Region:Asia

Author(s):Rebecca

Product Code:KRAC3207

Pages:96

Published On:October 2025

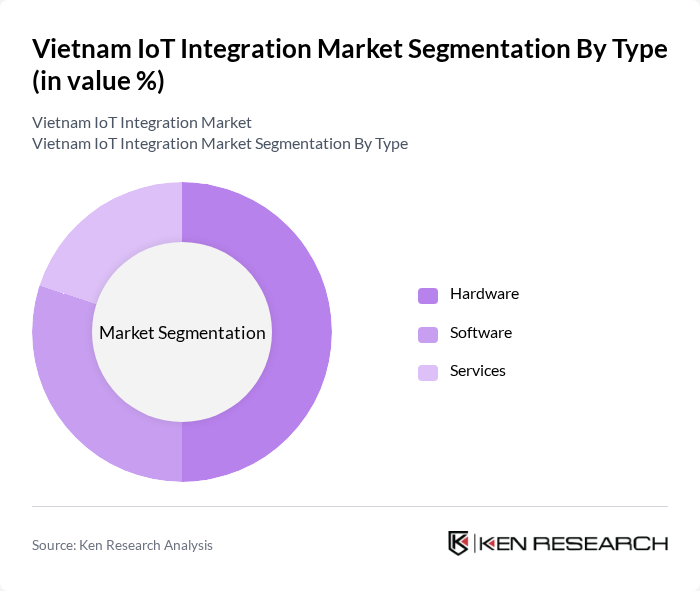

By Type:The market is segmented into Hardware, Software, and Services. Among these, the Hardware segment is currently leading due to the increasing demand for IoT devices such as sensors, connectivity modules, and edge computing hardware. The proliferation of smart devices in homes and industries has significantly contributed to the growth of this segment, with IoT device adoption in Vietnam rising substantially from 21 million devices in 2018 to approximately 96 million by 2025. Software solutions are also gaining traction as businesses seek to leverage data analytics, cloud computing, and AI-driven solutions for quality control, defect detection, and process optimization in manufacturing environments.

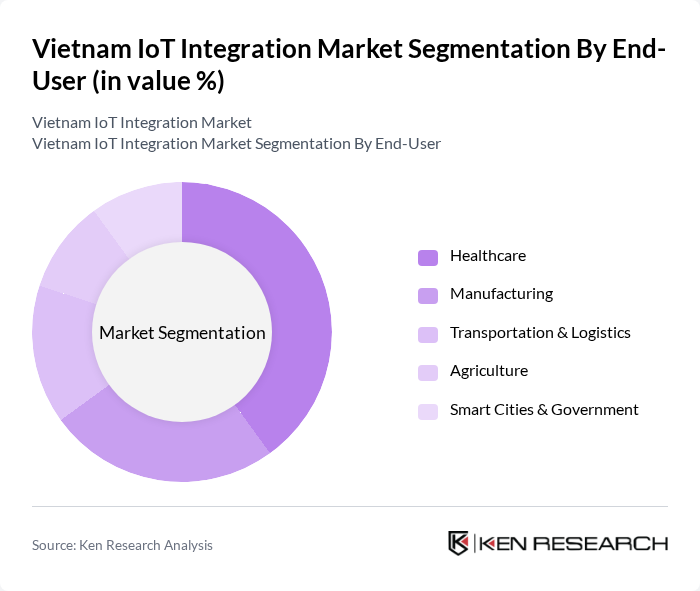

By End-User:The market is categorized into Healthcare, Manufacturing, Transportation & Logistics, Agriculture, and Smart Cities & Government. The Manufacturing sector has emerged as a significant end-user, driven by the Vietnamese manufacturing industry's unprecedented digital transformation underpinned by large-scale Industry 4.0 programs and government policy initiatives. Manufacturing organizations are increasingly adopting smart factory solutions, automation systems, connected sensors, machine-to-machine connectivity, and real-time monitoring systems to streamline production processes, minimize downtime, and enhance product quality. The Healthcare sector continues to show strong growth due to the increasing need for remote patient monitoring and telemedicine solutions, with IoT applications being extensively utilized for digitalization of the banking sector and fintech development as well.

The Vietnam IoT Integration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Group, FPT Corporation, CMC Corporation, VNPT Technology, Bosch Vietnam, Siemens Vietnam, Schneider Electric Vietnam, Huawei Technologies Vietnam, Intel Vietnam, Microsoft Vietnam, IBM Vietnam, Cisco Systems Vietnam, SAP Vietnam, Oracle Vietnam, Hitachi Vantara Vietnam, Advantech Vietnam, VinSmart (Vingroup), Rikkeisoft, MobiFone Corporation, Viettel Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam IoT integration market appears promising, driven by technological advancements and increasing investments in infrastructure. As the government continues to prioritize digital transformation, the integration of IoT with emerging technologies like AI and 5G will enhance operational efficiencies across various sectors. Furthermore, the growing emphasis on sustainability will likely lead to innovative IoT applications that address environmental challenges, positioning Vietnam as a competitive player in the global IoT landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Software Services |

| By End-User | Healthcare Manufacturing Transportation & Logistics Agriculture Smart Cities & Government |

| By Application | Smart Home & Building Automation Industrial IoT (IIoT) Smart Cities Connected Vehicles & Fleet Management Energy Management Healthcare Monitoring & Telemedicine |

| By Component | Sensors (e.g., pressure, temperature, motion) Connectivity Modules (Wi-Fi, LPWAN, 5G, NB-IoT) Cloud Platforms & Edge Computing Gateways & Controllers |

| By Sales Channel | Direct Sales Distributors & System Integrators Online Sales & E-commerce Platforms |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Others | Niche Applications (e.g., smart agriculture, environmental monitoring) Emerging Technologies (AIoT, blockchain integration) Custom Solutions & System Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing IoT Solutions | 100 | Plant Managers, Operations Directors |

| Agricultural IoT Applications | 60 | Agronomists, Farm Managers |

| Smart City Initiatives | 50 | Urban Planners, City Officials |

| Healthcare IoT Devices | 70 | Healthcare Administrators, IT Managers |

| Telecommunications IoT Services | 55 | Network Engineers, Product Managers |

The Vietnam IoT Integration Market is valued at approximately USD 3.15 billion, driven by the increasing adoption of smart technologies across sectors like manufacturing, healthcare, and smart cities, along with rising demand for automation and data analytics.