Region:Asia

Author(s):Rebecca

Product Code:KRAD7525

Pages:88

Published On:December 2025

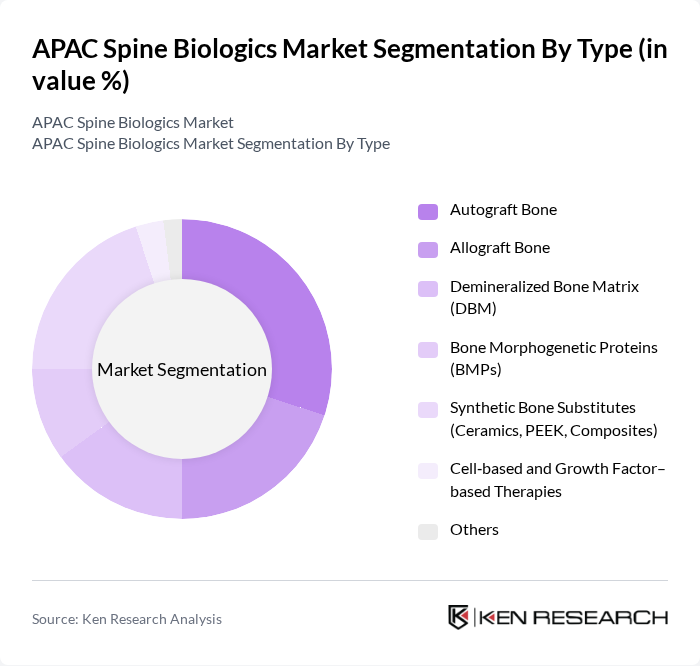

By Type:The market is segmented into various types of biologics, including autograft bone, allograft bone, demineralized bone matrix (DBM), bone morphogenetic proteins (BMPs), synthetic bone substitutes, cell-based and growth factor-based therapies, and others. Among these, autograft bone and synthetic bone substitutes are particularly prominent due to their well?established effectiveness in spinal fusion procedures and broad surgeon familiarity. The increasing preference for minimally invasive surgeries and day?care spine procedures has also led to a rise in the adoption of synthetic substitutes (such as ceramics and bioactive composites) and DBM, which offer advantages such as reduced donor?site morbidity, more predictable graft volumes, shorter operative times, and lower complication rates compared with traditional iliac?crest harvesting.

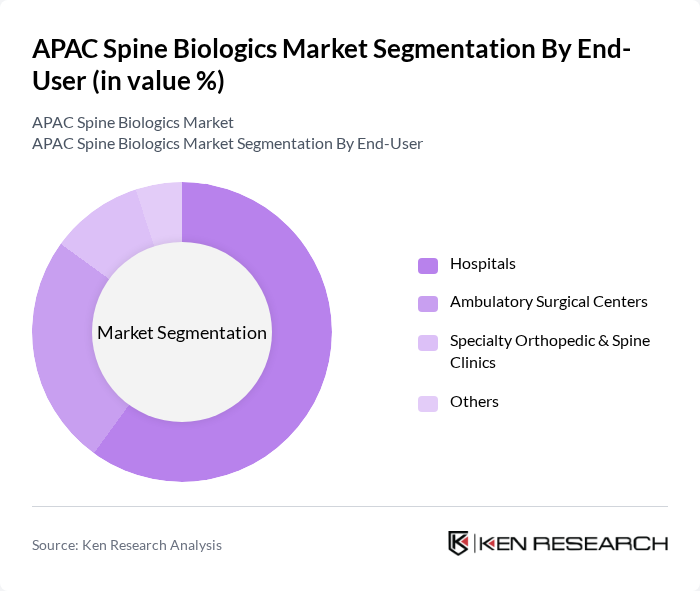

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers, specialty orthopedic and spine clinics, and others. Hospitals are the leading end-users due to their comprehensive facilities, availability of multidisciplinary spine teams, and capability to manage complex spinal deformity, trauma, and revision fusion surgeries, which are the primary indications for spine biologics. The increasing number of outpatient and short?stay minimally invasive fusion and decompression procedures has also led to a rise in the utilization of ambulatory surgical centers, which offer cost-effective solutions and faster turnaround for selected cases. Specialty orthopedic and spine clinics are gaining traction as they provide focused care, higher surgeon volumes, and advanced treatment options such as motion?preserving techniques, image?guided interventions, and tailored biologic combinations for degenerative disc disease and chronic low?back pain.

The APAC Spine Biologics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (DePuy Synthes), Stryker Corporation, Zimmer Biomet Holdings, Inc., NuVasive, Inc. (a Globus Medical company), Globus Medical, Inc., Orthofix Medical Inc., Seaspine Holdings (now part of Orthofix), RTI Surgical Holdings, Inc., Bioventus LLC, Xtant Medical Holdings, Inc., Kuros Biosciences AG, Cerapedics Inc., Wright Medical Group N.V. (Stryker), Local and Regional APAC Players (e.g., Japan Spine Biologics manufacturers, China?based allograft processors) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC spine biologics market is poised for transformative growth, driven by technological advancements and an increasing focus on personalized medicine. As healthcare providers adopt innovative treatment modalities, the integration of artificial intelligence and data analytics will enhance patient outcomes. Furthermore, the rise of regenerative medicine is expected to reshape treatment paradigms, offering new solutions for spinal disorders. These trends indicate a dynamic future for the market, with significant potential for improved patient care and expanded access to biologic therapies.

| Segment | Sub-Segments |

|---|---|

| By Type | Autograft Bone Allograft Bone Demineralized Bone Matrix (DBM) Bone Morphogenetic Proteins (BMPs) Synthetic Bone Substitutes (Ceramics, PEEK, Composites) Cell?based and Growth Factor–based Therapies Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Orthopedic & Spine Clinics Others |

| By Region | China Japan India South Korea Australia & New Zealand ASEAN (Indonesia, Thailand, Malaysia, Vietnam, Philippines, Others) Rest of APAC |

| By Application | Spinal Fusion Non-fusion/ Motion Preservation Procedures Spinal Deformity & Reconstruction Spinal Trauma & Tumor Others |

| By Distribution Channel | Direct Sales to Hospitals and IDNs Distributors / Local Importers Group Purchasing Organizations (GPOs) and Tender-based Sales Online and Other Channels |

| By Material Type | Natural (Autograft, Allograft, DBM) Synthetic (Ceramics, Polymers, Bioactive Glass) Composite and Hybrid Materials Others |

| By Technology | Conventional Open Surgery Minimally Invasive and Navigation?assisted Techniques Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 120 | Spine Surgeons, Orthopedic Specialists |

| Hospital Procurement Managers | 100 | Supply Chain Managers, Purchasing Directors |

| Biologics Manufacturers | 80 | Product Managers, R&D Directors |

| Healthcare Policy Makers | 60 | Health Economists, Regulatory Affairs Specialists |

| Clinical Researchers | 70 | Clinical Trial Coordinators, Research Scientists |

The APAC Spine Biologics Market is valued at approximately USD 470 million, driven by the increasing prevalence of spinal disorders and advancements in surgical techniques across major economies like China, Japan, and India.