Region:Middle East

Author(s):Rebecca

Product Code:KRAC9877

Pages:84

Published On:November 2025

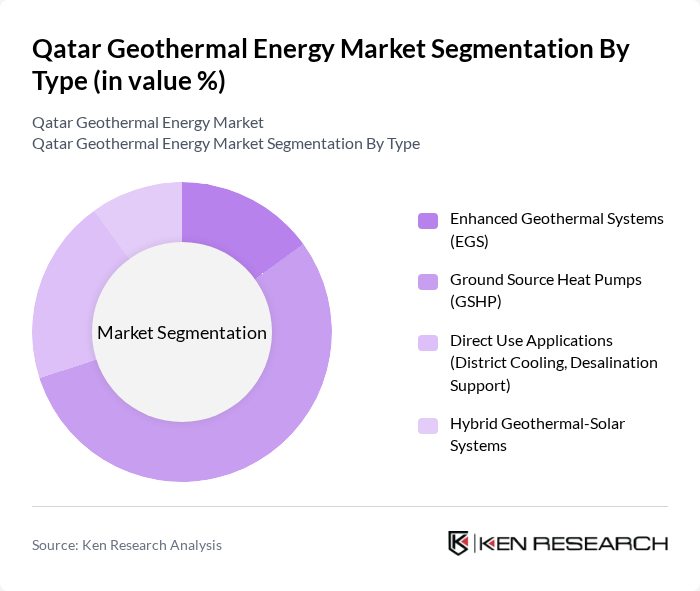

By Type:The market is segmented into Enhanced Geothermal Systems (EGS), Ground Source Heat Pumps (GSHP), Direct Use Applications (District Cooling, Desalination Support), and Hybrid Geothermal-Solar Systems. Ground Source Heat Pumps are the most widely adopted geothermal technology in Qatar, particularly for residential and commercial heating and cooling, due to their compatibility with the local subsurface and GSAS incentives. Direct Use Applications are increasingly utilized for district cooling in urban developments and for supporting desalination, which is critical in Qatar’s arid climate. Enhanced Geothermal Systems remain in the pilot phase, with limited deployment due to geological constraints. Hybrid geothermal-solar systems are emerging as innovative solutions for energy efficiency in smart cities and institutional campuses .

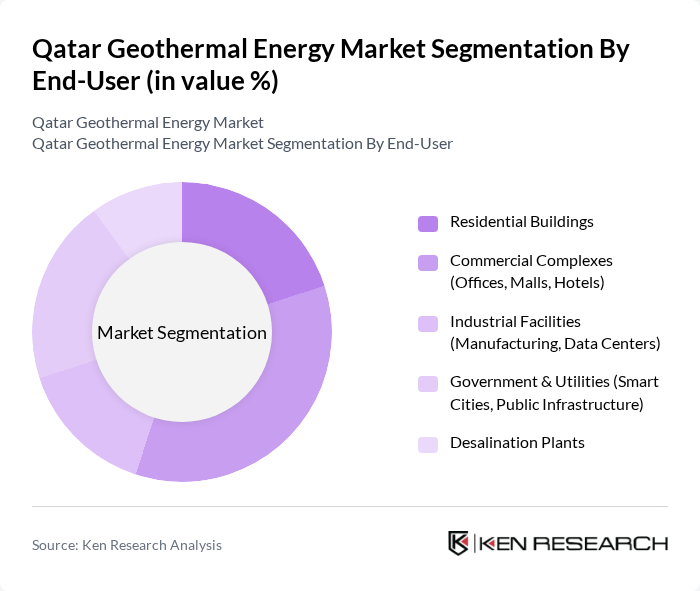

By End-User:The end-user segmentation includes Residential Buildings, Commercial Complexes (Offices, Malls, Hotels), Industrial Facilities (Manufacturing, Data Centers), Government & Utilities (Smart Cities, Public Infrastructure), and Desalination Plants. Commercial complexes and government/institutional buildings are the primary adopters of geothermal solutions, leveraging ground source heat pumps and direct use systems for energy efficiency and compliance with sustainability standards. Residential uptake is growing, particularly in new developments with GSAS certification. Industrial facilities and desalination plants are exploring geothermal integration to reduce operational costs and support sustainability goals .

The Qatar Geothermal Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kahramaa (Qatar General Electricity and Water Corporation), QatarEnergy (formerly Qatar Petroleum), Qatar Green Building Council, Qatar Foundation, Marubeni Corporation (Qatar District Cooling/Geothermal Projects), Veolia Qatar (Geothermal and District Cooling Solutions), ENGIE Qatar (Renewable Energy and Geothermal Initiatives), TAQA Geothermal Energy Company (Regional Projects), Qatar National Research Fund (QNRF), Qatar University, Qatar Development Bank, Lusail Real Estate Development Company, Qatar Cool (District Cooling Integrator), Gulf Organisation for Research & Development (GORD), Qatar Investment Authority contribute to innovation, geographic expansion, and service delivery in this space.

The future of the geothermal energy market in Qatar appears promising, driven by increasing investments in renewable energy and a strong governmental push towards sustainability. As the country aims to diversify its energy portfolio, geothermal energy is expected to play a crucial role in meeting future energy demands. Additionally, the integration of smart grid technologies and energy efficiency measures will enhance the operational capabilities of geothermal systems, making them more competitive against other renewable sources in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Enhanced Geothermal Systems (EGS) Ground Source Heat Pumps (GSHP) Direct Use Applications (District Cooling, Desalination Support) Hybrid Geothermal-Solar Systems |

| By End-User | Residential Buildings Commercial Complexes (Offices, Malls, Hotels) Industrial Facilities (Manufacturing, Data Centers) Government & Utilities (Smart Cities, Public Infrastructure) Desalination Plants |

| By Region | Doha Al Rayyan Al Wakrah Lusail Others |

| By Technology | Binary Cycle Power Plants Flash Steam Power Plants Dry Steam Power Plants Direct-Use Heat Exchange Systems Others |

| By Application | Electricity Generation District Heating & Cooling Desalination Support Industrial Process Heating Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) GSAS/LEED Certification Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Energy Policy Makers | 45 | Energy Ministers, Regulatory Authorities |

| Geothermal Project Developers | 40 | Project Managers, Technical Directors |

| Energy Consultants and Analysts | 30 | Market Analysts, Energy Consultants |

| Academic Researchers in Renewable Energy | 20 | University Professors, Research Scientists |

| Utility Companies and Energy Providers | 35 | Operations Managers, Strategic Planners |

The Qatar Geothermal Energy Market is valued at approximately USD 25 million, reflecting its early-stage development primarily driven by pilot projects and district cooling applications rather than large-scale power generation.