Region:Middle East

Author(s):Shubham

Product Code:KRAA8546

Pages:90

Published On:November 2025

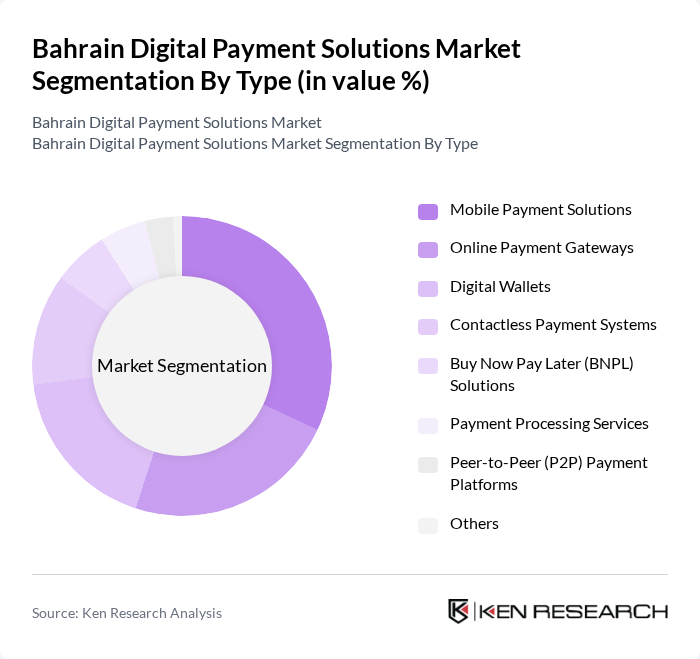

By Type:The market is segmented into various types of digital payment solutions, including Mobile Payment Solutions, Online Payment Gateways, Digital Wallets, Contactless Payment Systems, Buy Now Pay Later (BNPL) Solutions, Payment Processing Services, Peer-to-Peer (P2P) Payment Platforms, and Others. Each of these subsegments plays a crucial role in catering to the diverse needs of consumers and businesses in Bahrain .

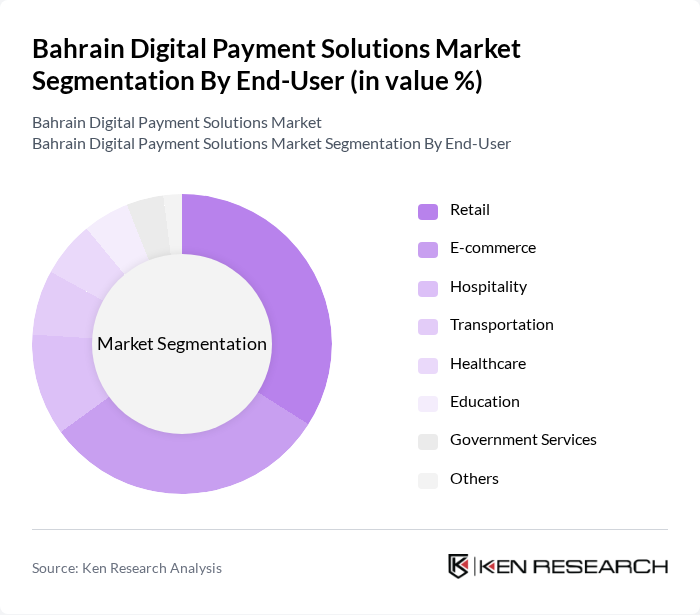

By End-User:The end-user segmentation includes Retail, E-commerce, Hospitality, Transportation, Healthcare, Education, Government Services, and Others. Each segment reflects the growing reliance on digital payment solutions across various sectors, driven by the need for efficiency, enhanced customer experiences, and the expansion of online and mobile commerce .

The Bahrain Digital Payment Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as BenefitPay, Tap Payments, Bahrain FinTech Bay, The BENEFIT Company, Zain Cash Bahrain, stc pay Bahrain, PayTabs Bahrain, CrediMax, Mastercard, Visa, Gulf International Bank (GIB), Bank of Bahrain and Kuwait (BBK), National Bank of Bahrain (NBB), Al Baraka Islamic Bank, Arab Banking Corporation (Bank ABC), Tamara, Postpay, TelyPay contribute to innovation, geographic expansion, and service delivery in this space.

The future of Bahrain's digital payment solutions market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance transaction security and user experience. Additionally, the growing trend of contactless payments and mobile wallets will likely reshape consumer behavior, making digital transactions more convenient. As regulatory frameworks evolve, they will further support innovation and competition, fostering a dynamic market landscape that encourages growth and investment.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Payment Solutions Online Payment Gateways Digital Wallets Contactless Payment Systems Buy Now Pay Later (BNPL) Solutions Payment Processing Services Peer-to-Peer (P2P) Payment Platforms Others |

| By End-User | Retail E-commerce Hospitality Transportation Healthcare Education Government Services Others |

| By Industry | Financial Services Healthcare Education Entertainment Telecommunications Travel & Tourism Utilities Others |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments QR Code Payments Contactless/NFC Payments Others |

| By Transaction Size | Micro Transactions (Below BHD 10) Small Transactions (BHD 10–100) Medium Transactions (BHD 101–1,000) Large Transactions (Above BHD 1,000) Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Government Entities Expatriates Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Fintech Sandbox Participation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Payment Usage | 100 | Individual Users, Mobile Wallet Users |

| SME Adoption of Digital Payments | 70 | Business Owners, Financial Managers |

| Corporate Payment Solutions | 50 | Finance Directors, IT Managers |

| Regulatory Perspectives on Digital Payments | 40 | Regulatory Officials, Compliance Officers |

| Fintech Innovation Insights | 60 | Product Managers, Technology Officers |

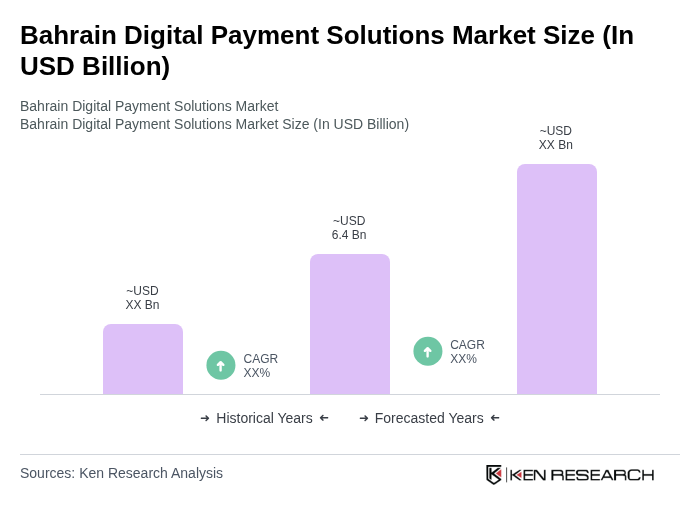

The Bahrain Digital Payment Solutions Market is valued at approximately USD 6.4 billion, reflecting significant growth driven by the increasing adoption of digital payment methods, e-commerce, and mobile banking.