Region:Middle East

Author(s):Shubham

Product Code:KRAA8560

Pages:81

Published On:November 2025

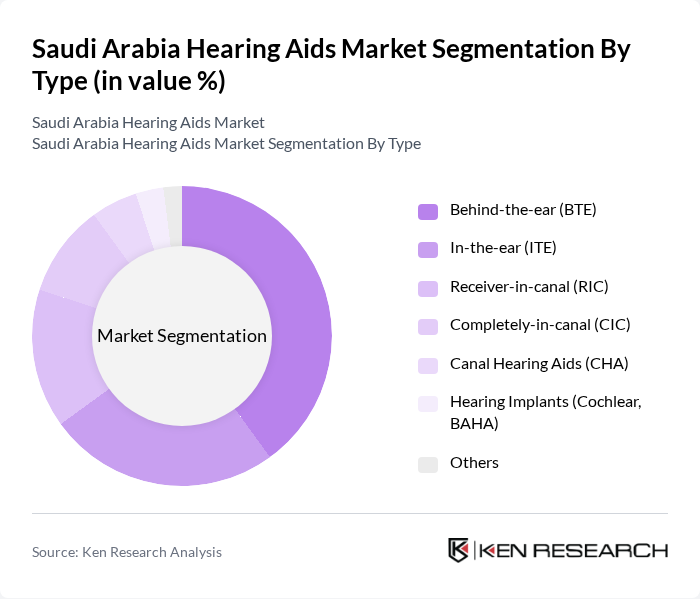

By Type:The market can be segmented into various types of hearing aids, including Behind-the-ear (BTE), In-the-ear (ITE), Receiver-in-canal (RIC), Completely-in-canal (CIC), Canal Hearing Aids (CHA), Hearing Implants (Cochlear, BAHA), and Others. Among these, the Behind-the-ear (BTE) segment is the most dominant due to its versatility, comfort, and suitability for a wide range of hearing loss levels. BTE devices are particularly favored by older adults, who represent a significant portion of the hearing-impaired population in Saudi Arabia. The market is also witnessing increased adoption of discreet and AI-powered devices, reflecting consumer preference for advanced technology and user comfort .

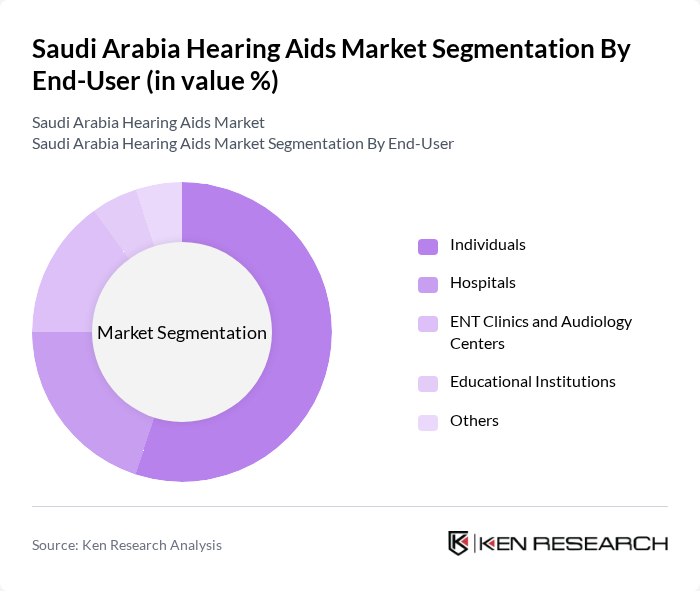

By End-User:The end-user segmentation includes Individuals, Hospitals, ENT Clinics and Audiology Centers, Educational Institutions, and Others. The Individuals segment holds the largest share, driven by the increasing number of people seeking personal hearing solutions. Hospitals and ENT clinics also play a crucial role in the market, providing professional services and fitting for hearing aids, which further supports the growth of the overall market. Outpatient facilities, including audiology centers, are the most lucrative end-use segment, reflecting the shift toward specialized hearing care and accessibility .

The Saudi Arabia Hearing Aids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sonova Holding AG, Demant A/S, GN Store Nord A/S (ReSound), Cochlear Limited, Starkey Hearing Technologies, Amplifon S.p.A., WS Audiology (Widex, Signia), RION Co., Ltd., Microson, Batterjee & Bros. Co., Arab Tone, Eargo, Inc., Rexton, Hear.com, Audicus contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia hearing aids market is poised for significant transformation, driven by technological advancements and demographic shifts. As the population ages and awareness of hearing health increases, demand for innovative and affordable solutions will rise. The integration of telehealth services is expected to enhance accessibility, particularly in rural areas. Additionally, partnerships with healthcare providers will facilitate better distribution and education about hearing aids, ultimately improving market penetration and user acceptance in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Behind-the-ear (BTE) In-the-ear (ITE) Receiver-in-canal (RIC) Completely-in-canal (CIC) Canal Hearing Aids (CHA) Hearing Implants (Cochlear, BAHA) Others |

| By End-User | Individuals Hospitals ENT Clinics and Audiology Centers Educational Institutions Others |

| By Distribution Channel | Government Private Online Retail Offline Retail Audiology Clinics Hospitals Others |

| By Age Group | Pediatric Adult Senior Others |

| By Technology | Analog Hearing Aids Digital Hearing Aids Smart Hearing Aids (AI-powered, Bluetooth-enabled) Rechargeable Hearing Aids Others |

| By Price Range | Budget Mid-range Premium Others |

| By Brand Preference | Local Brands International Brands Others |

| By Type of Hearing Loss | Sensorineural Hearing Loss Conductive Hearing Loss Mixed Hearing Loss |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hearing Aid Users | 100 | Patients aged 50+, Audiology Patients |

| Audiologists and Hearing Care Professionals | 60 | Audiologists, Hearing Aid Dispensers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Policy Advisors |

| Family Members of Hearing Impaired | 50 | Caregivers, Family Members of Patients |

| Hearing Aid Retailers | 40 | Retail Managers, Sales Representatives |

The Saudi Arabia Hearing Aids Market is valued at approximately USD 70 million, driven by factors such as an aging population, increased awareness of hearing health, and advancements in hearing aid technology.