiencies will improve, enabling longer flight times and reduced charging periods. Additionally, the integration of AI in drone operations is expected to enhance decision-making processes, further expanding market potential. The focus on sustainability will also drive innovations in battery recycling and eco-friendly practices, aligning with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Battery Type | Lithium Polymer (LiPo) Batteries Lithium-Ion (Li-ion) Batteries Nickel-Metal Hydride (NiMH) Batteries Solid-State Batteries Others |

| By Drone Type | Mini Quad Micro Quad Fixed-Wing Drones Hybrid/VTOL Drones Others |

| By End-User | Commercial Industrial Government & Defense Agriculture Infrastructure & Construction Others |

| By Application | Aerial Photography & Videography Agriculture Monitoring & Crop Spraying Delivery & Logistics Surveillance & Inspection Emergency Services Others |

| By Region | China Japan South Korea India Southeast Asia Rest of APAC |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors/Dealers Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Drone Manufacturers | 60 | Product Managers, R&D Engineers |

| Battery Suppliers for Drones | 50 | Sales Directors, Technical Specialists |

| Logistics Companies Using Drones | 40 | Operations Managers, Supply Chain Analysts |

| Regulatory Bodies on Drone Usage | 40 | Policy Makers, Compliance Officers |

| End-users in Agriculture and Delivery | 50 | Agricultural Managers, Delivery Service Operators |

The APAC Drone Battery Market is valued at approximately USD 2.6 billion, driven by the increasing adoption of drones across various sectors, advancements in battery technology, and the integration of smart battery management systems.