Global Gaming Peripherals Market Overview

- The Global Gaming Peripherals Market is valued at USD 6.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing popularity of eSports, the rise of online gaming, and advancements in wireless and ergonomic technology that enhance user experience. The demand for high-quality peripherals such as keyboards, mice, and headsets has surged as gamers seek to improve their performance and immersion in gaming environments. Additional growth drivers include the proliferation of game streaming platforms, the expansion of cloud gaming, and the integration of customizable features like RGB lighting and advanced sensors, all of which are shaping consumer preferences and driving innovation in the sector .

- Key players in this market include the United States, China, and Germany, which dominate due to their robust gaming communities, technological advancements, and significant investments in gaming infrastructure. North America, particularly the United States, holds the largest market share, while the Asia Pacific region, led by China, is rapidly expanding due to a large and growing gamer population and increased adoption of advanced peripherals. The presence of major gaming companies and a high concentration of gamers in these regions further contribute to their market leadership, making them pivotal in shaping trends and innovations in gaming peripherals .

- The European Union’s Regulation (EU) 2019/1020 on market surveillance and compliance of products, issued by the European Parliament and Council, mandates that gaming peripherals and similar electronic devices meet specific safety, performance, and CE marking requirements before being marketed in the EU. This regulation requires manufacturers to ensure conformity with essential safety standards, maintain technical documentation, and affix CE markings, thereby ensuring consumer protection and promoting fair competition among manufacturers. Compliance with these standards is crucial for companies looking to operate within the EU market .

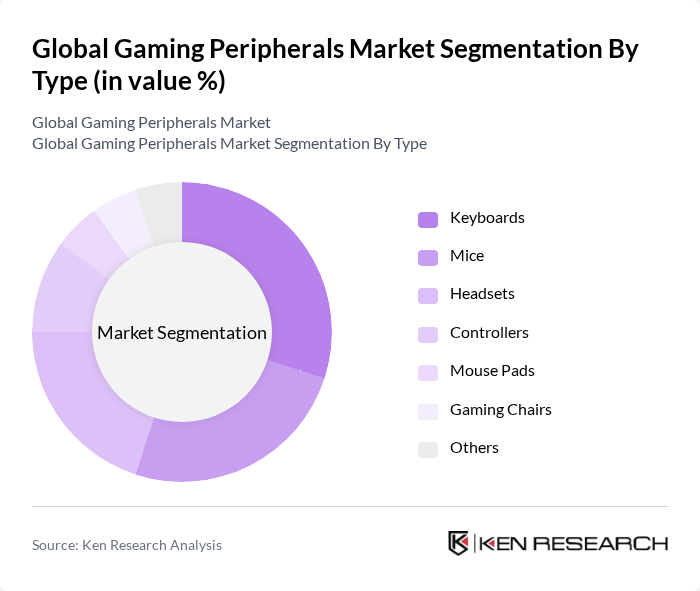

Global Gaming Peripherals Market Segmentation

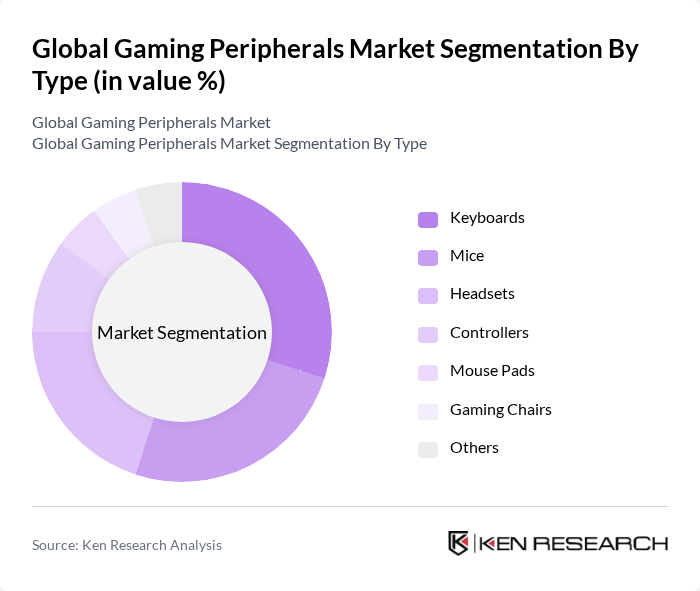

By Type:The gaming peripherals market is segmented into various types, including keyboards, mice, headsets, controllers, mouse pads, gaming chairs, and others. Among these, gaming keyboards and mice are particularly popular due to their essential role in enhancing gameplay and user experience. The demand for high-performance gaming peripherals has led to significant innovation in design and technology, with features such as customizable RGB lighting, ergonomic designs, and advanced sensor technology driving consumer preferences. Headsets also hold a substantial share, driven by the growth of online multiplayer and streaming, where audio quality and communication are critical .

