Region:Asia

Author(s):Dev

Product Code:KRAD5181

Pages:88

Published On:December 2025

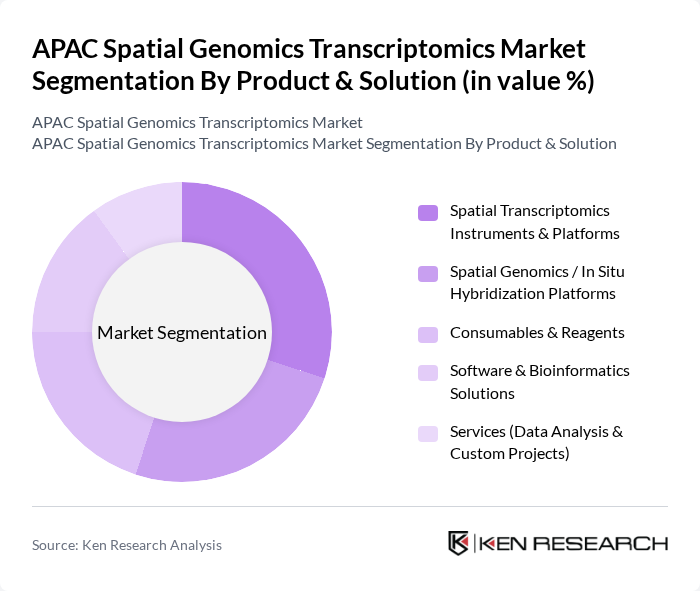

By Product & Solution:The product and solution segment encompasses various offerings that facilitate spatial genomics and transcriptomics research. This includes instruments, consumables, software, and services tailored to meet the needs of researchers and clinicians.

The leading subsegment in this category is Spatial Transcriptomics Instruments & Platforms, which accounts for a significant portion of the market share, although consumables currently generate the largest recurring revenue in many APAC deployments due to high run?rate usage in spatial assays. This dominance of instrument platforms in installed capacity is attributed to the increasing demand for high-throughput sequencing and imaging technologies with precise spatial resolution, including platforms from 10x Genomics, NanoString (now under Bruker), Akoya Biosciences, and Vizgen that are being adopted by leading cancer centers and research institutes in the region. Researchers are increasingly using these advanced instruments, supported by specialized consumables and cloud? or server?based software, to dissect cellular heterogeneity, tumor microenvironments, and tissue architecture, driving innovation, grant funding, and private investment in this area.

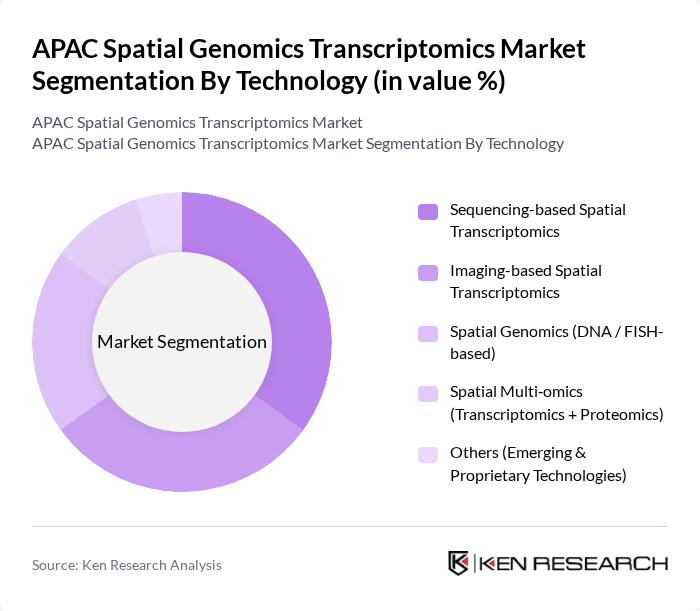

By Technology:The technology segment includes various methodologies employed in spatial genomics and transcriptomics, each offering unique advantages for research applications.

