Region:Asia

Author(s):Shubham

Product Code:KRAA8658

Pages:82

Published On:November 2025

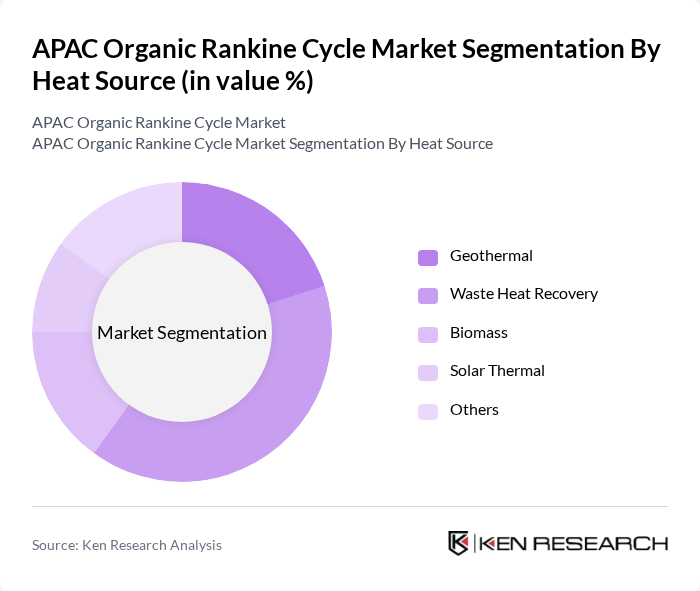

By Heat Source:The heat source segmentation includes Geothermal, Waste Heat Recovery, Biomass, Solar Thermal, and Others. Among these, Waste Heat Recovery is the leading sub-segment due to its ability to utilize excess heat from industrial processes, thereby improving overall energy efficiency. The expanding industrial sector in the APAC region is increasingly adopting waste heat recovery systems to reduce operational costs and achieve sustainability goals .

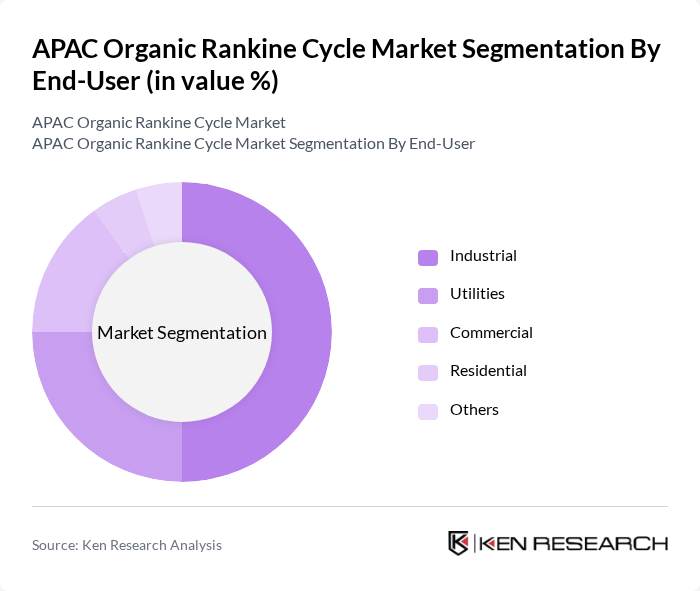

By End-User:The end-user segmentation comprises Industrial, Utilities, Commercial, Residential, and Others. The Industrial segment is the most significant contributor to the market, driven by the need for energy efficiency and cost reduction in manufacturing processes. Industries such as cement, steel, and chemicals are increasingly implementing ORC systems to recover waste heat, thus enhancing their operational efficiency and sustainability .

The APAC Organic Rankine Cycle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, General Electric, Mitsubishi Heavy Industries, Ormat Technologies, Inc., Turboden S.p.A., Enel Green Power, MAN Energy Solutions, Wärtsilä Corporation, Cogen Microsystems, Exergy International S.r.l., Infinity Turbine LLC, Electratherm, Enerkem Inc., Echogen Power Systems, and Climeon AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC Organic Rankine Cycle market appears promising, driven by increasing energy efficiency demands and the integration of digital technologies. As industries seek to optimize energy consumption, ORC systems will play a crucial role in waste heat recovery. Furthermore, the trend towards decentralized energy generation is expected to enhance the adoption of ORC technology, particularly in remote areas. Collaborative efforts between governments and private sectors will likely accelerate innovation and deployment, ensuring a sustainable energy future for the region.

| Segment | Sub-Segments |

|---|---|

| By Heat Source (Geothermal, Waste Heat Recovery, Biomass, Solar Thermal) | Geothermal Waste Heat Recovery Biomass Solar Thermal Others |

| By End-User (Industrial, Utilities, Commercial, Residential) | Industrial Utilities Commercial Residential Others |

| By Region (China, India, Japan, Australia, Southeast Asia, South Korea) | China India Japan Australia Southeast Asia South Korea |

| By Capacity Range (?1 MWe, >1-5 MWe, >5-10 MWe, >10 MWe) | ?1 MWe >1-5 MWe >5-10 MWe >10 MWe |

| By Application (Grid-Connected, Off-Grid, Distributed Energy, Utility-Scale) | Grid-Connected Off-Grid Distributed Energy Utility-Scale Others |

| By Investment Source (Government, Private Sector, PPP, FDI) | Government Private Sector PPP FDI Others |

| By Policy Support (Subsidies, Tax Incentives, RECs, Feed-in Tariffs) | Subsidies Tax Incentives RECs Feed-in Tariffs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Waste Heat Recovery Projects | 60 | Project Engineers, Facility Managers |

| Geothermal Energy Applications | 50 | Geologists, Energy Analysts |

| Industrial ORC Installations | 40 | Operations Managers, Energy Efficiency Consultants |

| Research & Development in ORC Technology | 40 | R&D Managers, University Researchers |

| Government Policy Makers on Renewable Energy | 40 | Policy Advisors, Regulatory Officials |

The APAC Organic Rankine Cycle market is valued at approximately USD 345 million, driven by the increasing demand for renewable energy sources and efficient waste heat recovery systems across various industries in the region.