Region:Asia

Author(s):Rebecca

Product Code:KRAD1398

Pages:92

Published On:November 2025

By Type:The market is segmented into various types of sesame oil, including Toasted Sesame Oil, Cold-Pressed Sesame Oil, Refined Sesame Oil, Organic Sesame Oil, Blended Sesame Oil, and Others. Each type caters to different consumer preferences and culinary applications, with organic and cold-pressed varieties gaining popularity due to their perceived health benefits and minimal processing. Toasted sesame oil is preferred for its robust flavor in Asian cuisines, while cold-pressed and organic oils attract health-conscious buyers seeking nutrient retention and environmentally friendly products.

The toasted sesame oil segment leads the market due to its rich flavor and aroma, making it a preferred choice in Asian cuisines. Cold-pressed sesame oil is also gaining traction among health-conscious consumers, as it retains more nutrients compared to refined varieties. Organic sesame oil is witnessing increased demand as consumers shift towards organic products, driven by health trends and environmental concerns. The market is characterized by a growing preference for natural and minimally processed oils, which is expected to continue influencing consumer choices.

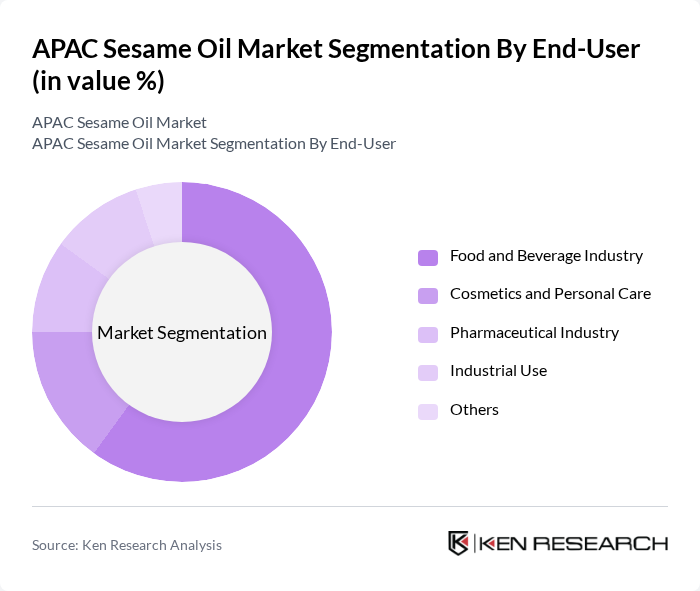

By End-User:The market is segmented based on end-users, including the Food and Beverage Industry, Cosmetics and Personal Care, Pharmaceutical Industry, Industrial Use, and Others. Each segment has unique requirements and applications for sesame oil, with the food and beverage sector being the largest consumer. The cosmetics and personal care segment is expanding due to the oil’s moisturizing and antioxidant properties, while pharmaceutical applications leverage its nutritional profile. Industrial use includes lubricants and specialty products.

The food and beverage industry dominates the market, driven by the increasing use of sesame oil in cooking and food preparation. Its unique flavor profile and health benefits make it a staple in many Asian cuisines. The cosmetics and personal care segment is also growing, as sesame oil is recognized for its moisturizing properties and is increasingly used in skincare products. The pharmaceutical industry utilizes sesame oil for its health benefits, further contributing to market growth.

The APAC Sesame Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kadoya Sesame Mills Inc., Wilmar International Ltd., Takemoto Oil & Fat Co., Ltd., Borges International Group, Marico Limited (Saffola), Sree Venkateshwara Oil Mills, Sree Gokulam Oil Mills, V. S. S. Oil Mills, AOS Products Pvt. Ltd., Bunge India Pvt. Ltd., Adani Wilmar Ltd., Cargill India Pvt. Ltd., Kevala, La Tourangelle, Pansari Group contribute to innovation, geographic expansion, and service delivery in this space.

The APAC sesame oil market is poised for growth, driven by increasing health awareness and a shift towards natural ingredients. As consumers continue to prioritize health and wellness, the demand for sesame oil is expected to rise, particularly in food processing and culinary applications. Additionally, the expansion of e-commerce platforms will facilitate direct sales, enhancing market accessibility. Companies that innovate and adapt to consumer preferences will likely thrive in this evolving landscape, ensuring a robust market presence in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Toasted Sesame Oil Cold-Pressed Sesame Oil Refined Sesame Oil Organic Sesame Oil Blended Sesame Oil Others |

| By End-User | Food and Beverage Industry Cosmetics and Personal Care Pharmaceutical Industry Industrial Use Others |

| By Region | China India Japan South Korea Southeast Asia Australia Rest of APAC |

| By Application | Cooking and Food Preparation Salad Dressings and Sauces Baking and Confectionery Pharmaceuticals Cosmetics and Personal Care Others |

| By Packaging Type | Bottles Cans Pouches Bulk Packaging Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Specialty Stores Convenience Stores B2B/Wholesale Others |

| By Price Range | Premium Mid-Range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 150 | Store Managers, Category Buyers |

| Food Processing Sector | 100 | Production Managers, Quality Control Officers |

| Consumer Preferences | 150 | Health-Conscious Consumers, Culinary Enthusiasts |

| Export Market Dynamics | 80 | Export Managers, Trade Analysts |

| Market Distribution Channels | 120 | Logistics Coordinators, Supply Chain Managers |

The APAC Sesame Oil Market is valued at approximately USD 1.7 billion, reflecting significant growth driven by increasing consumer demand for healthy cooking oils and the rising popularity of natural and organic food products.