Region:Asia

Author(s):Shubham

Product Code:KRAC3570

Pages:87

Published On:October 2025

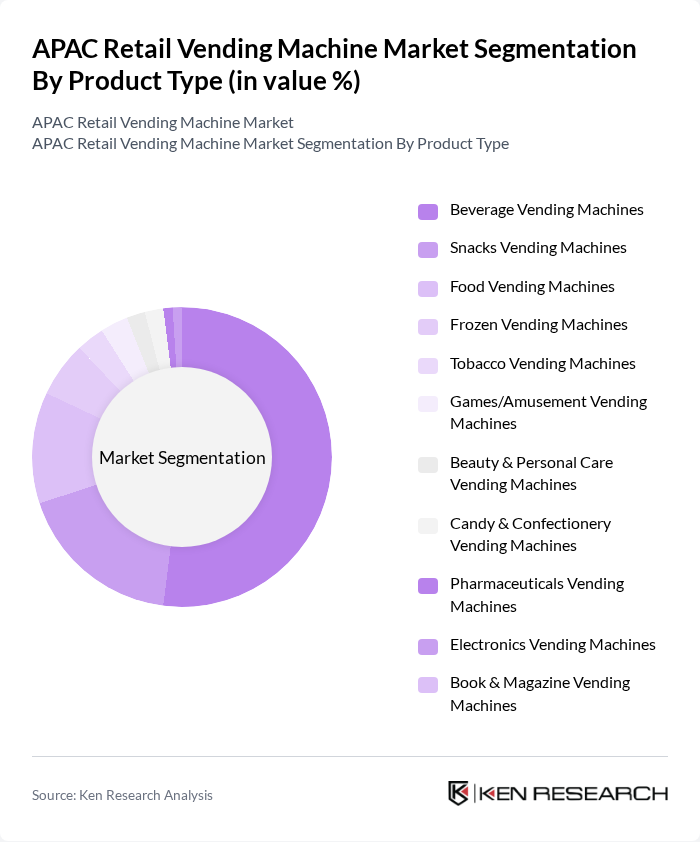

By Product Type:The product type segmentation includes various categories of vending machines that cater to different consumer needs. The subsegments are Beverage Vending Machines, Snacks Vending Machines, Food Vending Machines, Frozen Vending Machines, Tobacco Vending Machines, Games/Amusement Vending Machines, Beauty & Personal Care Vending Machines, Candy & Confectionery Vending Machines, Pharmaceuticals Vending Machines, Electronics Vending Machines, and Book & Magazine Vending Machines. Among these, Beverage Vending Machines are the most dominant due to the high demand for on-the-go refreshments.

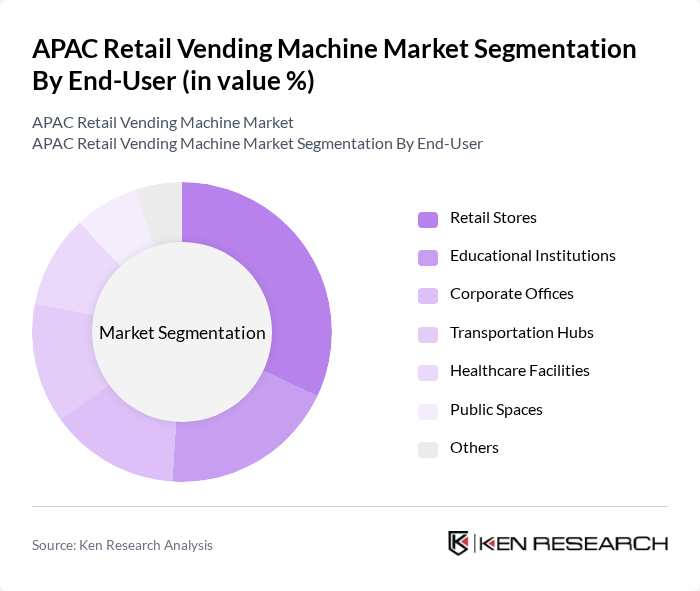

By End-User:The end-user segmentation encompasses various sectors that utilize vending machines, including Retail Stores, Educational Institutions, Corporate Offices, Transportation Hubs, Healthcare Facilities, Public Spaces, and Others. Retail Stores are the leading end-user segment, driven by the need for quick service and convenience in shopping environments.

The APAC Retail Vending Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Crane Merchandising Systems, Fuji Electric Co., Ltd., Sanden Holdings Corporation, Azkoyen Group, Royal Vendors, Inc., Selecta Group, Westomatic Vending Services Ltd., Glory Global Solutions, Seaga Manufacturing Inc., Cantaloupe Inc., Sellmat S.r.l., Express Vending Ltd., Aucma Co., Ltd., Bianchi Vending Group, Vendon SIA contribute to innovation, geographic expansion, and service delivery in this space .

The APAC retail vending machine market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As urbanization continues to rise, the demand for convenient retail solutions will likely increase. Furthermore, the integration of smart technologies and contactless payment systems will enhance user experiences, making vending machines more appealing. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Beverage Vending Machines Snacks Vending Machines Food Vending Machines Frozen Vending Machines Tobacco Vending Machines Games/Amusement Vending Machines Beauty & Personal Care Vending Machines Candy & Confectionery Vending Machines Pharmaceuticals Vending Machines Electronics Vending Machines Book & Magazine Vending Machines |

| By End-User | Retail Stores Educational Institutions Corporate Offices Transportation Hubs Healthcare Facilities Public Spaces Others |

| By Region | China Japan South Korea India Southeast Asia Oceania Others |

| By Application | Food and Beverages Personal Care Products Electronics Tickets and Services Others |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Partnerships Others |

| By Distribution Mode | On-Premise Off-Premise Mobile Vending Others |

| By Price Range | Low-End Vending Machines Mid-Range Vending Machines High-End Vending Machines Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vending Machine Operators | 150 | Operations Managers, Business Development Executives |

| Retail Store Managers | 100 | Store Managers, Retail Operations Directors |

| Consumer Insights | 150 | Frequent Vending Machine Users, General Consumers |

| Manufacturers of Vending Machines | 80 | Product Managers, Sales Directors |

| Distributors and Suppliers | 70 | Supply Chain Managers, Procurement Officers |

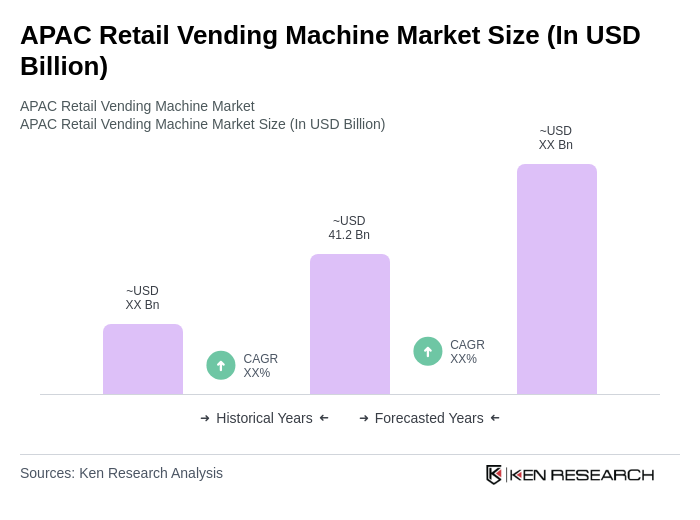

The APAC Retail Vending Machine Market is valued at approximately USD 41.2 billion, reflecting significant growth driven by increasing demand for convenience, automation, and smart technologies in retail environments.