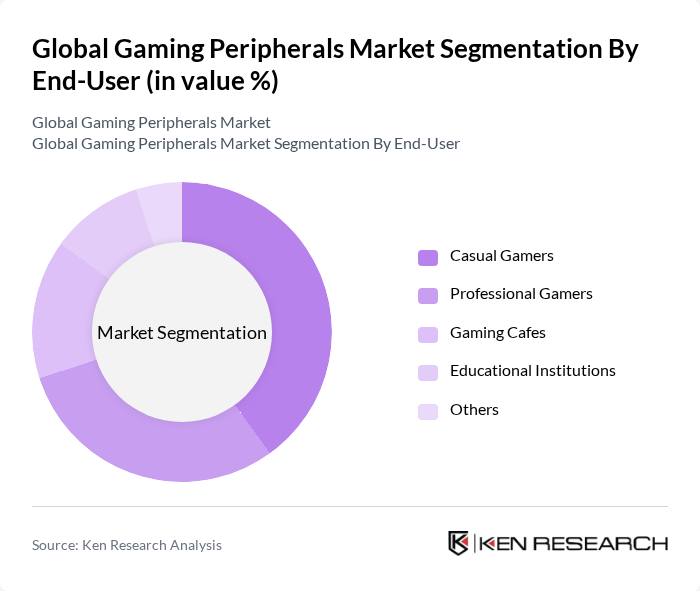

By End-User:The end-user segmentation includes casual gamers, professional gamers, gaming cafes, educational institutions, and others. Casual gamers represent a significant portion of the market, driven by the increasing accessibility of gaming platforms and the growing popularity of mobile and PC gaming. Professional gamers, on the other hand, demand high-quality peripherals that enhance their competitive edge, leading to a surge in demand for specialized equipment tailored to eSports and competitive gaming environments. Gaming cafes and educational institutions are also notable segments, with cafes providing shared access to advanced peripherals and institutions incorporating gaming for educational and extracurricular purposes .

Global Gaming Peripherals Market Competitive Landscape

The Global Gaming Peripherals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Logitech International S.A., Razer Inc., Corsair Gaming, Inc., SteelSeries ApS, HyperX (Kingston Technology Company, Inc.), ASUS Republic of Gamers, MSI (Micro-Star International), AORUS (GIGABYTE Technology Co., Ltd.), Roccat GmbH, Cooler Master Technology Inc., Zowie (BenQ), Alienware (Dell Technologies), Turtle Beach Corporation, Mad Catz Interactive, Inc., Thrustmaster (Guillemot Corporation) contribute to innovation, geographic expansion, and service delivery in this space.

Global Gaming Peripherals Market Industry Analysis

Growth Drivers

- Increasing Popularity of eSports:The eSports industry is projected to generate over $1.5 billion in revenue in future, driven by a global audience of more than 600 million viewers. This surge in viewership is prompting gamers to invest in high-quality peripherals, such as gaming mice and keyboards, to enhance their competitive edge. The rise of professional gaming tournaments and streaming platforms is further fueling demand, as players seek to replicate the experiences of their favorite eSports athletes.

- Rising Disposable Income Among Gamers:According to the World Bank, global GDP per capita is estimated at approximately USD 13,000 in future, indicating increased disposable income for consumers. This economic growth allows gamers to allocate more funds towards premium gaming peripherals. As a result, the market for high-end gaming accessories is expanding, with consumers willing to spend on products that enhance their gaming experience, such as advanced headsets and customizable controllers.

- Technological Advancements in Gaming Peripherals:The gaming peripherals market is witnessing rapid innovation, with advancements in wireless technology and AI integration. For instance, the introduction of low-latency wireless gaming mice and AI-driven gaming headsets is enhancing user experience. The global market for smart gaming peripherals is expected to reach $3 billion in future, driven by consumer demand for cutting-edge technology that improves performance and immersion in gaming environments.

Market Challenges

- High Competition Among Manufacturers:The gaming peripherals market is characterized by intense competition, with over 200 manufacturers vying for market share. This saturation leads to price wars, which can erode profit margins. Companies like Logitech and Razer are constantly innovating to maintain their competitive edge, but the pressure to differentiate products in a crowded market remains a significant challenge, impacting overall profitability and market stability.

- Rapid Technological Changes:The fast-paced nature of technological advancements poses a challenge for manufacturers in the gaming peripherals sector. Companies must continuously invest in research and development to keep up with trends, such as the shift towards wireless and AI-integrated devices. This need for constant innovation can strain resources, as firms must balance the costs of development with the risk of products becoming obsolete quickly in a dynamic market environment.

Global Gaming Peripherals Market Future Outlook

The future of the gaming peripherals market appears promising, driven by ongoing technological advancements and the increasing popularity of immersive gaming experiences. As gamers continue to seek high-quality, customizable products, manufacturers are likely to focus on developing innovative solutions that enhance user engagement. Additionally, the rise of subscription-based gaming services is expected to create new revenue streams, further stimulating market growth and encouraging collaborations with gaming influencers to reach broader audiences.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Latin America, present significant growth opportunities for gaming peripheral manufacturers. With a combined population exceeding 2.5 billion and increasing internet penetration, these regions are witnessing a surge in gaming enthusiasts. Companies can capitalize on this trend by tailoring products to local preferences and price points, potentially increasing market share and revenue.

- Development of Eco-Friendly Gaming Peripherals:As environmental concerns grow, there is a rising demand for eco-friendly gaming peripherals. Manufacturers can explore sustainable materials and production processes to appeal to environmentally conscious consumers. The global market for sustainable electronics is projected to reach $1 trillion in future, indicating a lucrative opportunity for companies that prioritize sustainability in their product offerings, enhancing brand loyalty and market differentiation.