Region:Asia

Author(s):Shubham

Product Code:KRAD6709

Pages:95

Published On:December 2025

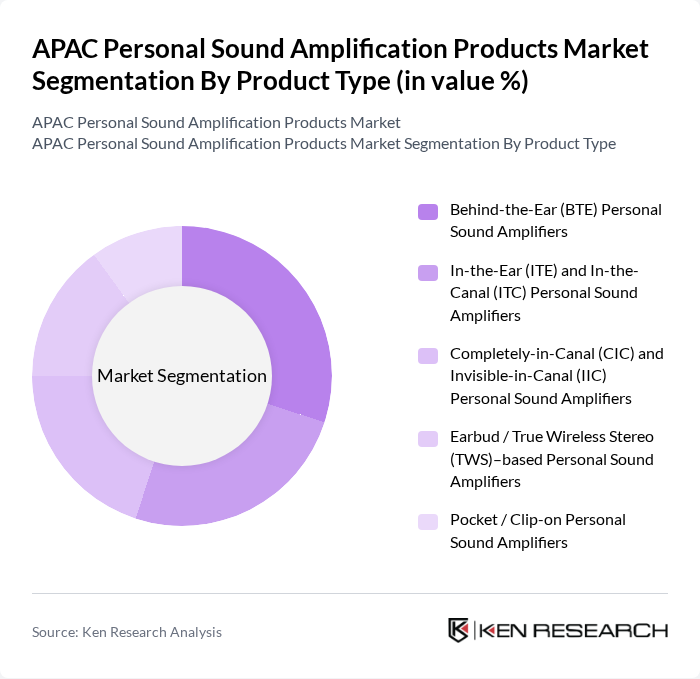

By Product Type:The product type segmentation includes various categories of personal sound amplification products, each catering to different consumer preferences and needs. The Behind-the-Ear (BTE) amplifiers are popular due to their comfort and ease of use, while In-the-Ear (ITE) and In-the-Canal (ITC) amplifiers are favored for their discreetness. Completely-in-Canal (CIC) and Invisible-in-Canal (IIC) amplifiers appeal to users seeking maximum invisibility. Earbud/True Wireless Stereo (TWS) amplifiers are gaining traction among younger consumers, while Pocket/Clip-on amplifiers are preferred for their portability and convenience.

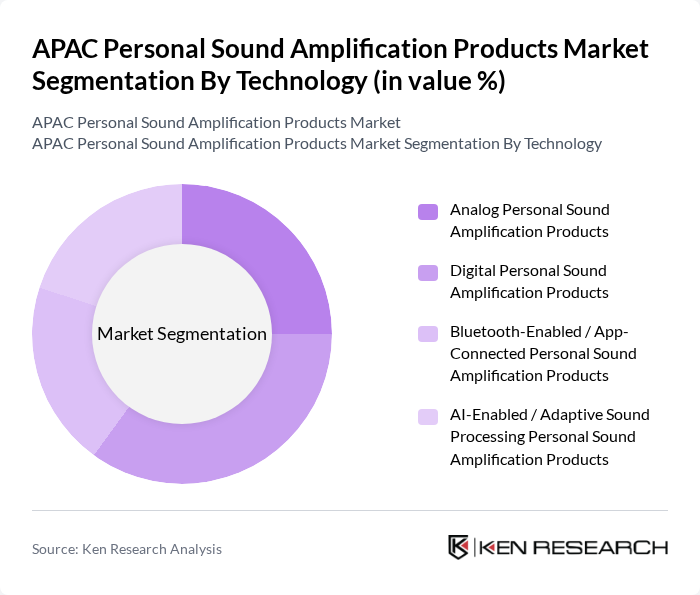

By Technology:The technology segmentation highlights the various types of sound amplification technologies available in the market. Analog personal sound amplification products are still in demand due to their simplicity and lower cost. However, digital personal sound amplification products are gaining popularity for their superior sound quality and customization options. Bluetooth-enabled/app-connected products are increasingly sought after for their convenience and connectivity features, while AI-enabled/adaptive sound processing products are emerging as the latest trend, offering advanced features that enhance user experience.

The APAC Personal Sound Amplification Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sonova Holding AG, GN Store Nord A/S, WS Audiology A/S, Demant A/S, Starkey Hearing Technologies, William Demant (Bernafon / Oticon Brands in APAC), Sound World Solutions, Inc., Etymotic Research, Inc., Williams Sound, LLC, Bellman & Symfon AB, MERRY ELECTRONICS Co., Ltd., Tinteo SAS, Sonic Technology Products, Inc., Bose Corporation, Sony Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The APAC personal sound amplification products market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As manufacturers increasingly focus on integrating artificial intelligence and machine learning into their products, personalized sound experiences will become more prevalent. Additionally, the rise of e-commerce platforms is expected to enhance product accessibility, allowing consumers to explore a wider range of options conveniently. These trends indicate a dynamic market landscape that will adapt to meet the diverse needs of consumers in the region.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Behind-the-Ear (BTE) Personal Sound Amplifiers In-the-Ear (ITE) and In-the-Canal (ITC) Personal Sound Amplifiers Completely-in-Canal (CIC) and Invisible-in-Canal (IIC) Personal Sound Amplifiers Earbud / True Wireless Stereo (TWS)–based Personal Sound Amplifiers Pocket / Clip-on Personal Sound Amplifiers |

| By Technology | Analog Personal Sound Amplification Products Digital Personal Sound Amplification Products Bluetooth-Enabled / App-Connected Personal Sound Amplification Products AI-Enabled / Adaptive Sound Processing Personal Sound Amplification Products |

| By End-User | Adults (19–64 Years) Geriatric Population (65+ Years) Teenagers and Young Adults (13–18 Years) Others |

| By Application | Personal Listening and Everyday Communication TV, Cinema, and Home Entertainment Outdoor and Recreational Activities Professional and Occupational Use |

| By Distribution Channel | Online Marketplaces and Brand E-commerce Pharmacies and Opticals Consumer Electronics and Specialty Retail Stores Hospital, ENT Clinics, and Hearing Centers Others |

| By Price Range | Entry-Level (Below USD 100) Mid-Range (USD 100–299) Premium (USD 300 and Above) Subscription / Rental-Based Offerings |

| By Country (APAC) | China Japan India South Korea Australia & New Zealand Southeast Asia (Indonesia, Thailand, Malaysia, Vietnam, Philippines, Others) Rest of Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| End-User Feedback on Personal Sound Amplification | 150 | Individuals aged 50+, Hearing Impairment Patients |

| Healthcare Professional Insights | 120 | Audiologists, ENT Specialists |

| Retailer Perspectives on Market Trends | 90 | Store Managers, Product Buyers |

| Caregiver Experiences with Sound Amplification Products | 70 | Family Caregivers, Home Health Aides |

| Market Trends from Industry Experts | 60 | Market Analysts, Product Developers |

The APAC Personal Sound Amplification Products Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the increasing prevalence of hearing loss among the aging population and rising awareness of these products as alternatives to traditional hearing aids.