Sequencing-based Spatial Transcriptomics is the leading technology subsegment globally and in APAC, driven by its ability to provide comprehensive, genome?wide insights into gene expression patterns with high spatial and, in many workflows, single?cell or near?single?cell resolution. The growing emphasis on personalized medicine, biomarker discovery, and targeted therapies in oncology and immunology has further propelled the adoption of sequencing?based spatial technologies, as researchers seek to map the molecular underpinnings of disease within intact tissue contexts. This trend is reinforced by ongoing reductions in sequencing costs, improvements in library?prep chemistries, and the emergence of spatial multi?omics workflows that integrate RNA, protein, and, increasingly, DNA and epigenetic readouts, enhancing accessibility and analytical depth for APAC laboratories.

The APAC Spatial Genomics Transcriptomics Market is characterized by a dynamic mix of regional and international players. Leading participants such as 10x Genomics, Inc., NanoString Technologies, Inc., Akoya Biosciences, Inc., Vizgen, Inc., Illumina, Inc., Thermo Fisher Scientific Inc., BGI Group, Novogene Co., Ltd., Roche Holding AG / F. Hoffmann-La Roche Ltd, Agilent Technologies, Inc., PerkinElmer, Inc. (Revvity, Inc.), Bio-Rad Laboratories, Inc., QIAGEN N.V., Pacific Biosciences of California, Inc., Oxford Nanopore Technologies plc contribute to innovation, geographic expansion, and service delivery in this space, offering instruments, high?content imaging systems, sequencing platforms, specialized reagents, and advanced bioinformatics solutions tailored to spatial omics workflows in APAC.

The future of the APAC spatial genomics transcriptomics market appears promising, driven by ongoing technological advancements and increasing investments in healthcare infrastructure. As governments prioritize healthcare innovation, funding for genomic research is expected to rise, facilitating the development of new applications. Additionally, the integration of artificial intelligence in genomic analysis is likely to enhance data interpretation, leading to more effective treatments. These trends will collectively contribute to a more robust market landscape, fostering growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product & Solution | Spatial Transcriptomics Instruments & Platforms Spatial Genomics / In Situ Hybridization Platforms Consumables & Reagents Software & Bioinformatics Solutions Services (Data Analysis & Custom Projects) |

| By Technology | Sequencing-based Spatial Transcriptomics Imaging-based Spatial Transcriptomics Spatial Genomics (DNA / FISH-based) Spatial Multi?omics (Transcriptomics + Proteomics) Others (Emerging & Proprietary Technologies) |

| By Application | Cancer & Tumor Microenvironment Research Neurology & Neurodegenerative Disorders Immunology & Infectious Diseases Drug Discovery & Translational Research Others (Developmental Biology, Cardiovascular, etc.) |

| By End-User | Academic & Research Institutes Pharmaceutical & Biotechnology Companies Contract Research Organizations (CROs) Clinical & Diagnostic Laboratories / Hospitals Others (Core Genomics Facilities, Government Labs) |

| By Country / Sub?Region | China Japan South Korea India Australia & New Zealand Southeast Asia (Singapore, Malaysia, Thailand, Others) Rest of Asia-Pacific |

| By Research Funding Source | Government & Public Grants Venture Capital & Private Equity Internal Corporate R&D Budgets Philanthropic & Non?profit Funding Others (Public–Private Partnerships, Consortia) |

| By Data Analysis Workflow | Primary Data Processing & Image Analysis Pipelines Spatial Mapping & Cell?type Deconvolution Tools Integrative Multi?omics & AI/ML Analytics Data Management, Storage & Cloud Platforms Visualization & Reporting Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Genomics Applications | 100 | Clinical Researchers, Genetic Counselors |

| Biotechnology Firms in APAC | 80 | Product Managers, R&D Directors |

| Academic Institutions and Research Labs | 70 | Professors, Lab Managers |

| Healthcare Providers Utilizing Genomic Data | 90 | Healthcare Administrators, Oncologists |

| Regulatory Bodies and Policy Makers | 50 | Regulatory Affairs Specialists, Policy Analysts |

The APAC Spatial Genomics Transcriptomics Market is valued at approximately USD 0.14 billion, driven by advancements in genomic technologies and increasing investments in research and development across the region.