Region:Asia

Author(s):Dev

Product Code:KRAA8321

Pages:85

Published On:November 2025

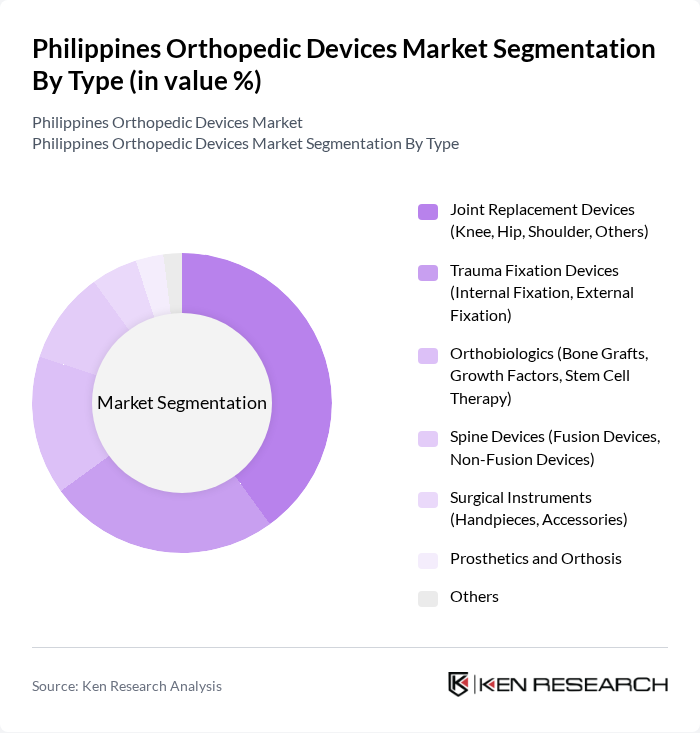

By Type:The orthopedic devices market can be segmented into various types, including Joint Replacement Devices, Trauma Fixation Devices, Orthobiologics, Spine Devices, Surgical Instruments, Prosthetics and Orthosis, and Others. Among these, Joint Replacement Devices are currently dominating the market due to the rising incidence of joint-related disorders and the growing preference for joint replacement surgeries among the aging population. The increasing awareness of advanced surgical techniques and the availability of innovative products are also contributing to the growth of this segment.

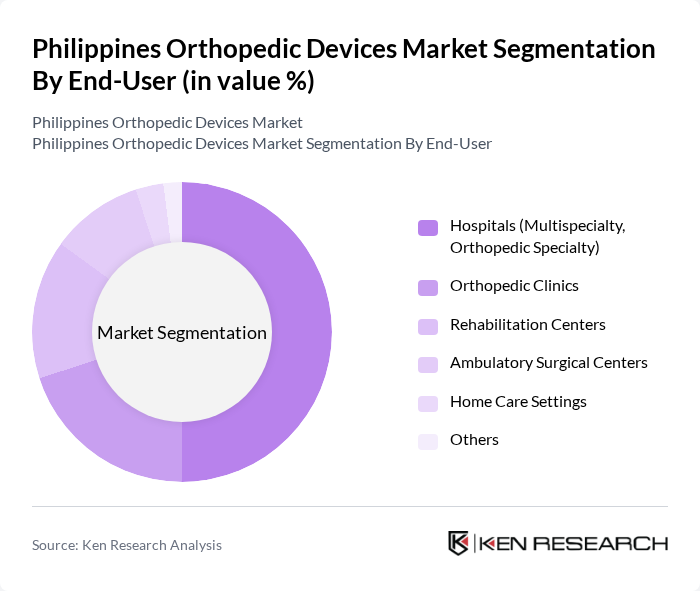

By End-User:The market can also be segmented based on end-users, which include Hospitals, Orthopedic Clinics, Rehabilitation Centers, Ambulatory Surgical Centers, Home Care Settings, and Others. Hospitals, particularly multispecialty and orthopedic specialty hospitals, are the leading end-users due to their comprehensive services and advanced surgical facilities. The increasing number of orthopedic surgeries performed in hospitals, along with the growing patient population seeking specialized care, drives the demand in this segment.

The Philippines Orthopedic Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet, Medtronic, Smith & Nephew, Arthrex, B. Braun Melsungen AG, NuVasive, Orthofix Medical Inc., Aesculap (B. Braun), CONMED Corporation, Wright Medical Group N.V., Exactech, Medacta International, United Orthopedic Corporation, MicroPort Orthopedics, Orthopaedic International Inc. (Philippines), PhilHealthCare, Inc. (Philippines distributor), Johnson & Johnson Philippines, Stryker Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the orthopedic devices market in the Philippines appears promising, driven by ongoing advancements in technology and an increasing focus on patient-centered care. As the healthcare infrastructure expands, particularly in underserved areas, access to orthopedic services is expected to improve. Additionally, the growing trend towards minimally invasive surgeries will likely enhance patient recovery experiences, further stimulating market demand. Stakeholders must remain agile to adapt to these evolving trends and capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Joint Replacement Devices (Knee, Hip, Shoulder, Others) Trauma Fixation Devices (Internal Fixation, External Fixation) Orthobiologics (Bone Grafts, Growth Factors, Stem Cell Therapy) Spine Devices (Fusion Devices, Non-Fusion Devices) Surgical Instruments (Handpieces, Accessories) Prosthetics and Orthosis Others |

| By End-User | Hospitals (Multispecialty, Orthopedic Specialty) Orthopedic Clinics Rehabilitation Centers Ambulatory Surgical Centers Home Care Settings Others |

| By Region | Luzon Visayas Mindanao |

| By Application | Trauma Surgery Joint Reconstruction (Knee, Hip, Shoulder) Spine Surgery Sports Medicine Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Direct Tenders Others |

| By Material | Metal Polymer Ceramic Composite Others |

| By Price Range | Premium Mid-range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 60 | Orthopedic Surgeons, Medical Directors |

| Healthcare Procurement Managers | 50 | Procurement Managers, Supply Chain Officers |

| Patients Using Orthopedic Devices | 80 | Patients, Caregivers, Rehabilitation Specialists |

| Medical Device Distributors | 40 | Sales Managers, Product Managers |

| Healthcare Policy Makers | 40 | Health Policy Analysts, Government Officials |

The Philippines Orthopedic Devices Market is valued at approximately USD 630 million, driven by factors such as the increasing prevalence of orthopedic disorders, an aging population, and advancements in medical technology.