Region:Asia

Author(s):Dev

Product Code:KRAC8823

Pages:85

Published On:November 2025

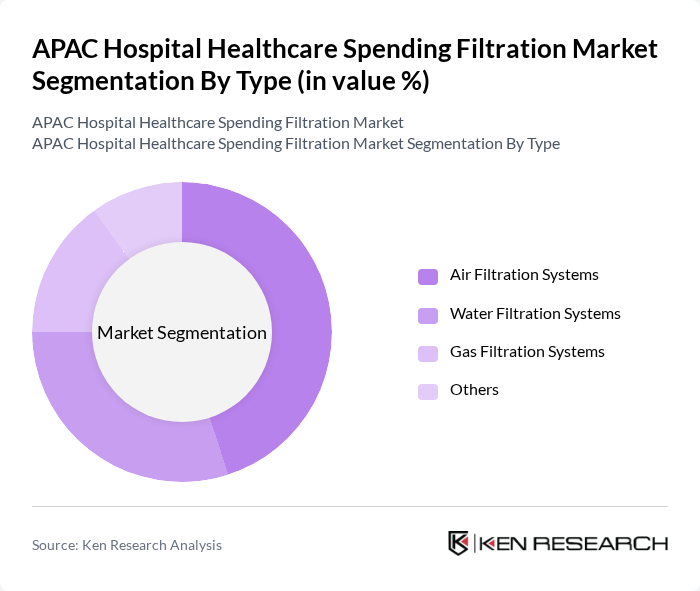

By Type:The filtration market can be segmented into various types, including air filtration systems, water filtration systems, gas filtration systems, and others. Each of these sub-segments plays a crucial role in maintaining the quality of healthcare environments. Air filtration systems are particularly dominant due to their essential function in controlling airborne pathogens and allergens, which is critical in hospital settings.

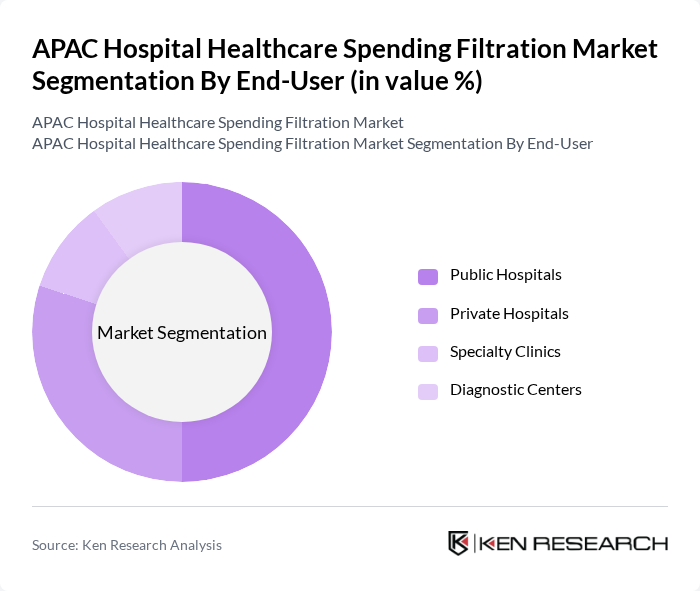

By End-User:The end-user segmentation includes public hospitals, private hospitals, specialty clinics, and diagnostic centers. Public hospitals are the leading segment, driven by government funding and the increasing number of patients seeking healthcare services. The growing focus on public health initiatives and the need for improved healthcare facilities contribute to the dominance of public hospitals in the filtration market. Additionally, the rise of medical tourism and establishment of high-end healthcare facilities to attract international patients accelerates adoption of advanced filtration technologies across both public and private healthcare segments.

The APAC Hospital Healthcare Spending Filtration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Camfil, AAF International (AAF Flanders), Daikin Industries, Ltd., Sharp Corporation, 3M Company, Pall Corporation, Honeywell International Inc., LG Electronics, Hitachi, Ltd., Samsung Electronics, Mitsubishi Electric Corporation, Blue Star Ltd., Eureka Forbes Ltd., Godrej & Boyce Mfg. Co. Ltd., LG Air Conditioning Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC hospital healthcare spending filtration market appears promising, driven by increasing healthcare investments and technological innovations. As governments prioritize healthcare infrastructure, the demand for advanced filtration systems is expected to rise significantly. Additionally, the integration of artificial intelligence and smart technologies into filtration solutions will enhance efficiency and patient safety. These trends indicate a robust growth trajectory, positioning the market for substantial advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Filtration Systems Water Filtration Systems Gas Filtration Systems Others |

| By End-User | Public Hospitals Private Hospitals Specialty Clinics Diagnostic Centers |

| By Region | China India Japan South Korea Southeast Asia (Indonesia, Thailand, Vietnam, Malaysia, Philippines) Australia & New Zealand |

| By Technology | HEPA/ULPA Filtration UVGI (Ultraviolet Germicidal Irradiation) Activated Carbon Filtration Membrane Filtration Plasmacluster/Ionization Others |

| By Application | Operating Rooms ICUs and Isolation Wards Laboratories Emergency Departments General Patient Care Others |

| By Investment Source | Government Funding Private Investments International Aid Public-Private Partnerships |

| By Policy Support | Subsidies for Filtration Systems Tax Incentives Grants for Healthcare Innovations Regulatory Mandates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Expenditure | 120 | Hospital Administrators, Financial Officers |

| Private Hospital Spending Trends | 100 | Procurement Managers, Operations Directors |

| Healthcare Technology Investments | 80 | IT Managers, Chief Technology Officers |

| Pharmaceutical and Medical Supplies Budgeting | 70 | Supply Chain Managers, Pharmacy Directors |

| Patient Care Services Funding | 90 | Clinical Managers, Service Line Directors |

The APAC Hospital Healthcare Spending Filtration Market is valued at approximately USD 2.2 billion, reflecting significant growth driven by increased healthcare expenditures and the rising need for advanced filtration technologies in hospitals across the region.