Region:Asia

Author(s):Rebecca

Product Code:KRAC3932

Pages:91

Published On:October 2025

By Type:The luxury travel market can be segmented into Adventure Travel, Cultural Tours, Luxury Cruises, Wellness Retreats, Private Tours, Culinary Experiences, Boutique Hotel Stays, Eco-Luxury Experiences, and Others. Each of these segments caters to different consumer preferences and travel motivations, with a notable trend towards personalized, experiential, and sustainable travel. Adventure and cultural immersion are increasingly popular, while wellness and eco-luxury experiences are gaining traction among high-end travelers seeking meaningful and responsible journeys .

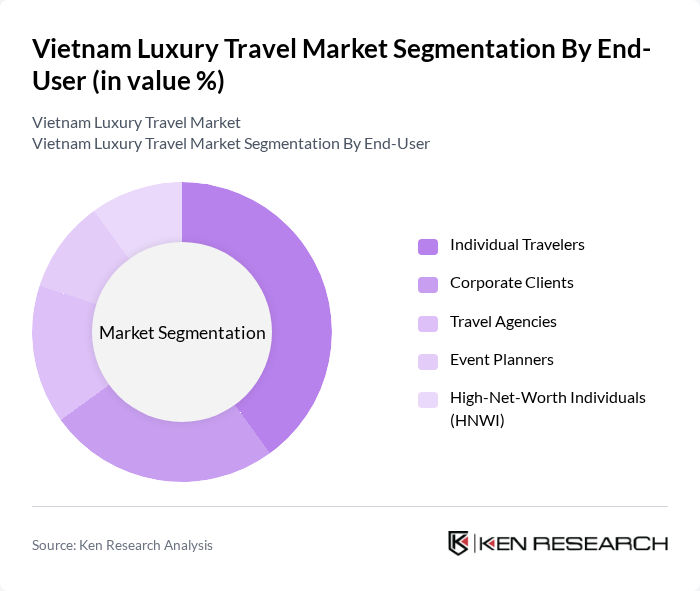

By End-User:The end-user segmentation includes Individual Travelers, Corporate Clients, Travel Agencies, Event Planners, and High-Net-Worth Individuals (HNWI). Each segment has distinct needs and preferences, with a growing trend of corporate clients seeking luxury travel for business events and retreats. High-net-worth individuals and private groups increasingly demand bespoke, high-value experiences, while travel agencies and event planners are focusing on curated, exclusive packages .

The Vietnam Luxury Travel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietravel, Saigontourist, TST Tourist, Exotissimo Travel, Luxury Travel Vietnam (Lux Travel DMC), Indochina Pioneer, Vietnam Travel Group, Buffalo Tours (now part of Discova), Travel Sense Asia, Vietnam Unique Tours, The Luxe Nomad, Journeys Within, Paradise Cruises, Heritage Line, Victoria Voyages contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam luxury travel market is poised for significant growth, driven by rising disposable incomes and an increasing number of international tourists. As travelers seek more personalized and unique experiences, the market will likely adapt to these demands through innovative offerings. Additionally, the government's focus on tourism promotion and infrastructure development will further enhance the attractiveness of Vietnam as a luxury destination. However, addressing economic fluctuations and regional competition will be crucial for sustaining this growth trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Adventure Travel Cultural Tours Luxury Cruises Wellness Retreats Private Tours Culinary Experiences Boutique Hotel Stays Eco-Luxury Experiences Others |

| By End-User | Individual Travelers Corporate Clients Travel Agencies Event Planners High-Net-Worth Individuals (HNWI) |

| By Travel Style | Group Travel Solo Travel Family Travel Couple Travel |

| By Duration | Short Getaways (1-3 days) Medium Stays (4-7 days) Long Vacations (8+ days) |

| By Booking Channel | Online Travel Agencies Direct Bookings Travel Agents Mobile Apps Concierge Services |

| By Price Range | Budget Luxury Mid-Range Luxury High-End Luxury |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Key Destinations (Hanoi, Ho Chi Minh City, Hoi An, Ha Long Bay, Da Nang, Sapa) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Sector | 100 | Hotel Managers, Marketing Directors |

| High-End Travel Agencies | 60 | Travel Consultants, Agency Owners |

| Luxury Tour Operators | 50 | Operations Managers, Product Development Heads |

| Affluent Consumer Insights | 120 | High-Net-Worth Individuals, Luxury Travelers |

| Luxury Experience Providers | 40 | Service Managers, Experience Coordinators |

The Vietnam luxury travel market is valued at approximately USD 3.2 billion, driven by rising disposable incomes, demand for unique travel experiences, and the expansion of luxury accommodations and services.