Region:Asia

Author(s):Dev

Product Code:KRAC4837

Pages:96

Published On:October 2025

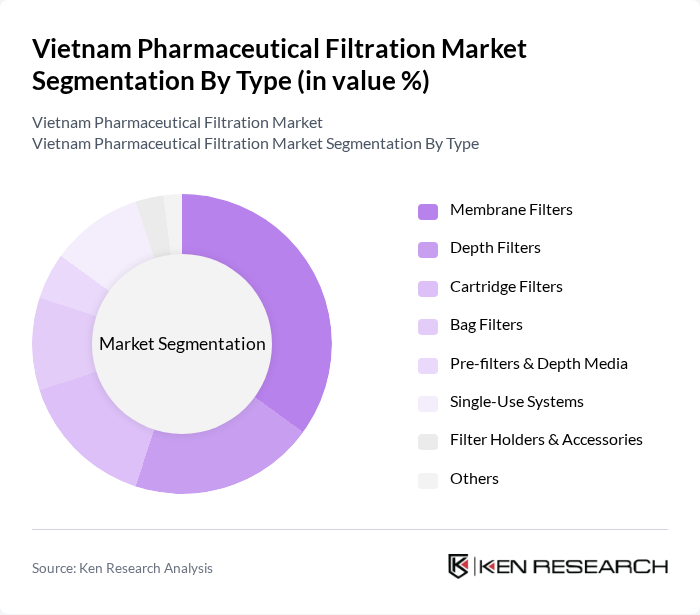

By Type:The market is segmented into various types of filtration solutions, including membrane filters, depth filters, cartridge filters, bag filters, pre-filters & depth media, single-use systems, filter holders & accessories, and others. Among these, membrane filters are gaining traction due to their efficiency in separating particles and microorganisms, making them essential in sterile filtration processes. The increasing adoption of single-use systems is also notable, driven by the need for flexibility and reduced contamination risks in pharmaceutical manufacturing. Microfiltration remains the most preferred technology, with membrane filters accounting for over one-third of pharmaceutical filtration sales in the country .

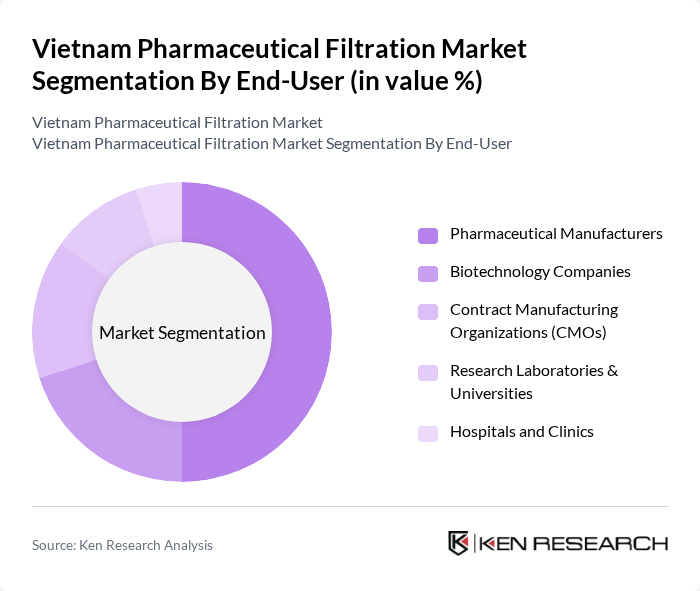

By End-User:The end-user segment includes pharmaceutical manufacturers, biotechnology companies, contract manufacturing organizations (CMOs), research laboratories & universities, and hospitals and clinics. Pharmaceutical manufacturers are the leading end-users, driven by the need for stringent quality control and compliance with regulatory standards. The increasing collaboration between CMOs and pharmaceutical companies is also contributing to the growth of this segment, as it allows for more efficient production processes. Growth in the biotechnology sector and research institutions further supports market expansion .

The Vietnam Pharmaceutical Filtration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Merck KGaA, Pall Corporation (Danaher Corporation), Sartorius AG, 3M Company, GE Healthcare, Parker Hannifin Corporation, Eaton Corporation, Amazon Filters Ltd., Meissner Filtration Products Inc., Graver Technologies, MilliporeSigma (Merck Group), Repligen Corporation, Filtration Group Corporation, Koch Membrane Systems, Donaldson Company, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam pharmaceutical filtration market appears promising, driven by increasing investments in healthcare infrastructure and a growing emphasis on product quality. As the government continues to enhance regulatory frameworks, companies will be compelled to adopt advanced filtration technologies. Additionally, the rise of biopharmaceuticals and contract manufacturing organizations will further stimulate demand for efficient filtration solutions, ensuring that the market remains dynamic and responsive to evolving industry needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Membrane Filters Depth Filters Cartridge Filters Bag Filters Pre-filters & Depth Media Single-Use Systems Filter Holders & Accessories Others |

| By End-User | Pharmaceutical Manufacturers Biotechnology Companies Contract Manufacturing Organizations (CMOs) Research Laboratories & Universities Hospitals and Clinics |

| By Application | Final Product Processing Raw Material Filtration Cell Separation Water Purification Air Purification Sterilization Clarification Aseptic Processing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| By Price Range | Low Price Mid Price High Price |

| By Technology | Microfiltration Ultrafiltration Nanofiltration Crossflow Filtration Conventional Filtration Advanced Filtration Technologies Hybrid Filtration Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | Production Managers, Quality Control Officers |

| Filtration Equipment Suppliers | 60 | Sales Managers, Product Managers |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Research Institutions | 50 | Research Scientists, Lab Managers |

| End-users in Biotechnology | 50 | Process Engineers, R&D Managers |

The Vietnam Pharmaceutical Filtration Market is valued at approximately USD 60 million, reflecting a significant growth trend driven by the increasing demand for high-quality pharmaceutical products and stringent regulatory requirements.