Region:Asia

Author(s):Rebecca

Product Code:KRAB2308

Pages:88

Published On:January 2026

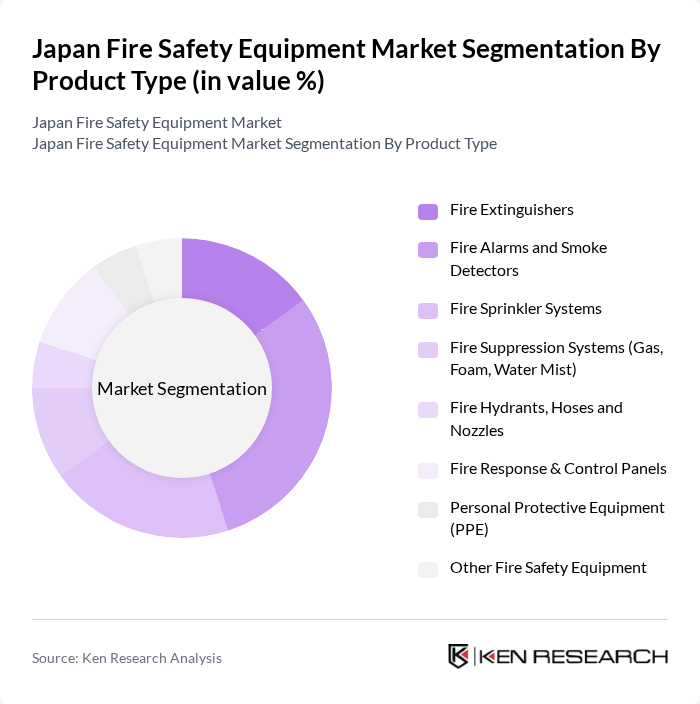

By Product Type:The product type segmentation includes various categories of fire safety equipment that cater to different needs and applications. The primary subsegments are Fire Extinguishers, Fire Alarms and Smoke Detectors, Fire Sprinkler Systems, Fire Suppression Systems (Gas, Foam, Water Mist), Fire Hydrants, Hoses and Nozzles, Fire Response & Control Panels, Personal Protective Equipment (PPE), and Other Fire Safety Equipment. In line with industry data showing that detection and related hardware form the largest component of Japan’s fire protection spend, Fire Alarms and Smoke Detectors are leading the market due to their essential role in early fire detection and prevention, which is critical in both residential and commercial settings and is strongly emphasized by the Fire Service Act and Building Standards Act.

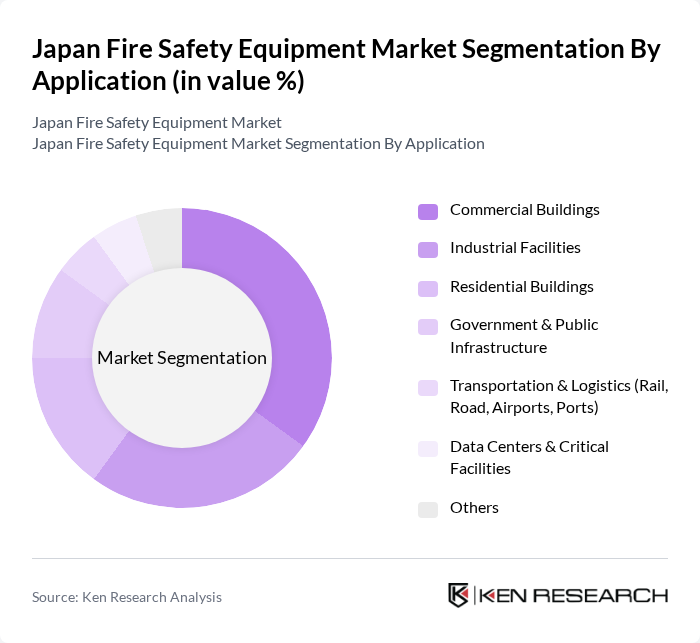

By Application:The application segmentation encompasses various sectors where fire safety equipment is utilized, including Commercial Buildings, Industrial Facilities, Residential Buildings, Government & Public Infrastructure, Transportation & Logistics (Rail, Road, Airports, Ports), Data Centers & Critical Facilities, and Others. The Commercial Buildings segment is the most significant, driven by the increasing number of office spaces, mixed-use developments, retail establishments, and hospitality assets that require comprehensive fire safety solutions to protect occupants and assets and ensure compliance with the Fire Service Act and Building Standards Act. Industrial facilities and data centers are also accelerating adoption of advanced detection, monitoring, and suppression systems, reflecting Japan’s focus on business continuity and protection of high-value critical infrastructure.

The Japan Fire Safety Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson Controls International plc, Honeywell International Inc., Siemens AG, Tyco Fire & Security, Carrier Global Corporation (Kidde, Chubb), Hochiki Corporation, Nittan Company, Limited, Mitsubishi Electric Corporation, NEC Corporation, Panasonic Corporation, Hitachi, Ltd., Daikin Industries, Ltd., Fujitsu Limited, Minimax Viking, UTC Fire & Security contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fire safety equipment market in Japan appears promising, driven by ongoing urbanization and technological advancements. As cities expand, the demand for innovative fire safety solutions will likely increase, particularly in smart buildings. Additionally, the government's commitment to enhancing fire safety regulations will further stimulate market growth. Companies that invest in training programs and skilled workforce development will be better positioned to capitalize on these trends, ensuring compliance and safety in an evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fire Extinguishers Fire Alarms and Smoke Detectors Fire Sprinkler Systems Fire Suppression Systems (Gas, Foam, Water Mist) Fire Hydrants, Hoses and Nozzles Fire Response & Control Panels Personal Protective Equipment (PPE) Other Fire Safety Equipment |

| By Application | Commercial Buildings Industrial Facilities Residential Buildings Government & Public Infrastructure Transportation & Logistics (Rail, Road, Airports, Ports) Data Centers & Critical Facilities Others |

| By System Type | Fire Detection & Alarm Systems Fire Suppression Systems Passive Fire Protection (Doors, Barriers, Coatings) Emergency & Evacuation Systems Integrated Fire & Building Management Systems Others |

| By Technology | Conventional Systems Addressable / Intelligent Systems Wireless & IoT-Enabled Systems Smart, Cloud-Connected Systems Others |

| By Service | Installation & Design Services Maintenance & Inspection Services Managed & Remote Monitoring Services Retrofit & Upgrade Services Others |

| By Building Type | New Construction Existing Buildings / Retrofitting Mixed-Use Developments Others |

| By Region | Kanto Kansai Chubu Tohoku Kyushu Hokkaido Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Fire Safety Equipment | 100 | Facility Managers, Safety Officers |

| Residential Fire Safety Solutions | 80 | Homeowners, Property Managers |

| Industrial Fire Protection Systems | 85 | Plant Managers, Safety Compliance Officers |

| Fire Safety Training Services | 65 | Training Coordinators, HR Managers |

| Fire Safety Equipment Distribution | 95 | Distributors, Retail Managers |

The Japan Fire Safety Equipment Market is valued at approximately USD 2.2 billion, reflecting a robust growth driven by stringent regulations, increased awareness of fire safety, and the rising demand for advanced fire safety solutions in urban areas.