Region:Middle East

Author(s):Dev

Product Code:KRAB1989

Pages:85

Published On:January 2026

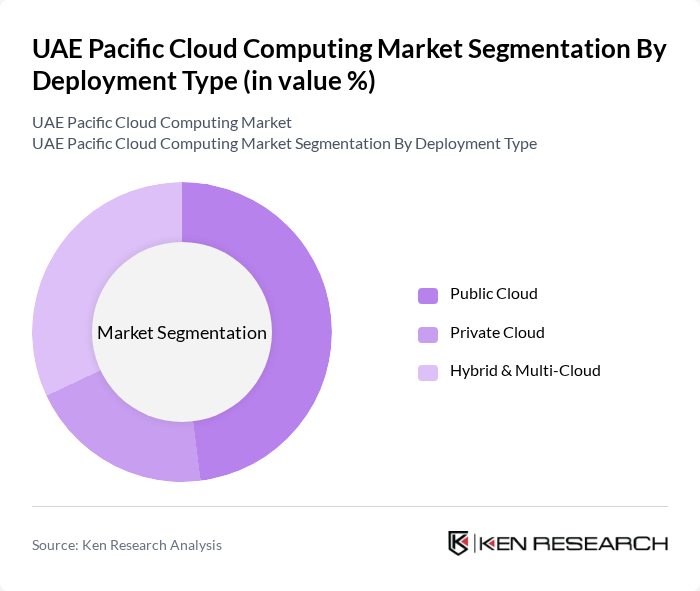

By Deployment Type:The deployment type segmentation includes Public Cloud, Private Cloud, and Hybrid & Multi-Cloud. The Public Cloud segment is gaining traction due to its cost-effectiveness and scalability, particularly as ministries and enterprises shift workloads from on?premises infrastructure to hyperscale platforms. The Private Cloud segment is preferred by organizations requiring enhanced security, data sovereignty, and control, especially in regulated sectors such as government, banking, and healthcare. Hybrid & Multi-Cloud solutions are increasingly popular as they offer flexibility, enable “local data, global scale” architectures, and allow organizations to leverage both public and private cloud resources while meeting residency and compliance requirements.

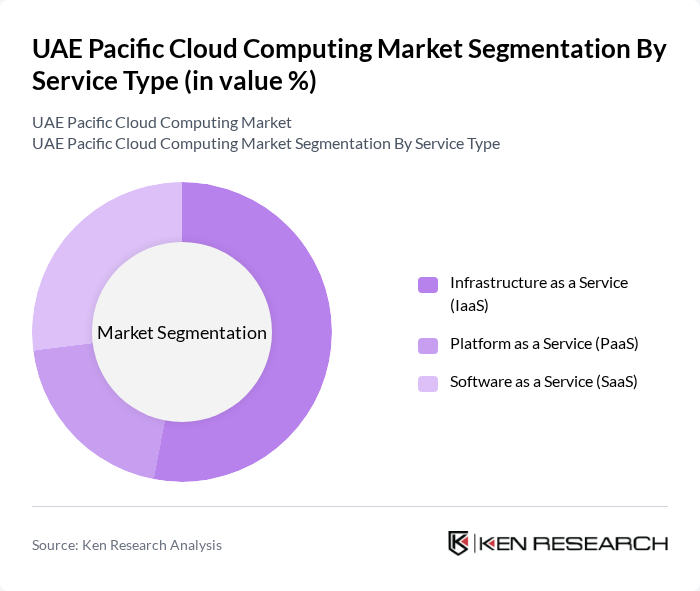

By Service Type:The service type segmentation encompasses Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). IaaS is leading the market due to its ability to provide virtualized computing resources over the internet and support large-scale migrations from legacy data centers. SaaS is popular for its ease of use, subscription-based access, and rapid deployment across functions such as CRM, ERP, and collaboration tools, and it represents one of the largest revenue segments in the UAE cloud market. PaaS is also gaining traction as it allows developers to build, test, and deploy applications without worrying about the underlying infrastructure, supporting AI, analytics, and cloud?native development initiatives.

The UAE Pacific Cloud Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud Infrastructure (OCI), Alibaba Cloud, Huawei Cloud, SAP Cloud, Salesforce, Cisco (Cloud & Security Services), Fujitsu Cloud Services, Rackspace Technology, VMware Cloud, Etisalat by e& (UAE Cloud & Data Center Services), du (Emirates Integrated Telecommunications Company – Cloud Services) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE Pacific cloud computing market is poised for significant growth, driven by technological advancements and increasing digitalization across sectors. As organizations prioritize agility and scalability, the adoption of multi-cloud strategies is expected to rise, enhancing operational efficiency. Furthermore, the emphasis on sustainability will lead to the integration of green computing practices. With government support and a focus on innovation, the market is likely to witness transformative changes, positioning the UAE as a regional leader in cloud computing solutions.

| Segment | Sub-Segments |

|---|---|

| By Deployment Type | Public Cloud Private Cloud Hybrid & Multi-Cloud |

| By Service Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By End User | Banking, Financial Services & Insurance (BFSI) Government & Public Sector IT & Telecom Healthcare Education Retail & E-commerce Others (Real Estate, Manufacturing, Logistics, Energy & Utilities, etc.) |

| By Workload / Use Case | Data Storage & Backup Cloud-native Application Development Analytics, AI & ML Workloads Business Applications (CRM, ERP, Collaboration) Disaster Recovery & Business Continuity |

| By Geography (Within UAE Pacific Focus) | Dubai Abu Dhabi Sharjah & Northern Emirates Rest of UAE |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cloud Adoption | 120 | IT Managers, Chief Technology Officers |

| Healthcare Data Management Solutions | 90 | Healthcare IT Directors, Data Security Officers |

| Education Sector Cloud Integration | 75 | IT Administrators, Educational Technology Coordinators |

| Retail Cloud Services Utilization | 85 | Operations Managers, E-commerce Directors |

| Government Cloud Initiatives | 60 | Public Sector IT Managers, Policy Makers |

The UAE Pacific Cloud Computing Market is valued at approximately USD 13.5 billion, reflecting significant growth driven by digital transformation initiatives and the demand for scalable IT solutions across various sectors.