Region:Asia

Author(s):Dev

Product Code:KRAC3373

Pages:84

Published On:January 2026

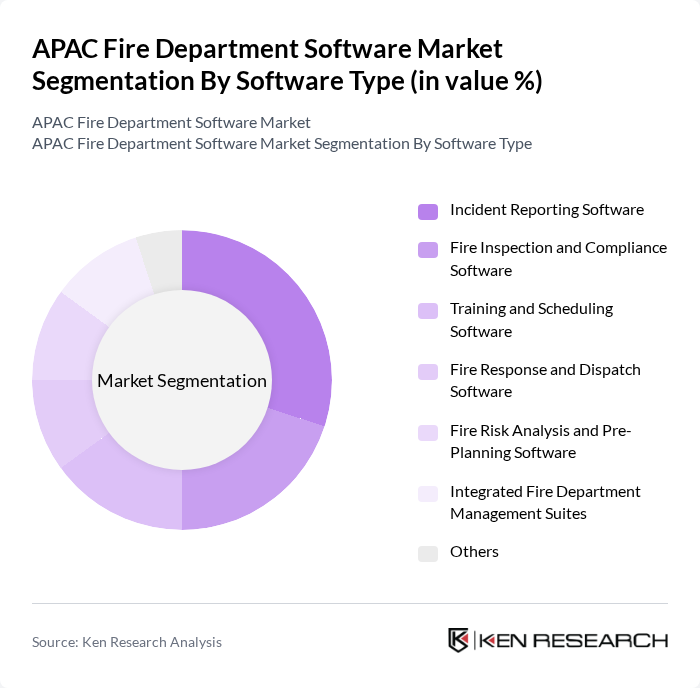

By Software Type:The software type segmentation includes various solutions tailored to meet the specific needs of fire departments. The subsegments are Incident Reporting Software, Fire Inspection and Compliance Software, Training and Scheduling Software, Fire Response and Dispatch Software, Fire Risk Analysis and Pre-Planning Software, Integrated Fire Department Management Suites, and Others. Among these, Incident Reporting Software is currently the leading subsegment due to its critical role in documenting incidents and facilitating data analysis for improved response strategies.

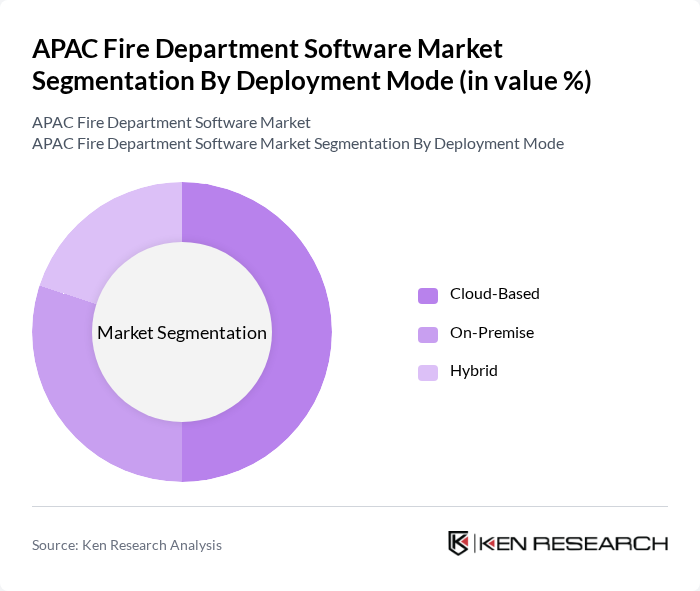

By Deployment Mode:The deployment mode segmentation includes Cloud-Based, On-Premise, and Hybrid solutions. Cloud-Based deployment is gaining traction due to its scalability, cost-effectiveness, and ease of access, making it the most preferred choice among fire departments. On-Premise solutions are still relevant for organizations with strict data security requirements, while Hybrid models offer a balanced approach.

The APAC Fire Department Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Firehouse Software (ESO Fire RMS), Emergency Reporting (ImageTrend ER), ImageTrend, ESO Solutions, ZOLL Data Systems, Vector Solutions (TargetSolutions), First Due, CentralSquare Fire (FireRMS), Aladtec, StationSmarts (Fire Station Software), Apparatus Tracker, RescueNet (ZOLL), FirePro, FireCAD, Firehouse Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The APAC fire department software market is poised for further growth supported by ongoing technological advancements and increasing regulatory pressures. As urbanization accelerates in many economies, fire departments are expected to adopt more integrated solutions that leverage AI and mobile applications for enhanced operational efficiency. Additionally, the growing policy focus on sustainability and resilient infrastructure is influencing software development, encouraging functionalities that support resource-efficient and risk-informed fire management. These trends indicate movement towards more responsive and adaptive fire services, helping to ensure public safety in rapidly evolving urban environments.

| Segment | Sub-Segments |

|---|---|

| By Software Type | Incident Reporting Software Fire Inspection and Compliance Software Training and Scheduling Software Fire Response and Dispatch Software Fire Risk Analysis and Pre?Planning Software Integrated Fire Department Management Suites Others |

| By Deployment Mode | Cloud-Based On-Premise Hybrid |

| By Organization Size | Small Fire Departments Medium Fire Departments Large and Metropolitan Fire Departments |

| By End-User | Municipal and City Fire Departments Industrial and Enterprise Fire Services Airport, Port, and Transport Authority Fire Services Oil, Gas, and Petrochemical Fire Services Others |

| By Application | Emergency Response and Dispatch Fire Prevention, Inspection, and Permitting Training, Certification, and Simulation Records Management and Reporting Asset, Fleet, and Resource Management Others |

| By Deployment Region (APAC) | China India Japan South Korea Australia & New Zealand Southeast Asia Rest of APAC |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Fire Departments | 120 | Fire Chiefs, IT Managers |

| Rural Fire Services | 90 | Operations Directors, Training Coordinators |

| Fire Safety Software Vendors | 60 | Product Managers, Sales Executives |

| Emergency Response Units | 60 | Emergency Managers, Logistics Coordinators |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The APAC Fire Department Software Market is valued at approximately USD 260 million, reflecting significant growth driven by urbanization, technological advancements, and the need for efficient emergency response systems.