Region:Asia

Author(s):Dev

Product Code:KRAD5217

Pages:97

Published On:December 2025

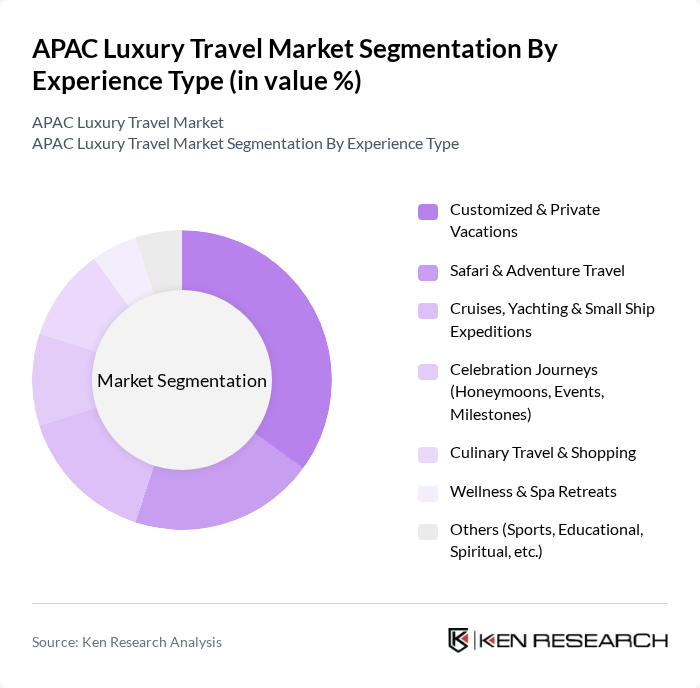

By Experience Type:The experience type segmentation includes various subsegments such as Customized & Private Vacations, Safari & Adventure Travel, Cruises, Yachting & Small Ship Expeditions, Celebration Journeys, Culinary Travel & Shopping, Wellness & Spa Retreats, and Others. Among these, Safari & Adventure Travel dominates the market due to the increasing demand for personalized travel experiences. Travelers are increasingly seeking unique itineraries tailored to their preferences, which has led to a surge in bespoke travel services. This trend is further fueled by the desire for privacy and exclusivity, especially in the post-pandemic era.

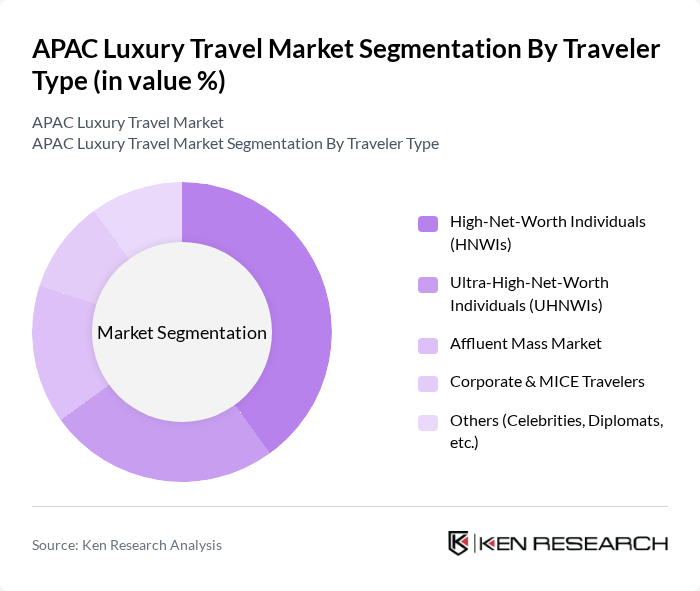

By Traveler Type:The traveler type segmentation encompasses High-Net-Worth Individuals (HNWIs), Ultra-High-Net-Worth Individuals (UHNWIs), Affluent Mass Market, Corporate & MICE Travelers, and Others. The High-Net-Worth Individuals segment is the leading subsegment, driven by their significant spending power and preference for exclusive travel experiences. This group is increasingly investing in luxury travel, seeking unique and personalized itineraries that cater to their specific interests and lifestyles. The rise of experiential travel among affluent consumers has further solidified this segment's dominance in the luxury travel market.

The APAC Luxury Travel Market is characterized by a dynamic mix of regional and international players. Leading participants such as TUI Group, Abercrombie & Kent, Scott Dunn, Lindblad Expeditions Holdings, Inc., Exodus Travels Limited, Butterfield & Robinson, Inc., Geographic Expeditions, Inc. (GeoEx), Travel Edge, Inc. (Navigatr Group), Four Seasons Hotels and Resorts, Aman Resorts, Shangri-La Group (Shangri-La Hotels and Resorts), Banyan Tree Group (Banyan Tree Holdings), The Oberoi Group (Oberoi Hotels & Resorts), Indian Hotels Company Limited (Taj Hotels, Taj Hotels Resorts and Palaces), Mandarin Oriental Hotel Group contribute to innovation, geographic expansion, and service delivery in this space.

The APAC luxury travel market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As travelers increasingly seek sustainable and personalized experiences, luxury brands must adapt to these trends. The integration of artificial intelligence in travel planning is expected to enhance customer engagement, while the rise of wellness tourism will cater to health-conscious travelers. These factors will shape the future landscape of luxury travel, creating new avenues for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Experience Type | Customized & Private Vacations Safari & Adventure Travel Cruises, Yachting & Small Ship Expeditions Celebration Journeys (Honeymoons, Events, Milestones) Culinary Travel & Shopping Wellness & Spa Retreats Others (Sports, Educational, Spiritual, etc.) |

| By Traveler Type | High-Net-Worth Individuals (HNWIs) Ultra-High-Net-Worth Individuals (UHNWIs) Affluent Mass Market Corporate & MICE Travelers Others (Celebrities, Diplomats, etc.) |

| By Country / Sub-region | China Japan South Korea India Australia & New Zealand ASEAN-5 (Singapore, Thailand, Indonesia, Malaysia, Vietnam) Rest of APAC |

| By Travel Style | Fully Independent Travelers (FIT) Small Group & Escorted Tours Family & Multi-generational Travel Couples & Honeymoon Travel Others (Bleisure, Solo Luxury, etc.) |

| By Duration of Stay | Short-Term (1–3 Days) Medium-Term (4–7 Days) Long-Term (8–14 Days) Extended Stays (15+ Days) |

| By Booking Channel | Online Travel Agencies (OTAs) Direct Brand Websites & Apps Luxury Travel Advisors & Tour Operators Corporate Travel Management Companies Others (Concierge Services, GDS, etc.) |

| By Service Type | Luxury Accommodation (Hotels, Resorts, Villas) Premium & Business-Class Transportation Activities & Bespoke Experiences Fine Dining & Gastronomy Ancillary Services (Concierge, Security, Private Guides) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Experiences | 150 | Hotel Managers, Luxury Travel Advisors |

| High-End Travel Packages | 120 | Travel Agency Owners, Tour Operators |

| Affluent Traveler Preferences | 140 | High-Net-Worth Individuals, Frequent Luxury Travelers |

| Luxury Cruise Market Insights | 80 | Cruise Line Executives, Travel Planners |

| Private Jet and Yacht Services | 70 | Private Aviation Executives, Yacht Charter Managers |

The APAC Luxury Travel Market is valued at approximately USD 290 billion, reflecting significant growth driven by increasing disposable incomes and a rising number of high-net-worth individuals seeking unique and personalized travel experiences.