Region:Asia

Author(s):Dev

Product Code:KRAC2981

Pages:95

Published On:January 2026

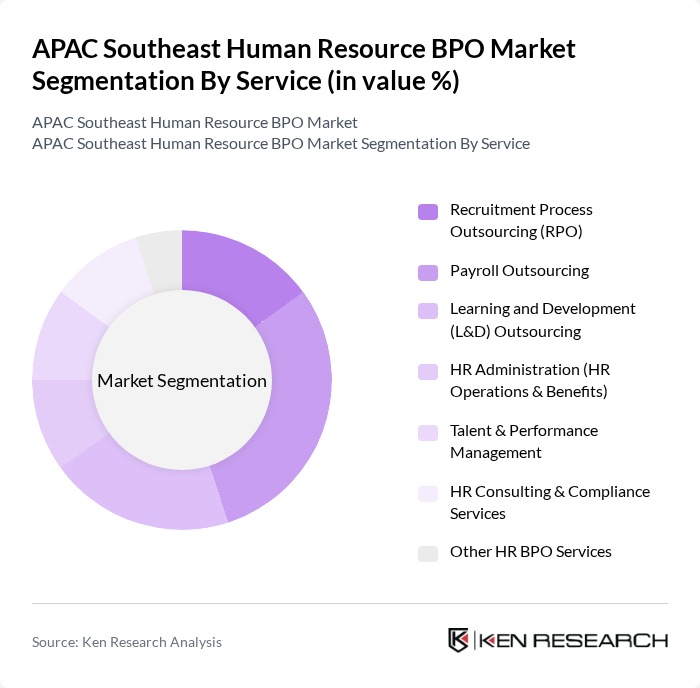

By Service:The service segment includes various offerings such as Recruitment Process Outsourcing (RPO), Payroll Outsourcing, Learning and Development (L&D) Outsourcing, HR Administration, Talent & Performance Management, HR Consulting & Compliance Services, and Other HR BPO Services, which is consistent with standard Southeast Asia HR BPO service taxonomies. Among these, Payroll Outsourcing is currently one of the leading sub-segments due to the increasing complexity of payroll, social security, and tax regulations across multiple Southeast Asian jurisdictions and the need for compliance and standardization in multi-country payroll operations, which drives organizations to seek specialized, technology-enabled payroll services.

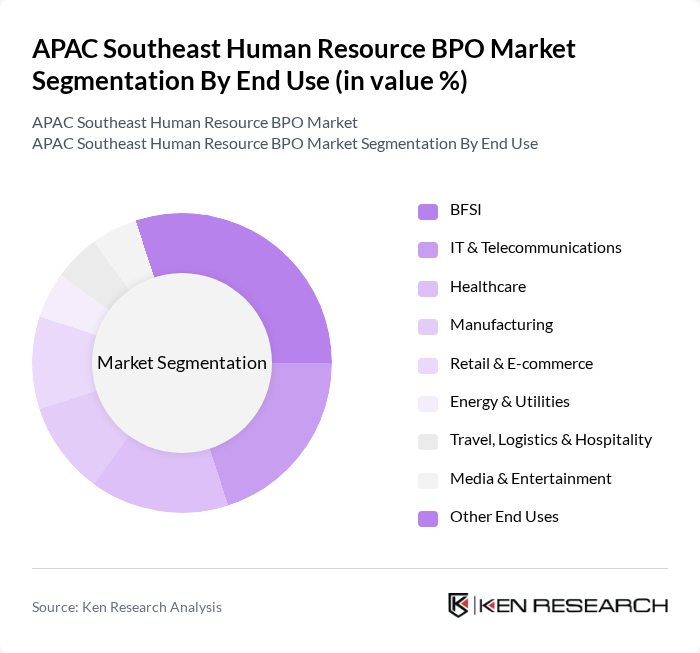

By End Use:The end-use segment encompasses various industries including BFSI, IT & Telecommunications, Healthcare, Manufacturing, Retail & E-commerce, Energy & Utilities, Travel, Logistics & Hospitality, Media & Entertainment, and Other End Uses, mirroring the key verticals that most actively source HR BPO services in Southeast Asia. The BFSI sector is a major end-user, driven by stringent regulatory requirements, complex benefits and compliance needs, and the requirement for robust background checks and workforce governance to handle large, distributed employee bases across multiple jurisdictions.

The APAC Southeast Human Resource BPO Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, ADP, Randstad, ManpowerGroup, Infosys BPM, Wipro, Tata Consultancy Services (TCS), Ceridian, Paychex, Concentrix, Alight Solutions, TMF Group, HCMWorks, TriNet, Kelly Services contribute to innovation, geographic expansion, and service delivery in this space, in line with the broader set of global and regional providers active in Southeast Asia HR BPO.

The APAC Southeast Human Resource BPO market is poised for transformative growth driven by technological advancements and evolving workforce dynamics. As companies increasingly adopt remote work solutions, the demand for flexible HR services will rise. Additionally, the integration of AI and analytics into HR processes will enhance decision-making capabilities. In future, the focus on employee experience and engagement will further shape service offerings, compelling providers to innovate and adapt to changing client needs in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Service | Recruitment Process Outsourcing (RPO) Payroll Outsourcing Learning and Development (L&D) Outsourcing HR Administration (HR Operations & Benefits) Talent & Performance Management HR Consulting & Compliance Services Other HR BPO Services |

| By End Use | BFSI IT & Telecommunications Healthcare Manufacturing Retail & E-commerce Energy & Utilities Travel, Logistics & Hospitality Media & Entertainment Other End Uses |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Outsourcing Type | Onshore Offshore Nearshore |

| By Deployment Model | Cloud-based HR BPO On-premise HR BPO Hybrid Deployment |

| By Technology Utilization | AI- and Analytics-driven HR BPO RPA-enabled HR BPO Mobile-first HR Solutions Digital Employee Experience Platforms Other Technology-enabled Services |

| By Country | Philippines Malaysia Singapore Indonesia Thailand Vietnam Rest of Southeast Asia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate HR Departments | 140 | HR Managers, Talent Acquisition Specialists |

| HR BPO Service Providers | 100 | Business Development Managers, Operations Directors |

| SMEs Utilizing HR BPO Services | 80 | Business Owners, HR Consultants |

| Industry Experts and Analysts | 50 | HR Analysts, Market Researchers |

| Government Labor Departments | 40 | Policy Makers, Labor Market Analysts |

The APAC Southeast Human Resource BPO Market is valued at approximately USD 4.5 billion, reflecting a significant growth trajectory driven by the increasing demand for outsourcing HR functions and the adoption of advanced technologies in HR processes.