Region:Asia

Author(s):Rebecca

Product Code:KRAA6367

Pages:91

Published On:January 2026

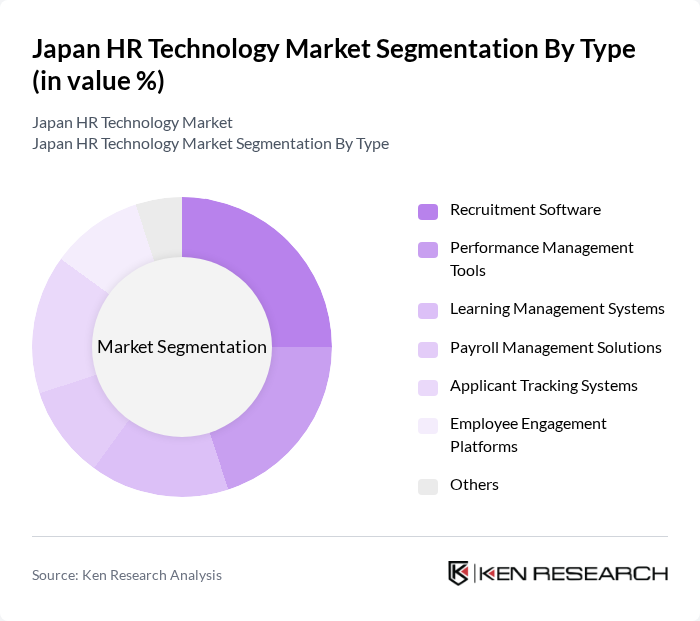

By Type:The market is segmented into various types of HR technology solutions, including recruitment software, performance management tools, learning management systems, payroll management solutions, applicant tracking systems, employee engagement platforms, talent management, workforce management, and others. Each of these subsegments plays a crucial role in enhancing HR processes and improving overall organizational efficiency.

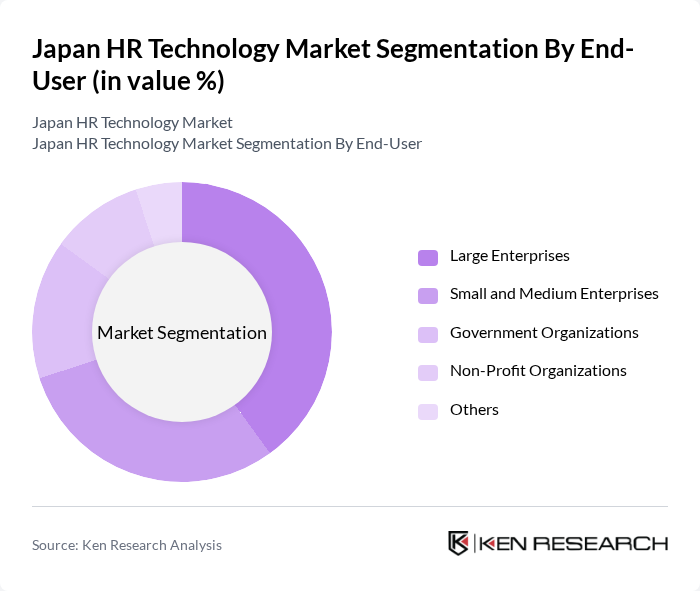

By End-User:The HR technology market is also segmented by end-users, which include large enterprises, small and medium enterprises (SMEs), government organizations, non-profit organizations, public sector, health care, information technology, BFSI, and others. Each end-user category has distinct needs and preferences, influencing the adoption of specific HR technologies.

The Japan HR Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Recruit Holdings, Workday, Inc., SAP SuccessFactors, Oracle HCM Cloud, ADP, LLC, IBM Watson Talent, Cornerstone OnDemand, BambooHR, Paycor HCM, Zenefits, Gusto, Namely, Cezar HR, Talentsoft, Personio contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan HR technology market appears promising, driven by technological advancements and changing workforce dynamics. As organizations increasingly embrace digital transformation, the integration of AI and machine learning into HR processes will enhance decision-making and operational efficiency. Furthermore, the growing emphasis on employee wellness and engagement will likely lead to the development of innovative HR solutions tailored to meet the evolving needs of the workforce, fostering a more agile and responsive HR landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Recruitment Software Performance Management Tools Learning Management Systems Payroll Management Solutions Applicant Tracking Systems Employee Engagement Platforms Others |

| By End-User | Large Enterprises Small and Medium Enterprises Government Organizations Non-Profit Organizations Others |

| By Industry | IT and Telecommunications Manufacturing Healthcare Retail Financial Services Education Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Functionality | Talent Acquisition Employee Development Compensation Management Workforce Planning Others |

| By Region | Kanto Kansai Chubu Kyushu Hokkaido Others |

| By Policy Support | Government Subsidies Tax Incentives Training Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate HR Technology Adoption | 120 | HR Managers, Chief HR Officers |

| SME HR Solutions Utilization | 80 | Business Owners, HR Consultants |

| Technology Vendors Insights | 60 | Product Managers, Sales Directors |

| Employee Experience Platforms | 50 | Employee Engagement Specialists, HR Analysts |

| Performance Management Systems | 70 | Performance Managers, Talent Development Leads |

The Japan HR Technology Market is valued at approximately USD 2 billion, reflecting a significant growth trend driven by the adoption of digital solutions in human resource management and the need for efficient recruitment processes.