Region:Asia

Author(s):Shubham

Product Code:KRAA8907

Pages:98

Published On:November 2025

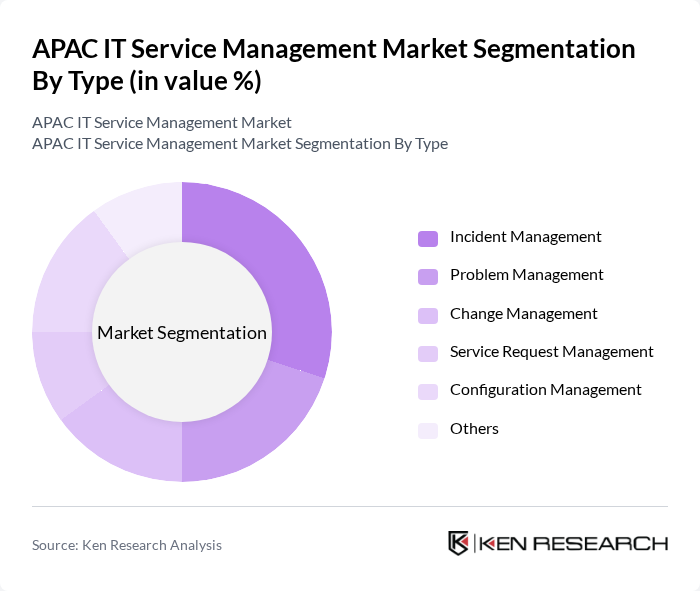

By Type:The market is segmented into various types of IT service management solutions, includingIncident Management, Problem Management, Change Management, Service Request Management, Configuration Management, and Others. Each of these segments plays a crucial role in enhancing IT service delivery and operational efficiency.

TheIncident Managementsegment is currently dominating the market due to its critical role in ensuring minimal disruption to IT services. Organizations are increasingly focusing on rapid incident resolution to maintain service quality and customer satisfaction. The growing complexity of IT environments and the need for effective incident tracking and management solutions are driving the demand for this segment. As a result, Incident Management is expected to maintain its leadership position in the market.

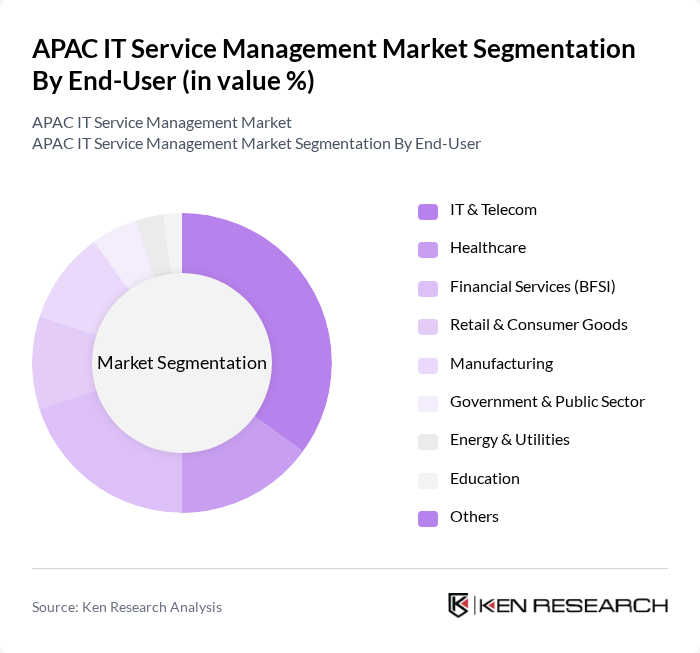

By End-User:The market is segmented based on end-users, includingIT & Telecom, Healthcare, Financial Services (BFSI), Retail & Consumer Goods, Manufacturing, Government & Public Sector, Energy & Utilities, Education, and Others. Each sector has unique requirements and challenges that drive the adoption of IT service management solutions.

TheIT & Telecomsector is the leading end-user of IT service management solutions, driven by the need for efficient service delivery and management of complex IT infrastructures. The rapid growth of digital services and the increasing reliance on technology in this sector necessitate robust IT service management practices. As a result, IT & Telecom is expected to continue dominating the market.

The APAC IT Service Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as ServiceNow, BMC Software, Atlassian, IBM, Micro Focus, Freshservice (Freshworks Inc.), Cherwell Software, ManageEngine (Zoho Corporation), Ivanti, CA Technologies (Broadcom Inc.), Zendesk, SolarWinds, SysAid Technologies, HappyFox, TOPdesk, Axios Systems (IFS AB), HCL Technologies, Fujitsu Limited, Tata Consultancy Services (TCS), Wipro Limited contribute to innovation, geographic expansion, and service delivery in this space.

The APAC IT service management market is poised for transformative growth, driven by technological advancements and evolving business needs. As organizations increasingly adopt ITSM as a Service (ITSMaaS), the focus will shift towards enhancing user experience and integrating ITSM with agile methodologies. Additionally, the rise of artificial intelligence and machine learning will further streamline IT operations, enabling proactive service management. This dynamic landscape will create opportunities for innovative solutions that cater to the unique demands of diverse industries across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Incident Management Problem Management Change Management Service Request Management Configuration Management Others |

| By End-User | IT & Telecom Healthcare Financial Services (BFSI) Retail & Consumer Goods Manufacturing Government & Public Sector Energy & Utilities Education Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Model | Managed Services Professional Services Consulting Services Others |

| By Industry Vertical | IT & Telecom BFSI Healthcare & Lifesciences Manufacturing Retail & Consumer Goods Government & Public Sector Energy & Utilities Education Others |

| By Geographic Region | China Japan India South Korea Australia & New Zealand Southeast Asia Rest of Asia Pacific |

| By Organization Size | Large Enterprises Small & Medium-sized Enterprises (SMEs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services IT Management | 100 | CIOs, IT Managers, Compliance Officers |

| Healthcare IT Service Delivery | 60 | IT Directors, Clinical Informatics Managers |

| Manufacturing IT Operations | 55 | Operations Managers, IT Support Leads |

| Retail IT Service Management | 70 | IT Service Managers, Customer Experience Directors |

| Telecommunications IT Support | 50 | Network Managers, Technical Support Supervisors |

The APAC IT Service Management Market is valued at approximately USD 2.7 billion, driven by the increasing adoption of digital transformation initiatives, cloud computing, and the need for efficient IT operations management.