Region:Middle East

Author(s):Rebecca

Product Code:KRAA9355

Pages:85

Published On:November 2025

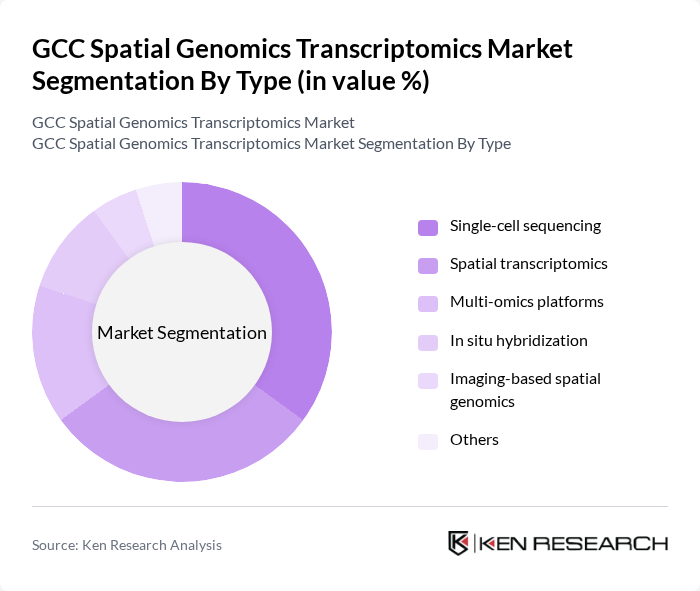

By Type:The market is segmented into various types, including Single-cell sequencing, Spatial transcriptomics, Multi-omics platforms, In situ hybridization, Imaging-based spatial genomics, and Others. Among these, Single-cell sequencing is gaining traction due to its ability to provide detailed insights into cellular heterogeneity, which is crucial for understanding complex diseases. Spatial transcriptomics is also emerging as a significant player, allowing researchers to analyze gene expression in the context of tissue architecture. The demand for these technologies is driven by their applications in cancer research, neurodegenerative disease research, and personalized medicine.

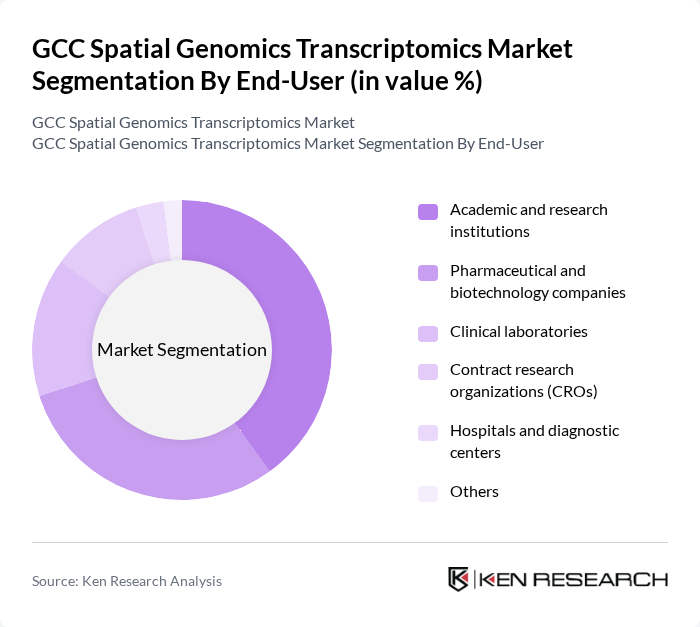

By End-User:The end-user segmentation includes Academic and research institutions, Pharmaceutical and biotechnology companies, Clinical laboratories, Contract research organizations (CROs), Hospitals and diagnostic centers, and Others. Academic and research institutions are the leading end-users, driven by the increasing focus on genomics research and the need for advanced technologies to support innovative studies. Pharmaceutical companies are also significant contributors, utilizing these technologies for drug discovery and development processes, particularly in oncology and rare disease research.

The GCC Spatial Genomics Transcriptomics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., 10x Genomics, Inc., BGI Group, Roche Sequencing Solutions, Agilent Technologies, Inc., PerkinElmer, Inc., QIAGEN N.V., Bio-Rad Laboratories, Inc., Pacific Biosciences of California, Inc., Oxford Nanopore Technologies Ltd., Genomatix Software GmbH, NanoString Technologies, Inc., Bruker Corporation, Vizgen, Inc., Akoya Biosciences, Inc., Fluidigm Corporation (now Standard BioTools Inc.), Cartana AB (a part of 10x Genomics), ReadCoor, Inc. (a part of 10x Genomics), Zeiss Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC Spatial Genomics Transcriptomics market appears promising, driven by ongoing advancements in technology and increasing collaboration between academia and industry. As the region invests in research and development, the integration of AI and machine learning into genomic analysis is expected to enhance data interpretation and accelerate discoveries. Furthermore, the expansion of biopharmaceuticals and innovative diagnostic tools will likely create new avenues for growth, positioning the GCC as a key player in the global genomics landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-cell sequencing Spatial transcriptomics Multi-omics platforms In situ hybridization Imaging-based spatial genomics Others |

| By End-User | Academic and research institutions Pharmaceutical and biotechnology companies Clinical laboratories Contract research organizations (CROs) Hospitals and diagnostic centers Others |

| By Application | Cancer research Neurological disorders Infectious diseases Drug discovery and development Immunology Others |

| By Technology | Next-generation sequencing (NGS) Microarray technology PCR-based methods Mass spectrometry Others |

| By Research Funding Source | Government grants Private investments Academic funding International collaborations Others |

| By Geographic Focus | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Regional partnerships International collaborations Others |

| By Data Management Solutions | Cloud-based solutions On-premise solutions Hybrid solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers in Genomic Medicine | 100 | Geneticists, Oncologists, Healthcare Administrators |

| Biotechnology Firms Specializing in Genomics | 70 | R&D Managers, Product Development Leads |

| Academic Institutions Conducting Genomic Research | 60 | Research Professors, Lab Directors |

| Government Health Agencies | 50 | Policy Makers, Health Program Coordinators |

| Pharmaceutical Companies Utilizing Genomic Data | 80 | Clinical Research Associates, Drug Development Managers |

The GCC Spatial Genomics Transcriptomics Market is valued at approximately USD 500 million, driven by advancements in genomic technologies, increased research investments, and the rising prevalence of chronic diseases necessitating innovative diagnostic solutions.