Region:Asia

Author(s):Dev

Product Code:KRAD5106

Pages:98

Published On:December 2025

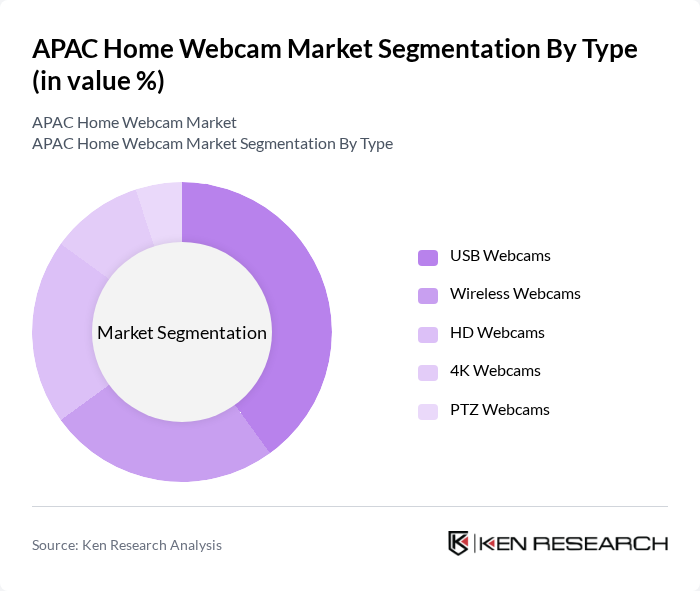

By Type:The market is segmented into various types of webcams, including USB Webcams, Wireless Webcams, HD Webcams, 4K Webcams, and PTZ Webcams. USB Webcams are widely used due to their ease of connectivity, plug?and?play compatibility, and affordability, and globally USB-type devices account for more than half of home webcam revenues. Wireless Webcams are gaining traction for their convenience, flexibility, and integration with Wi?Fi/Bluetooth enabled devices, especially in home offices and home surveillance. HD and 4K Webcams are preferred by content creators, gamers, and professional streamers for their superior image quality and support for high?resolution live streaming, while PTZ Webcams are popular in professional and prosumer settings for their advanced features such as pan?tilt?zoom, auto?framing, and wide?area coverage.

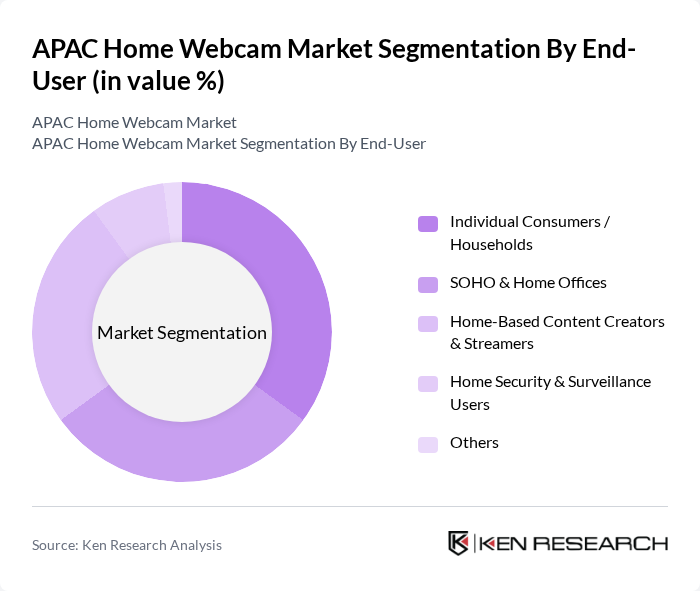

By End-User:The end-user segmentation includes Individual Consumers / Households, SOHO & Home Offices, Home-Based Content Creators & Streamers, Home Security & Surveillance Users, and Others. Individual consumers dominate the market due to the increasing need for personal video communication for social interaction, online classes, and telehealth. Home-based content creators and streamers are driving demand for high-quality HD and 4K webcams with better low-light performance and integrated microphones, in line with the rapid growth of the global creator and live?streaming economy. SOHO and home offices are also significant contributors as remote and hybrid work models remain widely adopted across APAC, supporting sustained demand for reliable webcams for corporate meetings and collaboration platforms.

The APAC Home Webcam Market is characterized by a dynamic mix of regional and international players. Leading participants such as Logitech International S.A., Razer Inc., Microsoft Corporation, Canon Inc., Sony Group Corporation, AVerMedia Technologies, Inc., Dell Technologies Inc., HP Inc., Creative Technology Ltd., ASUSTeK Computer Inc., Elgato (Corsair Gaming, Inc.), Jabra (GN Audio A/S), NexiGo, AUKEY, AVer Information Inc. (AVer) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC home webcam market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As remote work and online education continue to thrive, the demand for high-quality webcams is expected to rise. Additionally, the integration of AI features and enhanced video quality will likely become standard. Manufacturers will need to adapt to regulatory changes regarding privacy and data protection, ensuring that their products meet consumer expectations while navigating a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | USB Webcams Wireless Webcams HD Webcams K Webcams PTZ Webcams |

| By End-User | Individual Consumers / Households SOHO & Home Offices Home-Based Content Creators & Streamers Home Security & Surveillance Users Others |

| By Region | China Japan India South Korea ASEAN (Indonesia, Malaysia, Thailand, Vietnam, Philippines, Singapore, etc.) Australia & New Zealand Rest of APAC |

| By Technology | CMOS Sensor Technology CCD Sensor Technology Infrared / Night-Vision Enabled AI-Enabled / Smart Webcams |

| By Application | Video Conferencing & Remote Work Streaming and Content Creation Security & Surveillance Online Education & E-Learning Others |

| By Sales Channel | Online (E-commerce & Brand Webstores) Offline (Consumer Electronics Retail & IT Channels) OEM / Bundled Sales with PCs & Monitors Others |

| By Price Band | Entry-Level (? USD 30) Mid-Range (USD 31–99) Premium (? USD 100) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Home Webcams | 120 | Home Users, Remote Workers |

| Retail Insights on Webcam Sales | 90 | Retail Managers, Electronics Buyers |

| Technological Adoption Trends | 75 | IT Managers, Tech Enthusiasts |

| Market Trends in Online Education | 60 | Educators, E-learning Platform Managers |

| Impact of Social Media on Webcam Usage | 80 | Content Creators, Influencers |

The APAC Home Webcam Market is valued at approximately USD 1.4 billion, driven by increased demand for remote communication tools, online content creation, and video conferencing, particularly during and after the pandemic.