Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4757

Pages:87

Published On:December 2025

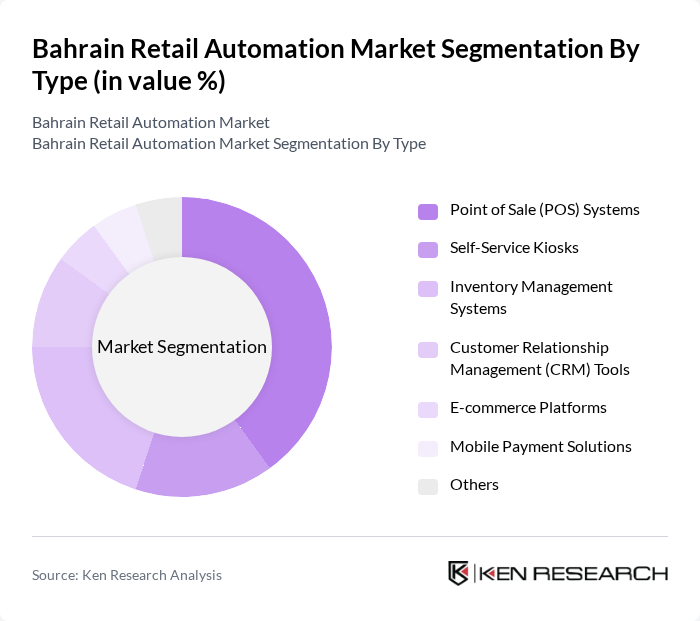

By Type:The market is segmented into various types of retail automation solutions, including Point of Sale (POS) Systems, Self-Service Kiosks, Inventory Management Systems, Customer Relationship Management (CRM) Tools, E-commerce Platforms, Mobile Payment Solutions, and Others. Among these, Point of Sale (POS) Systems are leading the market due to their essential role in transaction processing, integration with inventory management, and support for omnichannel and mobile payment experiences, which are critical for modern retail operations. Growing deployment of AI-enabled POS, cloud-based solutions, and integrated billing across hypermarkets, supermarkets, and speciality stores in Bahrain further reinforces the central role of POS within retail automation.

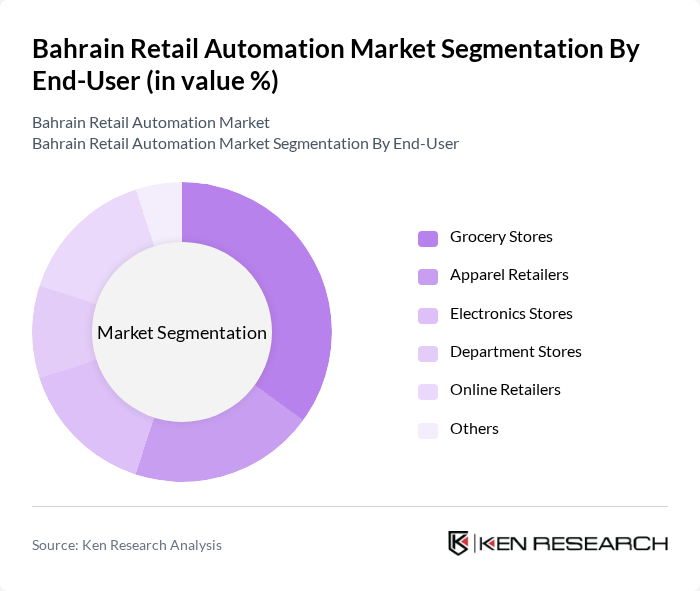

By End-User:The end-user segmentation includes Grocery Stores, Apparel Retailers, Electronics Stores, Department Stores, Online Retailers, and Others. Grocery Stores are the dominant segment, driven by the increasing demand for efficient checkout processes, high?throughput POS systems, and real-time inventory management solutions, which are essential for maintaining stock levels and enhancing customer satisfaction in high-frequency, high?volume retail formats. Strong modern trade presence in hypermarkets and supermarkets and the growing use of loyalty programs and digital promotions in food and grocery retail further increase adoption of automation technologies in this segment.

The Bahrain Retail Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrefour Bahrain, Lulu Hypermarket Bahrain, Al Meera Consumer Goods Company, Al Ameen Group, Batelco (Bahrain Telecommunications Company), Zain Bahrain, Bahrain Duty Free, Seef Mall, BMMI (Bahrain Maritime & Mercantile International), Al-Futtaim Group (operating in Bahrain retail & mall management), Panda Retail Co. (operating in Bahrain via franchise/partnership), Abdullah Al Othaim Markets (presence in Bahrain via franchise/partnership), Kuwait Finance House (KFH) – Bahrain Branch (digital banking & payment integration), APM Terminals Bahrain (warehouse & logistics automation), Gulf Air (retail & duty-free automation) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain retail automation market appears promising, driven by technological advancements and changing consumer behaviors. As retailers increasingly recognize the importance of operational efficiency and customer satisfaction, investments in automation technologies are expected to rise. The integration of AI and IoT will likely enhance data-driven decision-making, while the expansion of e-commerce will further necessitate automation solutions. Overall, the market is poised for significant transformation, aligning with global retail trends and local consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Point of Sale (POS) Systems Self-Service Kiosks Inventory Management Systems Customer Relationship Management (CRM) Tools E-commerce Platforms Mobile Payment Solutions Others |

| By End-User | Grocery Stores Apparel Retailers Electronics Stores Department Stores Online Retailers Others |

| By Product Category | Food and Beverages Clothing and Accessories Electronics and Appliances Home Goods Health and Beauty Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Mobile Applications AI and Machine Learning Technologies Others |

| By Distribution Channel | Online Sales Offline Sales Direct Sales Distributors and Resellers Others |

| By Customer Segment | B2B Customers B2C Customers Government and Institutions Others |

| By Policy Support | Subsidies for Automation Technologies Tax Incentives for Retailers Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grocery Retail Automation | 100 | Store Managers, IT Directors |

| Fashion Retail Technology Adoption | 80 | Operations Managers, E-commerce Directors |

| Electronics Retail Automation Solutions | 70 | Procurement Managers, Technology Officers |

| Food & Beverage Retail Innovations | 60 | Supply Chain Managers, Business Development Heads |

| Pharmacy Retail Automation Trends | 50 | Pharmacy Managers, Compliance Officers |

The Bahrain Retail Automation Market is valued at approximately USD 140 million, reflecting a significant growth trend aligned with the overall retail market size of around USD 5.80 billion, driven by technological advancements and increased consumer demand for automation solutions.